Silk Road Bitcoins worth $1 billion move to Coinbase, another sell-off on the horizon?

- US Government law enforcement transferred 49,000 Bitcoin seized from the Silk Road crime proceeds to Coinbase.

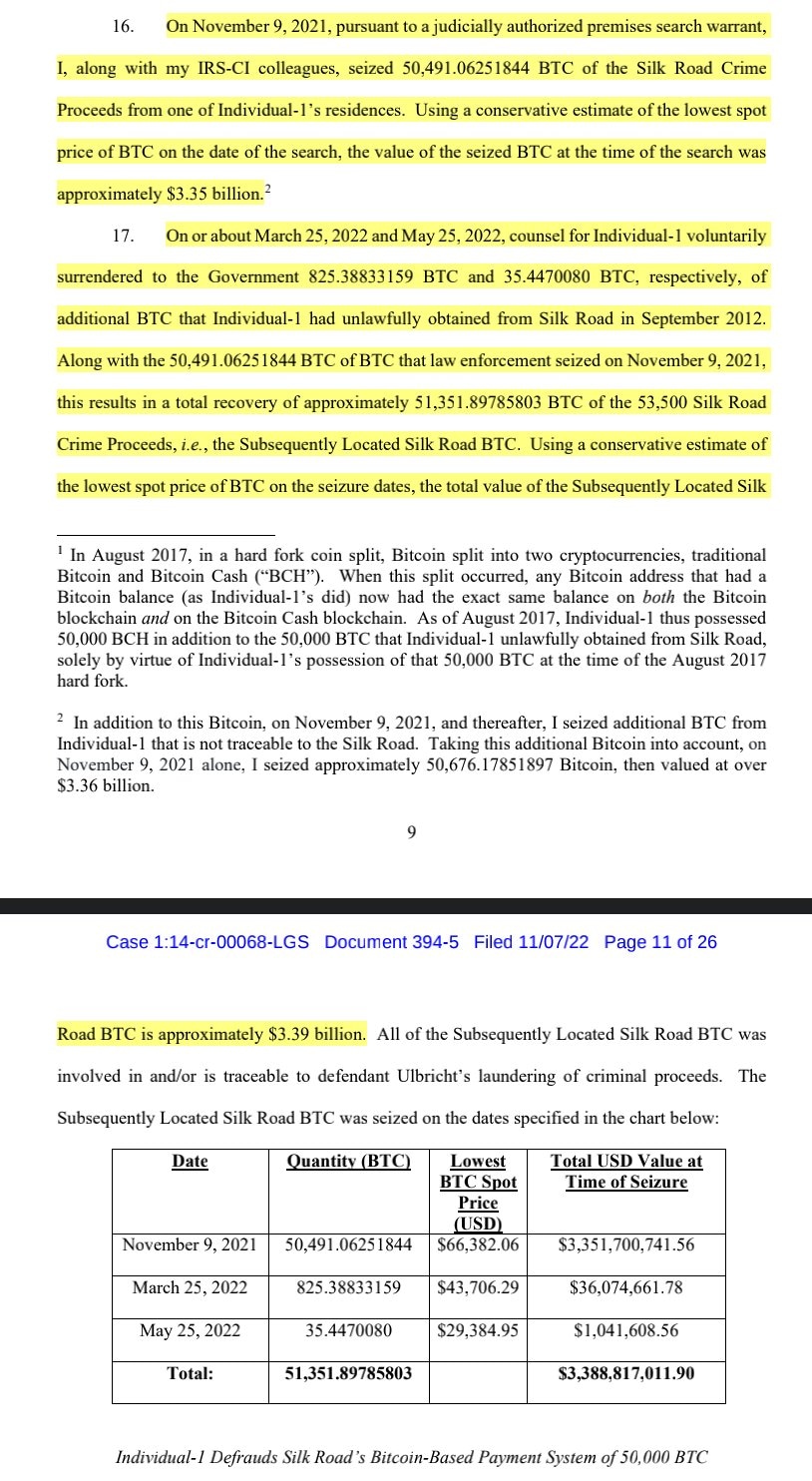

- Blockchain security firm PeckShield identified that the Bitcoin was seized by the US government in November 2021 and March 2022.

- Bitcoin price nosedived from $22,469 to $22,000 since the Coinbase transfer of seized BTC.

The US Government’s law enforcement moved $1 billion worth of BTC seized from the Silk Road to Coinbase, one of the largest cryptocurrency exchanges. A blockchain security firm identified the transfer of the BTC that was seized in November 2021 and March 2022.

Also read: Will crypto catch up with the rising S&P 500 after record levels of FUD?

Silk Road Bitcoin moves to Coinbase, here’s what to expect

The US Government law enforcement moved 49,000 Bitcoin worth $1 billion, from its two wallet addresses to Coinbase. This BTC was seized by the regulator in November 2021 and March 2022.

