Shiba Inu to outperform Dogecoin, as SHIBA targets a breakout to $0.000054

- Shiba Inu price action lower by only a tiny amount compared to last Monday.

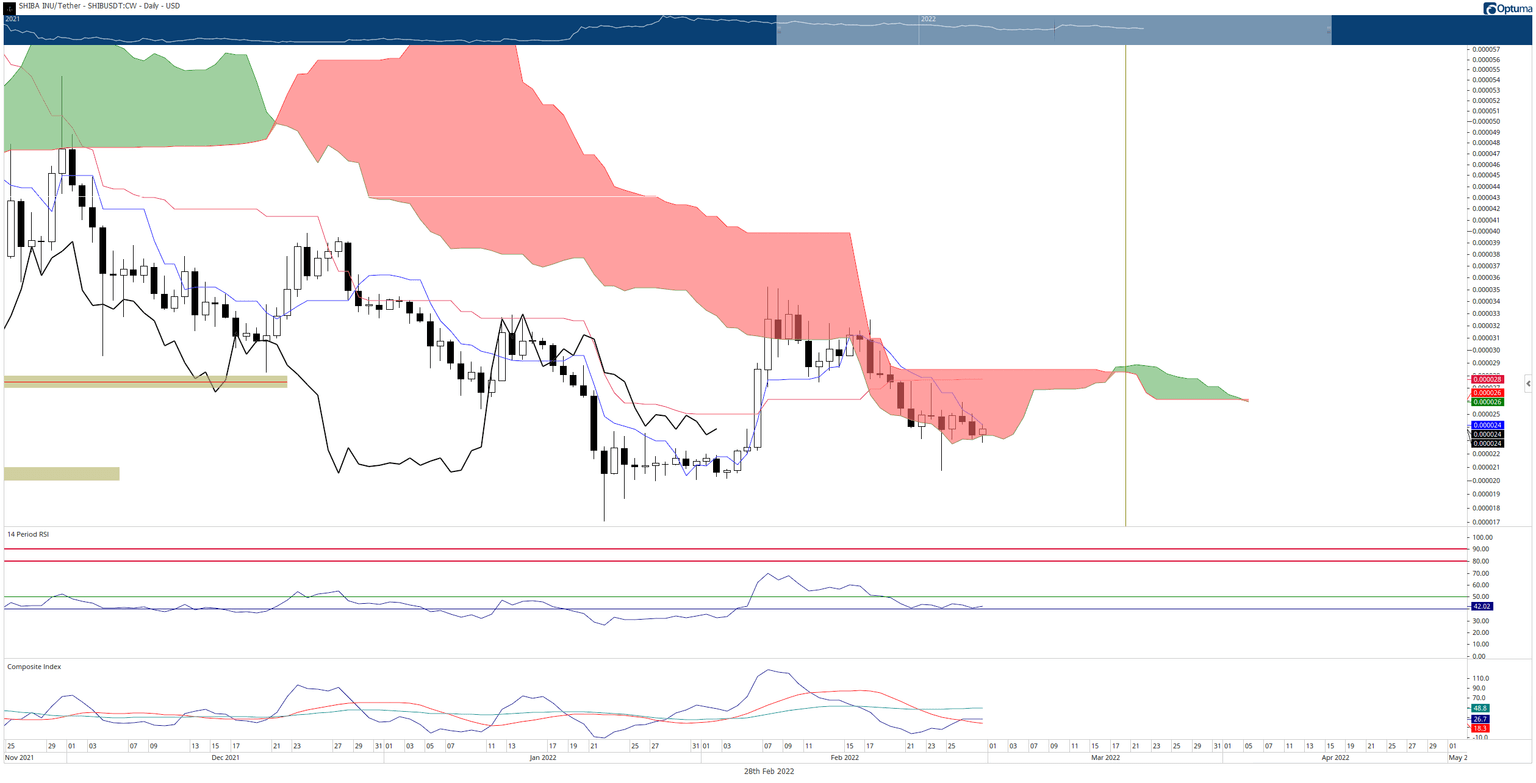

- Bulls have thus far kept the downside risks limited to the bottom of the Ichimoku Cloud.

- A new long opportunity has developed on the $0.0000025/3-box reversal Point and Figure Chart

Shiba Inu price has continued to slide south by marginal increments over the past week. However, the bottom of the Ichimoku Cloud (Senkou Span AB) has acted as a strong support zone and has prevented further sell-offs.

Shiba Inu price may be poised for a significant bullish break

Shiba Inu price has generated some bullish structure despite the current lows it is trading near. All of the conditions required to fulfill an Ideal Bullish Ichimoku breakout are complete save one: the current Close above the Ichimoku Cloud. If bulls can push Shiba Inu price to a close at or above $0.000029 to $0.000030, then that pattern will be complete, likely extending SHIBA’s run towards the $0.000054 value area. But an earlier entry is currently available on its Point and Figure Chart.

The hypothetical long entry for Shiba Inu price is a buy stop order on the three-box reversal of Xs that would form off the current O-column. At the time of publication, that entry would occur at $0.000028. The stop loss is a four-box stop, and the profit target is at $0.000454. The trade represents a 4.33:1 reward for the risk setup. A trailing stop of two to three boxes would help protect any profit made post entry.

SHIBA/USDT $0.0000025/3-box Reversal Point and Figure Chart

Additionally, as SHIBA continues to move lower, the entry and stop-loss move in tandem – but the profit target remains the same. The long trade idea is invalidated if Shiba Inu price falls to $0.000014 or lower before the entry is triggered. .

Downside risks, however, do remain a significant and nearby concern.

SHIBA/USDT Daily Ichimoku Kinko Hyo Chart

If the Shiba Inu price closes at or below $0.0000217, an Ideal Bearish Ichimoku Breakout will occur. In that scenario, a renewed bearish trend would likely begin for SHIBA. Therefore, bulls need to maintain Shiba Inu to daily closes, at a minimum, inside the daily Ichimoku Cloud.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.