Shiba Inu set for 30% rally with all elements present, except the catalyst

- Shiba Inu price sees bulls using a triple trifecta to defend price from falling.

- Although global markets do not have much to cheer for, SHIB looks to be an outlier with plenty of technical reasons to pop higher.

- Expect a bounce off the moving averages and see a solid uptrend next week.

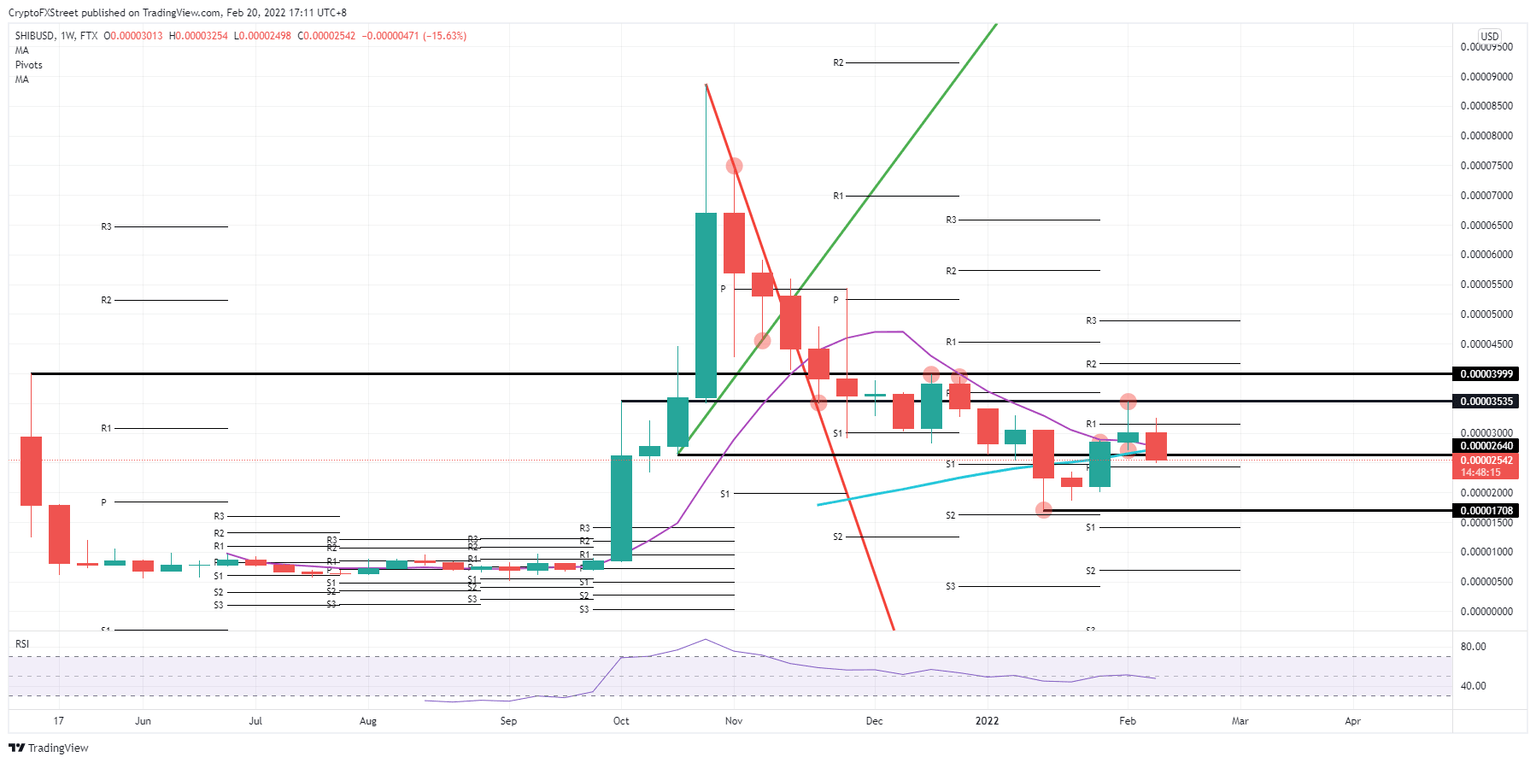

Shiba Inu (SHIB) price action is supported at the moment by the 55-daily and the 200-daily Simple Moving Average (SMA) just inches from one another with just below a crucial historical level at $0.00002640. As plenty of buy-orders awaits at these three levels, bears face a massive dam that is impossible to break. Expect this crack in sentiment for the bears to see them forfeit on their short positions once good news comes out of Ukraine or central banks take a step back from their hawkish tone, which would trigger a massive blowout rally to $0.00004000.

Shiba Inu set for a bullish outburst

Shiba Inu has all the ingredients needed for a solid rally as several technical supportive elements are falling in line. This week's weekly price action in SHIB got underpinned with the 55-day and the 200-day SMA, both just a few cents away from each other. If that had not done the trick, the historical level at $0.00002430 would have certainly done the trick as new monthly pivot.

With SHIB bulls set to blow into the sky, only one element is missing, which is the catalyst to light the dynamite. With some mild positive news over the weekend on Ukraine going into Monday, it could be that SHIB price trades around $0.00003173 with the monthly R1 resistance level. Very positive news could be that a peace agreement has been reached or that Russian troops are pulling back completely, which would see SHIB prices trading at $0.00003535, as the ultimate target would be at $0.00004000 for the open on Monday when all major futures are opening in the green, and a massive risk on wave lifts global markets higher.

SHIB/USD weekly chart

News during the weekend could come on the other side, with a more negative outcome heading into the open on Monday. Headlines on crossfire and more mortars and shelling would see Shiba Inu trading around $0.00002640. But would there be proof of a full-scale invasion with Russian tanks rolling in on Ukrainian soil and NATO retaliation with troops and violence, expect SHIB price to tank bank to $0.00001708 by Monday morning completely.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.