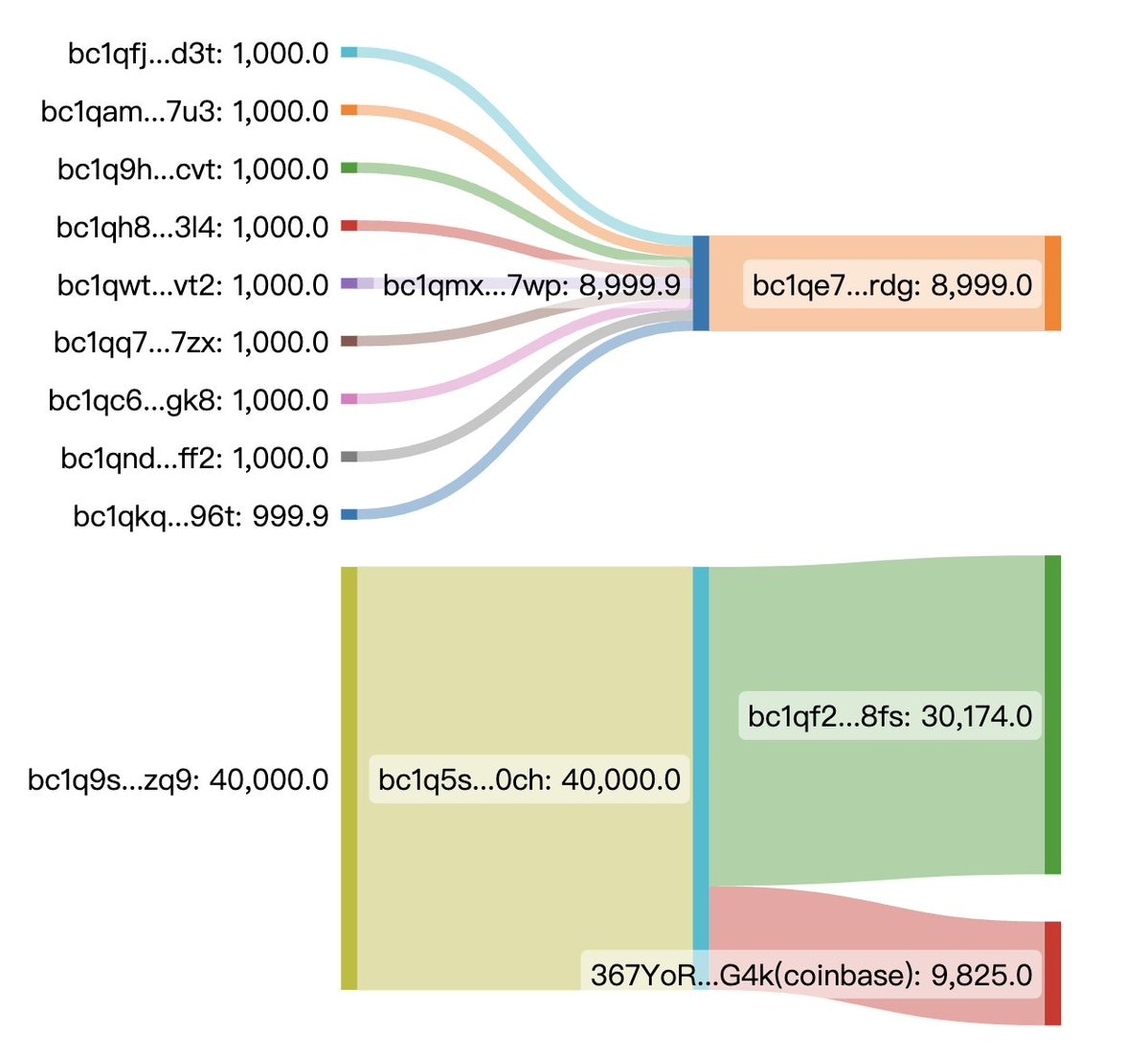

PeckShield, a blockchain security firm, tracked the move on-chain and identified it as proceeds from the Silk Road crimes.

US Government law enforcement seizes BTC from the Silk Road crimes

The two wallet addresses, bc1qf2…fsv moved 30,000 BTC and bc1qe7…rdg moved 9,000 BTC seized from Silk Road crimes to Coinbase.

Movement of seized BTC to Coinbase

A total of 51,351 BTC was seized from crime proceeds by the US Government.

What were the Silk Road crimes?

Silk Road was a digital black market platform popular for hosting money laundering activities and illegal drug transactions using Bitcoin. Regarded as the first darknet market, Silk Road was launched in 2011 and the Federal Bureau of Investigation (FBI) shut it down in 2013.

