Shiba Inu teases self custodial identity for SHIB holders, fails to push price higher

- Shiba Inu developer teased an update bringing self-custodial identity to SHIB holders.

- The SHIB community is awaiting the Shiba Inu identity surprise announced on October 28.

- Shiba Inu price climbed 12% over the past week, SHIB hit the $0.000008 level.

Shiba Inu, a dog-themed meme coin in the crypto ecosystem, is bringing self custodial identity to SHIB holders. Shiba Inu’s developer Kaaldhairya has teased a blockchain-based digital identification system for SHIB token holders in his comments on the October 28 announcement.

SHIB price is likely to react positively to the development, however, no gains have been noted in the past 24 hours.

Also read: Shiba Inu Price Forecast: SHIB could rally 10%

Shiba Inu holders await release of SHIB self-custodial identity feature

The Shiba Inu holder community is awaiting the release of a new feature for the SHIB token. The official X account (formerly Twitter) hinted at a surprise for SHIB token holders in an October 28 tweet.

Shib Army, brace for a seismic shift in the blockchain world!

— Shib (@Shibtoken) October 28, 2023

Attention, Shib Army! We all love a good surprise, and yours is on the horizon - the very first step to unlock your unique Shib identity is just 72 hours away!⏳

Plus, here’s your ticket to the $5,000 SHIB… pic.twitter.com/P9XzJOBGcy

The meme coin’s developers are yet to share the specifics of the Self Sovereign Identity (SSI) feature and are counting down 72 hours from October 28. The big reveal is expected on Tuesday, October 31. A Self Sovereign Identity is digital identification managed in a decentralized manner. This gives individuals sole ownership over their ability to control their personal data when interacting with a crypto asset or platform.

The introduction of SSI is expected to boost the decentralization of SHIB and make the Shiba Inu ecosystem and its Layer 2 scaling solution, Shibarium, further secure.

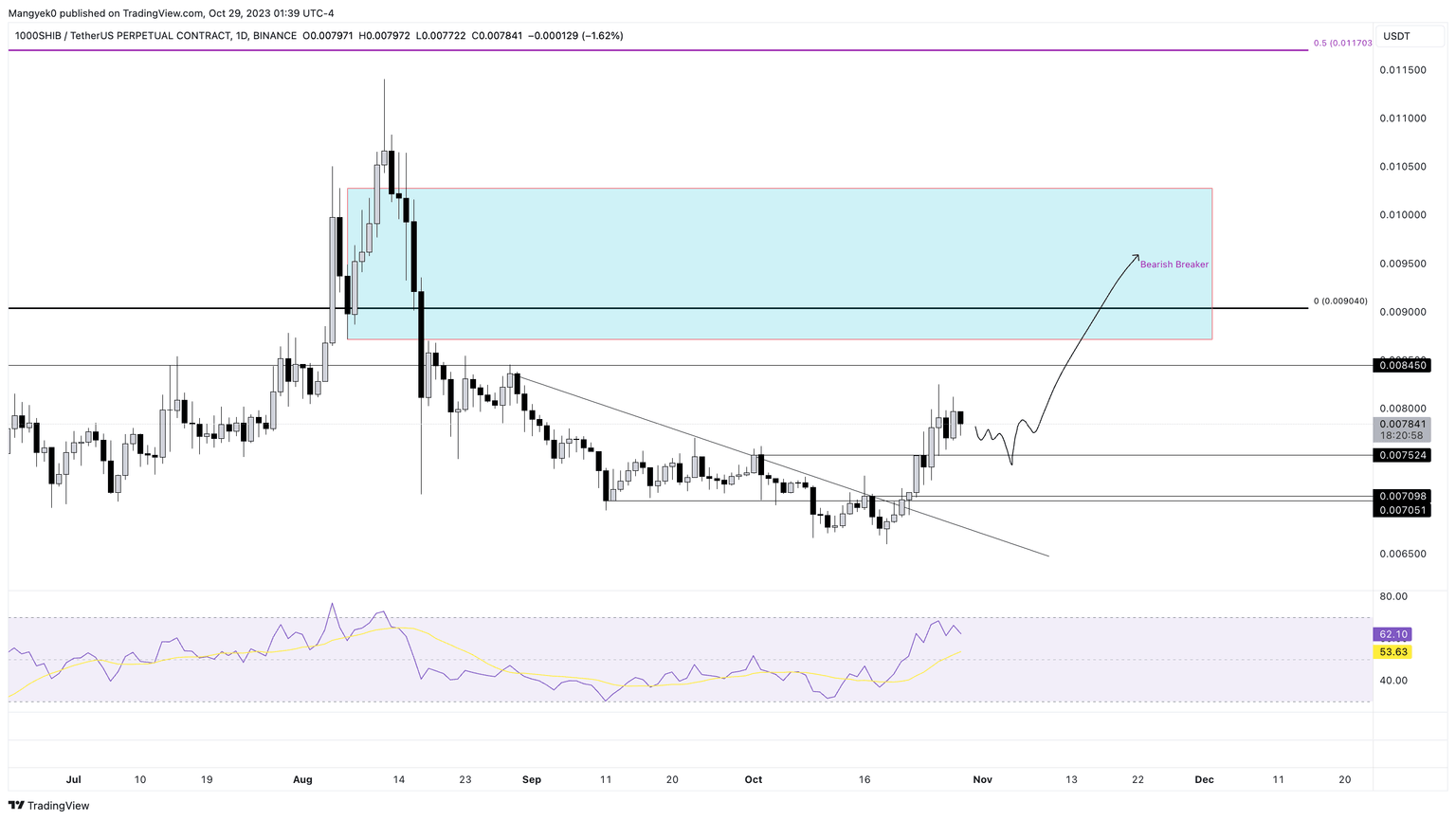

Technical analysis: SHIB price likely to rally 10%

Akash Girimath, lead technical analyst at FXStreet, evaluated the Shiba Inu price chart and predicted a 10% rally in the meme coin. SHIB price yielded 16% gains since October 26. The asset hit its local top of $0.00000824 on October 26 and the Relative Strength Index (RSI) failed to confirm the uptrend.

1000SHIB/USDT perpetual contract one-day price chart

Girimath notes that a rise in buying pressure could result in a minor pullback and pave the way for a rebound in SHIB price. Shiba Inu price is likely to rally 10%.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.