- Shiba Inu price action recovers back to key levels.

- SHIB price tries to refrain from printing new lows for October at the weekly close.

- Expect a possible short-term recovery, but the long-term outlook remains bearish.

Shiba Inu (SHIB) price action is, at the time of writing, still down 21% against 34% at the lowest point this week. Cryptocurrencies saw bulls storming out of the gate in the US trading session on Thursday as a lower inflation print sparked a buying wave in all asset classes except for safe havens. SHIB price action is enjoying a double whammy with a weaker dollar and the tailwinds from the rallying equities.

SHIB price doubles down on dollar weakness

Shiba Inu price action has been hanging against the ropes for most of 2022 as the stronger dollar kept pressing and squeezing bulls out of their positions. Whales were keen to pick up SHIB at lower levels than $0.00001000 and look to book some gains as price action recovers. There are certainly gains to be booked, although traders must be aware of the forces hanging over SHIB’s price.

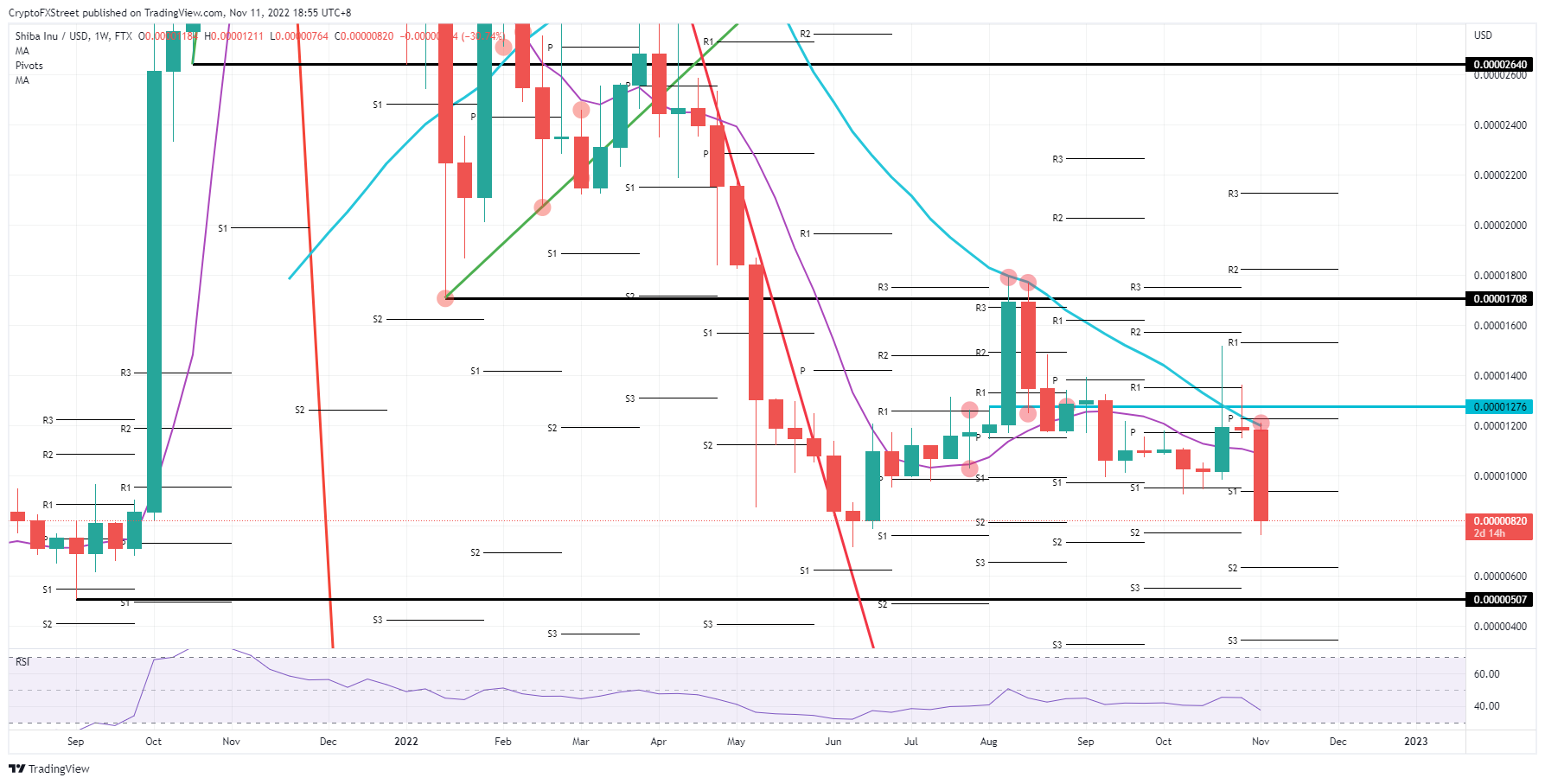

SHIB price has the 200-day Simple Moving Average (SMA) as its biggest threat from making more gains to the upside. Looking earlier on the chart, traders will spot the double top in August, which got rejected two weeks from breaking to the upside. The fact that SHIB closed below the 200-day SMA after breaking through it two weeks ago and again last week means that it is a force to be reckoned with. Expect the current rejection to be overdone, but the 200-day SMA will not be passed that easily.

SHIB/USD weekly chart

The key to unlocking the 200-day SMA comes from the dollar, which has been the driving force for most of 2022. The dollar should weaken further and continuously as more data shows that the Fed is nearing or at its pivot level. Expect more buyers and investors returning to cryptocurrencies, triggering a massive demand on the buy-side and watch as SHIB price action quickly breaks the 200-day SMA to the upside. The level to watch will be $0.00001708, the low from January

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Chainlink looks at $14 resistance as outflows from exchanges signal continued demand

Chainlink exchange outflows exceed $120 million in the last 30 days, hinting at increasing accumulation. The breakout from a falling wedge technical pattern and an uptrending RSI indicator signal stronger bullish momentum.

Bitcoin extends gains toward $90,000 as ETFs inflows exceed $381 million

Bitcoin is extending its gains, trading above $88,000 at the time of writing on Tuesday after rising nearly 3% the previous day. Institutional demand seems to be supporting BTC’s recent price rally, with US spot ETFs recording an inflow of $381.40 million on Monday.

Top 3 gainers Fartcoin, POL, DeepBook: Altcoins surge as Bitcoin nears $90,000

Investors in select altcoins like Fartcoin, POL and DeepBook welcome double-digit gains. Bitcoin inches closer to $90,000, potentially waking up as digital Gold amid uncertainty in the macro environment.

Hyperliquid updates validator to 21 permissionless nodes, HYPE price breaks out

Hyperliquid’s validator update allows anyone to register, with the 21 largest stakes forming the active set. Validators must lock up 10,000 HYPE for one year, whether in the active set or not.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.