Should Shiba Inu holders expect a 65% upswing or sell-off as SHIB developers tease Shibarium launch this week?

- Shiba Inu developers announced the Shibarium public beta launch this week, fueling bullish sentiment among SHIB holders.

- The SHIB layer-2 scaling solution will provide cheaper transactions, enhanced scalability and security, after months of testing and development.

- It remains to be seen whether Shiba Inu price will witness a 65% upswing or sell-off as Shibarium launch unravels.

Shiba Inu developers announced the launch of SHIB’s awaited layer-2 scaling solution Shibarium this week. Shibarium will enhance the scalability of SHIB and provide cheaper transactions to Shiba Inu holders.

Shiba Inu holders gear up for Shibarium launch this week

Shiba Inu holders anticipated Shibarium launch since Shytoshi Kusama teased the development of a layer-2 scaling solution. Developers announced that Shibarium will be launched this week in a public beta.

Attention #SHIBARMY

— Shib (@Shibtoken) March 7, 2023

We're thrilled to announce that #SHIBARIUM Public Beta will be launching THIS WEEK!

Make sure you’re following our official socials over the next few days as we reveal all the details on how to access the beta website. Hail Shib! #ShibariumBeta pic.twitter.com/0fG3u3mY4S

The Shibarium team spent months developing and testing the layer-2 scaling solution before releasing public beta. The announcement was made on Twitter via the official SHIB account, it urged followers to stay tuned for more details on how to access the beta. The launch of the public beta is a significant milestone for the Shibarium project, spearheaded by lead developer Shytoshi Kusama.

Will Shibarium launch trigger a 65% upswing or sell-the-news event?

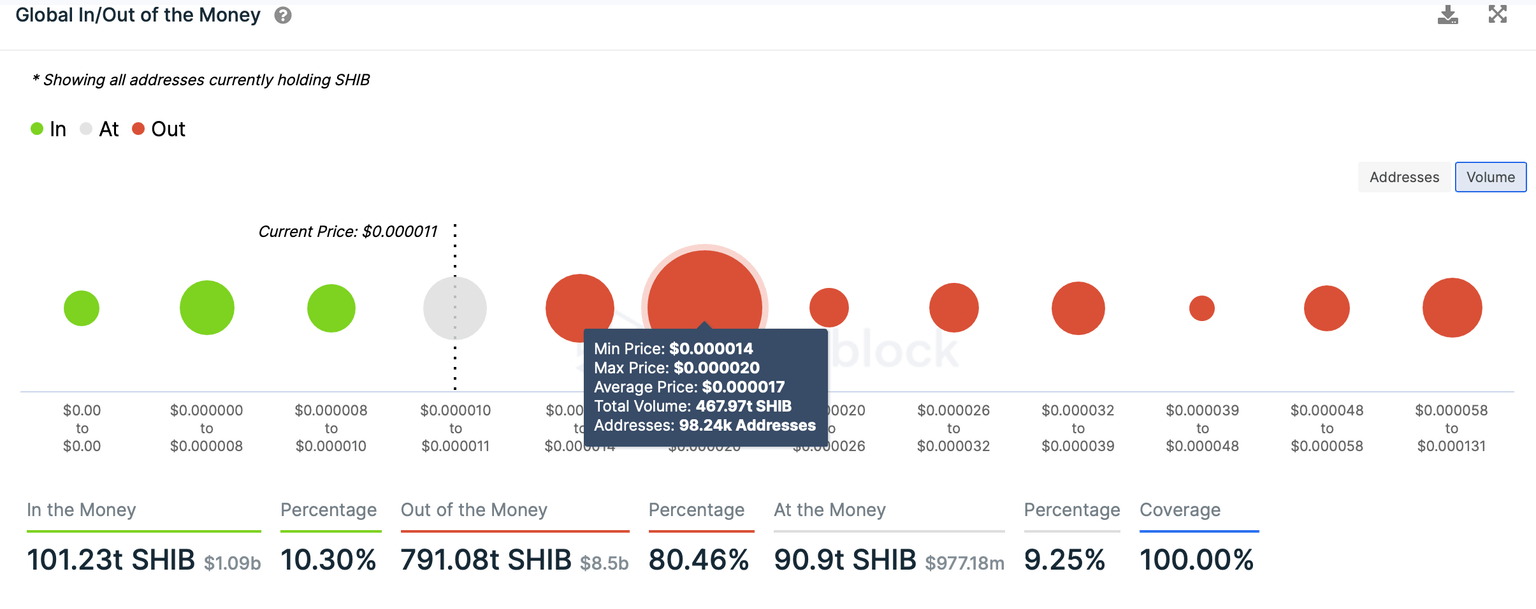

Based on data from crypto intelligence tracker IntoTheBlock, the next key resistance for Shiba Inu is the area between $0.000014 and $0.000020. This is a key zone as 98,240 addresses bought 469.97 Trillion SHIB tokens at this level.

Global In/Out of the Money

Once Shiba Inu price climbs to the zone between $0.000014 and $0.000020, the wallet addresses that acquired SHIB at this price level will turn profitable. These SHIB wallet holders would sit on unrealized profits once Shiba Inu flips the resistance into support.

As seen in the SHIB/USDT one-day price chart below, Shiba Inu could find intermediate support at $0.00000961. Buy-side liquidity is expected to come in at $0.00000772. The bullish targets for Shiba Inu in its upswing are at $0.00001581 and $0.00001797 as seen in the chart below.

SHIB/USDT 1D price chart

Since the announcement, the Dogecoin-killer meme coin’s price climbed nearly 5% to $0.00001130. The Shiba-Inu-themed meme coin is trading at $0.00001125 at press time.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.