Shiba Inu traders getting life-line from vital support as SHIB is the outlier in altcoin selloff

- Shiba Inu price is pushing over 1% higher on Wednesday while other altcoins as SOL and VET are tanking.

- SHIB bulls are getting support at an important moving average.

- Although price action pushes higher, bulls must be mindful of limited gains.

Shiba Inu (SHIB) price is seeing bulls getting unleashed as SHIB proves to be an outlier in this selloff Wednesday for alt-coins. From a technical point of view, the turnaround was projected and is setting sail for $0.00001225 or a 10% upswing. Another leg higher will depend on more altcoins seeing a similar turnaround and morale amongst bulls getting a boost.

Shiba Inu price is proving to be a rare outlier in this Wednesday selloff

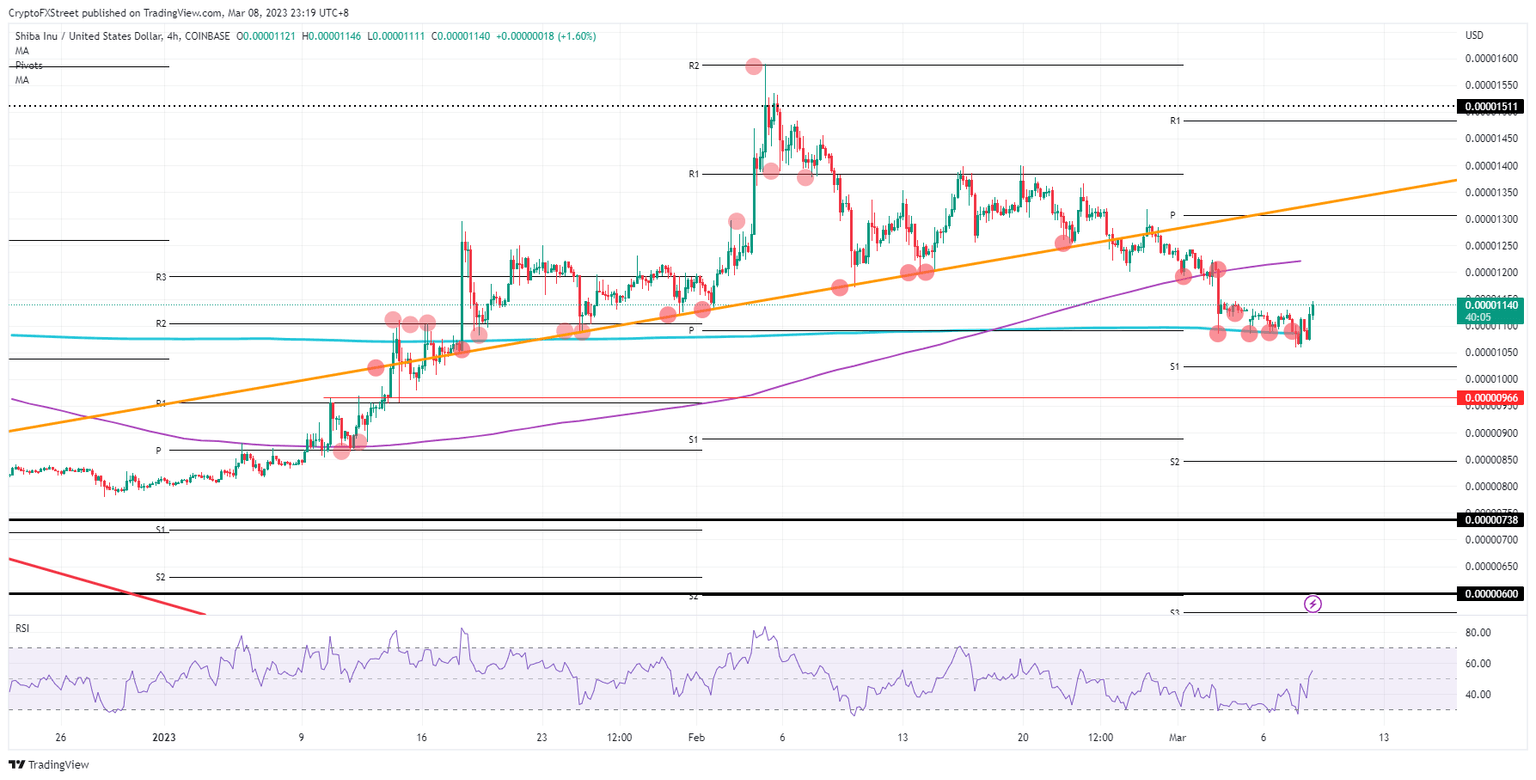

Shiba Inu price is pushing higher this Wednesday while several alt-coins are lying on their back, floored by the bearish forces that are pushing them to the downside. It should not come, though, as a surprise as Shiba Inu saw its Relative Strength Index (RSI) flooring out and started to tilt higher these past few days. Support comes from the always important 200-day Simple Moving Average (SMA) that saved SHIB traders from falling in a bear market that would have dragged Shiba Inu price below $0.00001000 for now.

SHIB bulls are in for a likely 10% gain as the 55-day SMA is very close and looks to be a cap. This is indicated by the previous reaction of SHIB on Tuesday, when it made a clean break below it and started to accelerate its decline. Should bulls be able to push beyond the 55-day SMA, the monthly pivot at $0.00001300 looks to be the ultimate profit target for now with 16% gains in total for the coming week.

SHIB/USD 4H-chart

A few altcoins as Vechain and Solana are flirting with bear market territory. Should those or other altcoins start to tank further and eke out more losses, a quick descent for SHIB would be unavoidable. In the decline, that $0.00001000 psychological level would be the ideal level bears want to go to test the strength of their decline and the belief of bulls for a turnaround.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.