Shibarium support by top payment processor could boost bullish momentum for SHIB and BONE

- Leading payment processor NOWPayments is eager to add support for Shibarium.

- The move would make the payments gateway the first to integrate the L2 blockchain.

- It will enable the company to support tokens and projects built on Shibarium.

- Shytoshi Kusama has welcomed the proposal.

Leading payment processor NOWPayments has delivered amazing news for meme crypto fans, announcing its plans to integrate the Shibarium blockchain and provide an ecosystem of tools for all Shiba Inu-related endeavors. This move will make the company the first payment gateway to adopt the Layer-2 (L2) blockchain.

NOWPayments is aiming to be the 1st crypto payment gateway to integrate #Shibarium!

— NOWPayments (@NOWPayments_io) April 26, 2023

We support #SHIB, #LEASH & #BONE.

We offer SHIB burn feature.

We help businesses accept SHIB.

We keep developing new tools for the amazing @Shibtoken ecosystem!

Try NOW!https://t.co/9nXThvyXc6

NOWPayments to support all Shibairum projects

Based on the official announcement, NOWPayments plans to focus its team’s efforts on adopting Shibarium upon its premiere. Upon implementation, the payment processor will be able to support tokens and projects built on Shibarium by providing infrastructure for all Shiba Inu-related endeavors and, in the process, accept Shibarium L2 payments.

NOWPayments touts itself as the best service for users to accept crypto payments on their websites, online stores, and social media accounts. Being a non-custodial service, it does not hold or store user funds in any way. The platform supports over 50 cryptocurrencies, offering low transaction fees.

Shibarium is the blockchain of the people

The interest comes as NOWPayments considers Shibarium “The Blockchain of The People,” promising expedited transaction speeds at lower fees. With these value-additions, the firm hails Shibarium as the ideal business integration choice.

Further, Shibarium is also lauded as the basal platform for developing decentralized applications (Dapps) like Shib-The Metaverse (Shib.io) and Shiba Eternity, among others. It is worth mentioning that the firm is drawn to Shibarium for its “security, transparency, efficiency, cost-effectiveness, and true decentralization,” which, according to NOWPayments, are the blockchain’s primary benefits.

Notably, the collaboration between NOWPayments and the Shibarium blockchain is expected to be mutually beneficial. The payment processor hopes to be a valuable addition to Shib-The Metaverse, Shib Eternity, and every other project built atop the Shibarium blockchain.

According to the payments company, Shibarium’s security hinges on a Proof-of-Stake (PoS) algorithm where users must stake BONE tokens. Noteworthy, you can use NOWPayments to accept the BONE tokens.

Shibarium’s Shytoshi Kusama approves

The announcement also notes that Shibarium lead developer Shytoshi Kusama has issued a welcome email to NOWPayments after the payments processor summited its application to the official Shibarium website. The approval letter is a go-ahead signal for the company to provide more details about its proposed solutions before further direction from the Shibarium team.

Besides integration, the financial processor indicates that it has been developing content around the real-life applications and benefits of Shiba Inu (SHIB) as part of its strategy to raise awareness and conduct educational campaigns.

Moving forward, NOWPayments will continue creating new infrastructure (tools and features) for Shibarium projects and the Shiba Inu ecosystem at large. These will all be partisan to its commitment to finding the best ways of integrating Shibarium.

Shiba Inu, Bone ShibaSwap price could record more gains if buyer momentum grows

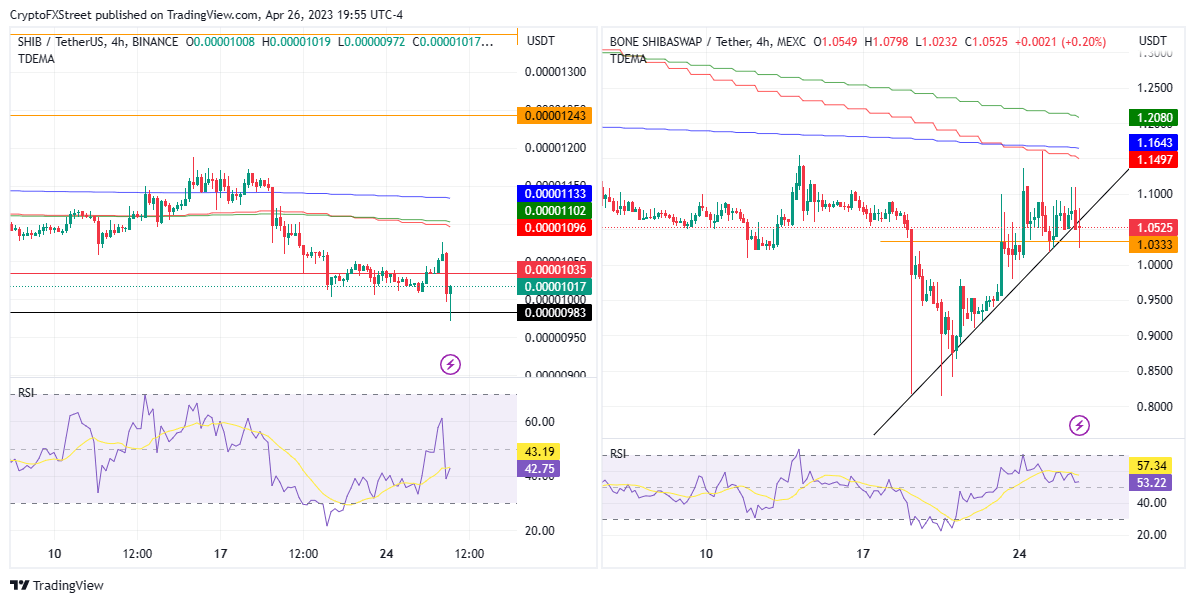

Shiba Inu price has recorded a green candlestick on the four-hour timeframe, hinting a bullish attempt to recover the market. Similarly, Bone ShibaSwap has been trading with a bullish bias for weeks, consolidating along an uptrend line.

SHIB/USDT 4-hour chart, BONE/USDT 4-hour chart

An increase in buyer momentum could solidify the uptrend move and deliver more gains for investors.

Also Read: Big Tech saves the day for Shiba Inu as a 10% profitable peak gets underway

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.