SingularityNET price trades within supply zone with 10% stakes on the table

- SingularityNET price is up 96% since the broader market turned bullish around October 18, rising to trade between $0.28380 and $0.31586.

- The uptrend could be out of steam as AGIX challenges a longstanding supply barrier, with 10% stakes on the table.

- The bearish thesis will be invalidated upon a decisive break and close above $0.32000.

SingularityNET (AGIX) price has been recording a striking uptrend that began around October 20, when the AI crypto coin pivoted around the $0.15858 support floor. Standing upwards of 95% above the support floor, the upside potential of this cryptocurrency could have reached its climax as it confronts a longstanding supply barrier.

Also Read: SingularityNET price rally countered by supply pressure from upcoming token unlock event

SingularityNET price at an inflection point

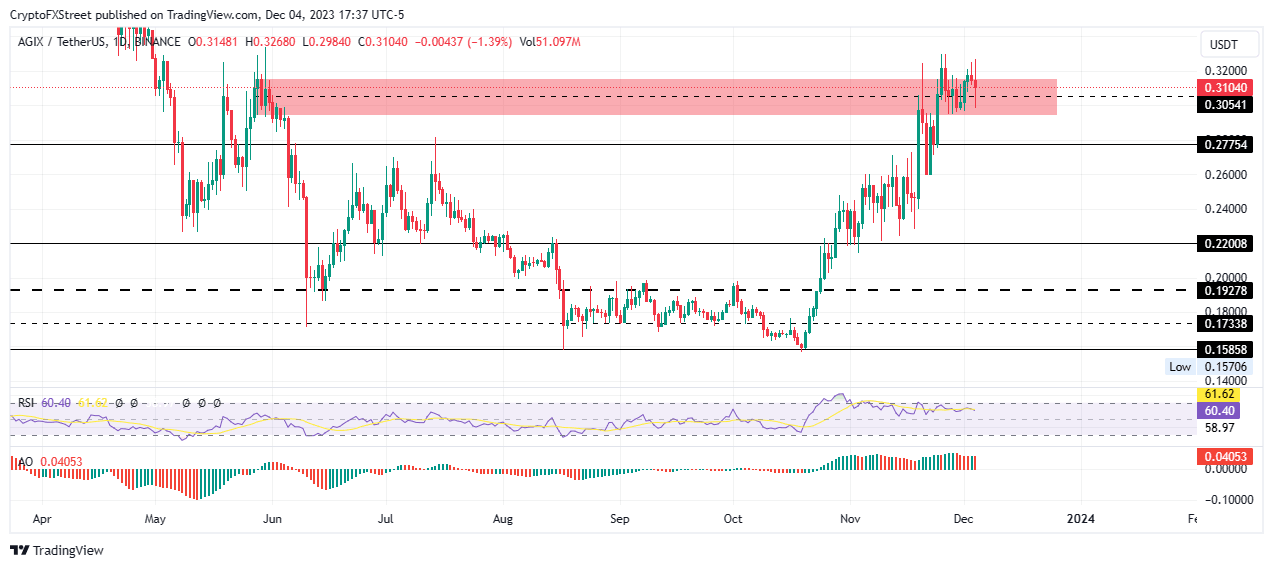

SingularityNET (AGIX) price remains bullish even as the altcoin trades within a supply barrier extending from $0.29380 to $0.31586. For the uptrend to continue, the price must record a daily candlestick close above the midline of this order block, above $0.30541.

A decisive move above $0.30541, confirmed by a flip of the $0.32000 level would effectively render the supply zone a bullish breaker, setting the pace for a continuation of the intermediate trend. The next possible target for SingularityNET price in such a directional bias would be the $0.34000 psychological level, in a move that would constitute a 10% climb above current levels.

The Relative Strength Index (RSI) remains well above 50, whereas the Awesome Oscillators (AO) indicators are still in the positive territory, giving the bulls a fair chance at extending north.

AGIX/USDT 1-day chart

However, considering the RSI is southbound, momentum has begun to fall, worsened by the red histogram bars of the AO, showing that bears are also at play. If the bulls show weakness, the bears could quickly take control, sending SingularityNET price on a slippery slope to find initial support at the base of the supply zone at $0.29380.

Failure of the aforementioned level to hold as support could see SingularityNET spiral all the way to the next buyer congestion level at $0.27754. Such a move would denote a 10% fall below current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.