Shiba Inu rings greed alarm as Bitcoin eyes record high

-

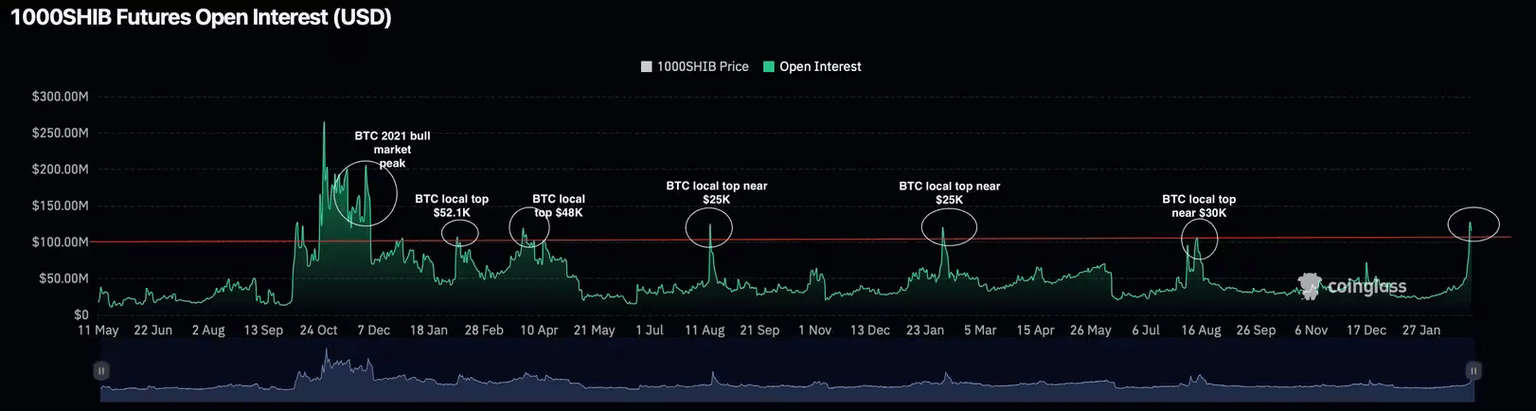

Open interest in SHIB futures has crossed above $100 million, hinting at speculative froth.

-

One analyst said that the supply-demand imbalance for Bitcoin has grown to 1:10, indicating a rally to record highs this week.

Speculative excess is building in the crypto market, suggesting caution to bitcoin (BTC) bulls as the leading cryptocurrency by market value looks to challenge record highs.

The notional open interest or the dollar value locked in the active perpetual futures contracts tied to meme cryptocurrency shiba inu (SHIB) has crossed $100 million for the first time since August 2023, according to CoinGlass. SHIB futures are sized at 1,000 SHIB per contract with up to 25 times leverage.

In the past seven days, SHIB’s market capitalization has surged over 130% to $13.44 million, beating the 22% rise in the CoinDesk 20 index. An increase in open interest alongside an uptick in market value represents an influx of new money into SHIB.

However, it’s a sign of speculative excess and an impending correction to the broader market.

The notional open interest has crossed above $100 million. (CoinGlass) (CoinGlass)

Previous instances of an above-$100 million open interest in SHIB futures have marked interim/local bitcoin price tops.

SHIB is not the only one signaling speculative froth. Data tracked by 10X Research shows volumes in South Korea have averaged at or near $8 billion recently, up significantly from $1 billion per day observed before the bitcoin bull run gathered steam.

“There is a wave of retail activity occurring from altcoins to meme-coins,” Markus Thielen, founder of 10X Research, said, referring to the uptick in trading volume on Korean exchanges.

Thielen added that Bitcoin could set a new all-time high above $69,000 this week as inflows into the U.S.-based spot ETFs continue to be significantly more than the number of BTC created per day. That has caused the supply-demand imbalance to grow to 1:10.

“Over-the-counter (OTC) trading desks are dealing with large institutional clients, and according to their aggregate inventory data, balances have decreased from nearly 10,000 Bitcoins in Q2 2023 to less than 2,000. This shows that institutions such as the Bitcoin ETF issuers, through their market makers, will have to purchase Bitcoins directly from exchanges. The supply/demand imbalance is 1:10 (daily mined vs. daily ETF demand),” Thielen noted.

Are traders running out of #Bitcoin?

— André Dragosch | Bitcoin & Macro ⚡ (@Andre_Dragosch) March 1, 2024

OTC desk balances at 388 $BTC per yesterday.

Although the data might not be representative for all OTC desks trading #Bitcoin around the world, the general trend is quite clear. https://t.co/etc4TT5ig2 pic.twitter.com/KniIfv09QL

Outflows from Grayscale’s spot ETF (GBTC) gathered pace late last week, with the fund losing $600 million on Thursday, its largest single-day redemption in over a month. Meanwhile, as per 10X Research, inflows into BlackRock’s IBIT cooled to $202 million on Friday after three consecutive days of $500-600 million.

Per Thielen, the slowdown is a temporary month-end phenomenon, and strong inflows could resume this week.

“We expect BlackRock inflows to resume this week. If Grayscale’s flows drop to less than $100m outflow, bitcoin will make a big move up,” Thielen noted.

Bitcoin changed hands at $63,300 at press time, representing a 2% gain on a 24-hour basis and a 22% rise in seven days.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.