The seized Bitcoin was held by law enforcement in two different wallet addresses identified by PeckShield.

Will the movement of Bitcoin to Coinbase trigger a BTC sell-off?

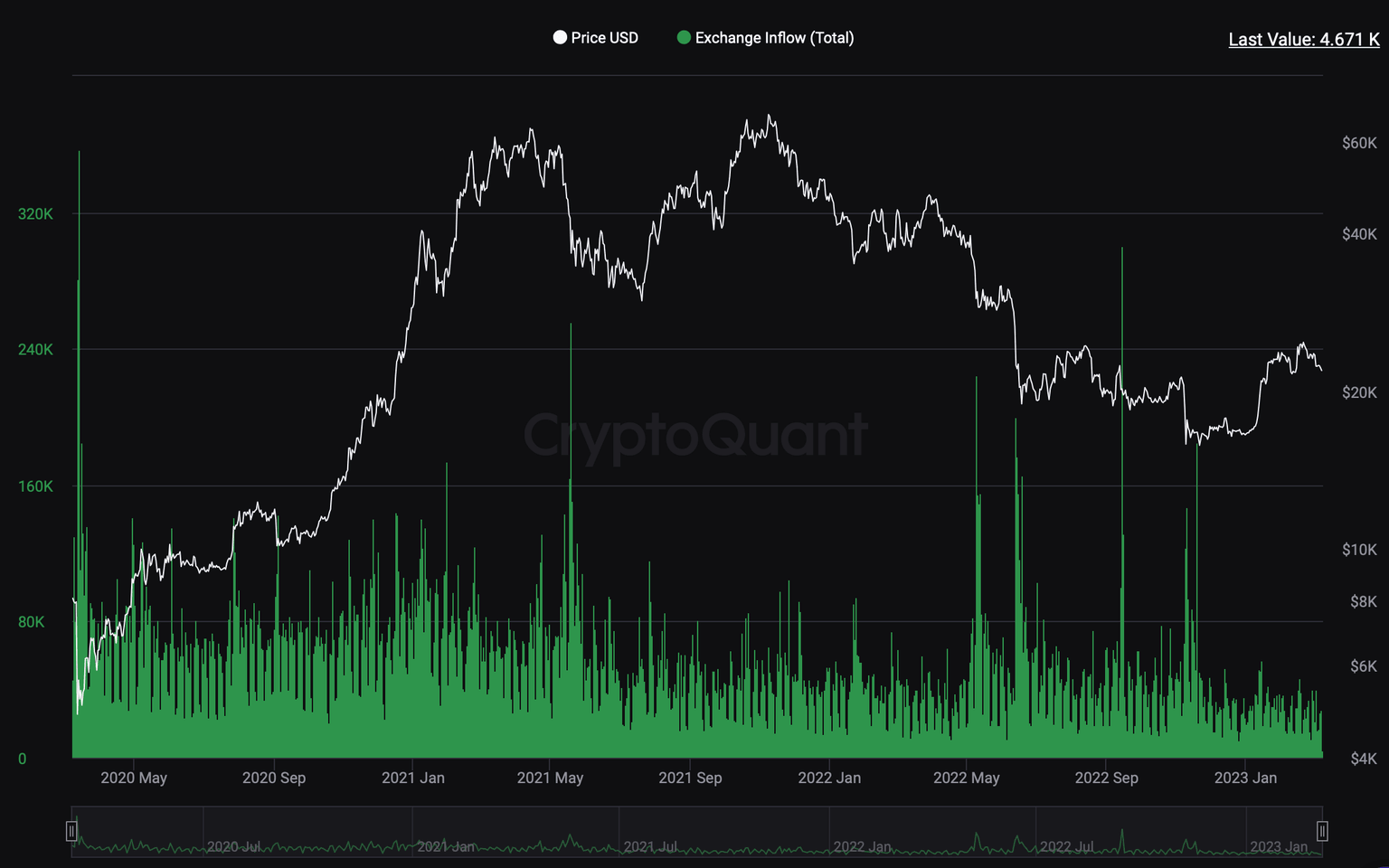

Bitcoin price nosedived since the announcement of the US Government’s move of seized BTC to a cryptocurrency exchange platform. Typically, a rise in BTC inflow to exchange’s wallet addresses increases the selling pressure on the asset and triggers a decline in the asset’s price.

Bitcoin exchange inflow (total)

As seen in the above chart from CryptoQuant, a spike in BTC exchange inflow is followed by a decline in Bitcoin price, historically. As of now, the data for March 8 is incomplete, it cannot be said with certainty that the spike in inflow is driving a sell-off in Bitcoin.

The largest asset by market capitalization declined from $22,469 to the $22,000 level within the past 24 hours. It remains to be seen whether the rising selling pressure drives the asset lower, or Bitcoin sustains above $22,000.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.