Shiba Inu-themed tokens were the top gainers during early Asian hours on Monday gaining as much as 26% in the past 24 hours, data from analytics tool CoinGecko showed.

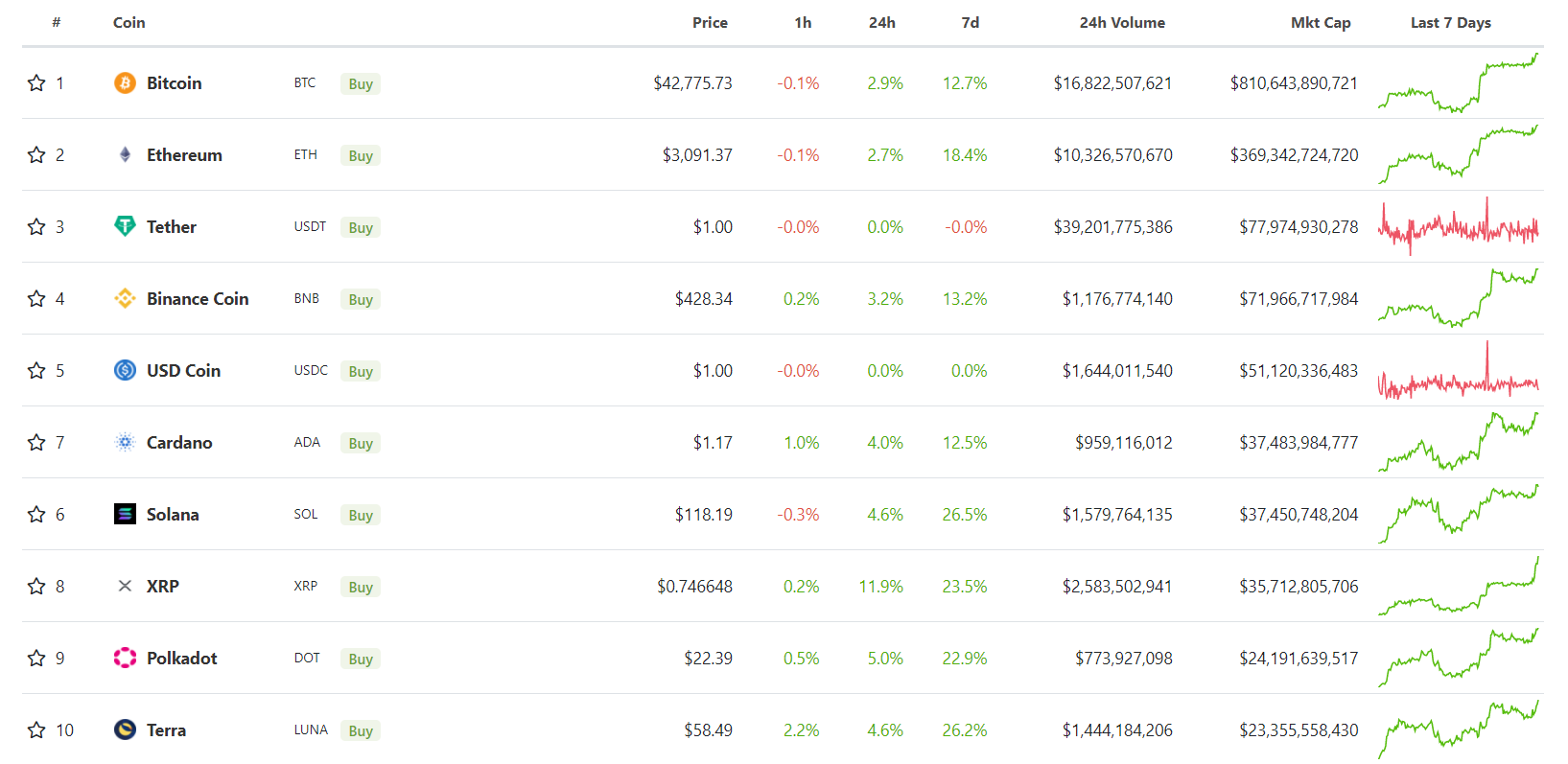

The move came amid a broader recovery in the crypto market as bitcoin and ether regained the $42,000 and $3,000 price levels respectively. Gains on the top ten cryptocurrencies by market capitalization ranged from a low of 1.6% on Terra’s LUNA to highs of 9.9% on XRP.

Memecoins led market moves outside of the top ten cryptocurrencies. Shiba Inu’s SHIB tokens surged to $0.000029 during Asian hours from the $0.000022 level on Sunday evening, a surge of over 24%, while Dogecoin’s DOGE jumped to $0.169 from $0.145.

Price charts showed SHIB hit resistance at the $0.000029 level, causing a sell-off during the Asian morning hours that brought prices lower.

The price movement caused nearly $10 million in losses to liquidations for traders of SHIB-tracked futures products. In the past 24 hours, traders lost $4.31 million to Binance’s 1000SHIB futures product, which holds 1,000 SHIB per contract. Traders also lost $5.49 million in SHIB futures. Over 74% of SHIB futures were short or betting against a price rally.

SHIB’s weekend surge came days after developers unveiled a tie-up with Welly’s, a fast-food chain selling burgers and fries. The partnership involves rebranding Welly’s stores to include Shiba Inu-themed products and imagery, and the issuance of non-fungible tokens (NFTs) for customers, developers said. Community members can buy products using SHIB and participate in Welly’s expansion via Shiba Inu’s decentralized governance forum ‘Doggy DAO.’

Elsewhere, prices of Floki Inu’s FLOKI – another Shiba Inu-themed token – bumped 17% to exchange hands at $0.00004 in Asian hours, recovering some of the losses from last week after developers disabled its cross-chain bridge after discovering an exploit. The bridge allowed users to transfer assets between the Ethereum and Binance Smart Chain networks. No FLOKI was affected in the attack, developers confirmed at the time.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Polygon joins forces with WSPN to expand stablecoin adoption

WSPN, a stablecoin infrastructure company based in Singapore, has teamed up with Polygon Labs to make its stablecoin, WUSD, more useful in payment and decentralized finance.

Coinbase envisages listing of more meme coins amid regulatory optimism

Donald Trump's expected return to the White House creates excitement in the cryptocurrency sector, especially at Coinbase, the largest US-based crypto exchange. The platform is optimistic that the new administration will focus on regulatory clarity, which could lead to more token listings, including popular meme coins.

Cardano's ADA leaps to 2.5-year high of 90 cents as whale holdings exceed $12B

As Bitcoin (BTC) gets closer to the $100,000 mark for the first time — it crossed $99,000 earlier Friday — capital is rotating into alternative cryptocurrencies, creating a buzz in the broader crypto market.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.