Shiba Inu price targets $0.000028 amid renewed interest

- Shiba Inu price tries to pop back above $0.00002402.

- SHIB price sees morale lifted as tailwinds from equity markets spills over into cryptocurrencies.

- A daily close above $0.00002494, which is the 55-day SMA, would signal to markets that bulls are in control.

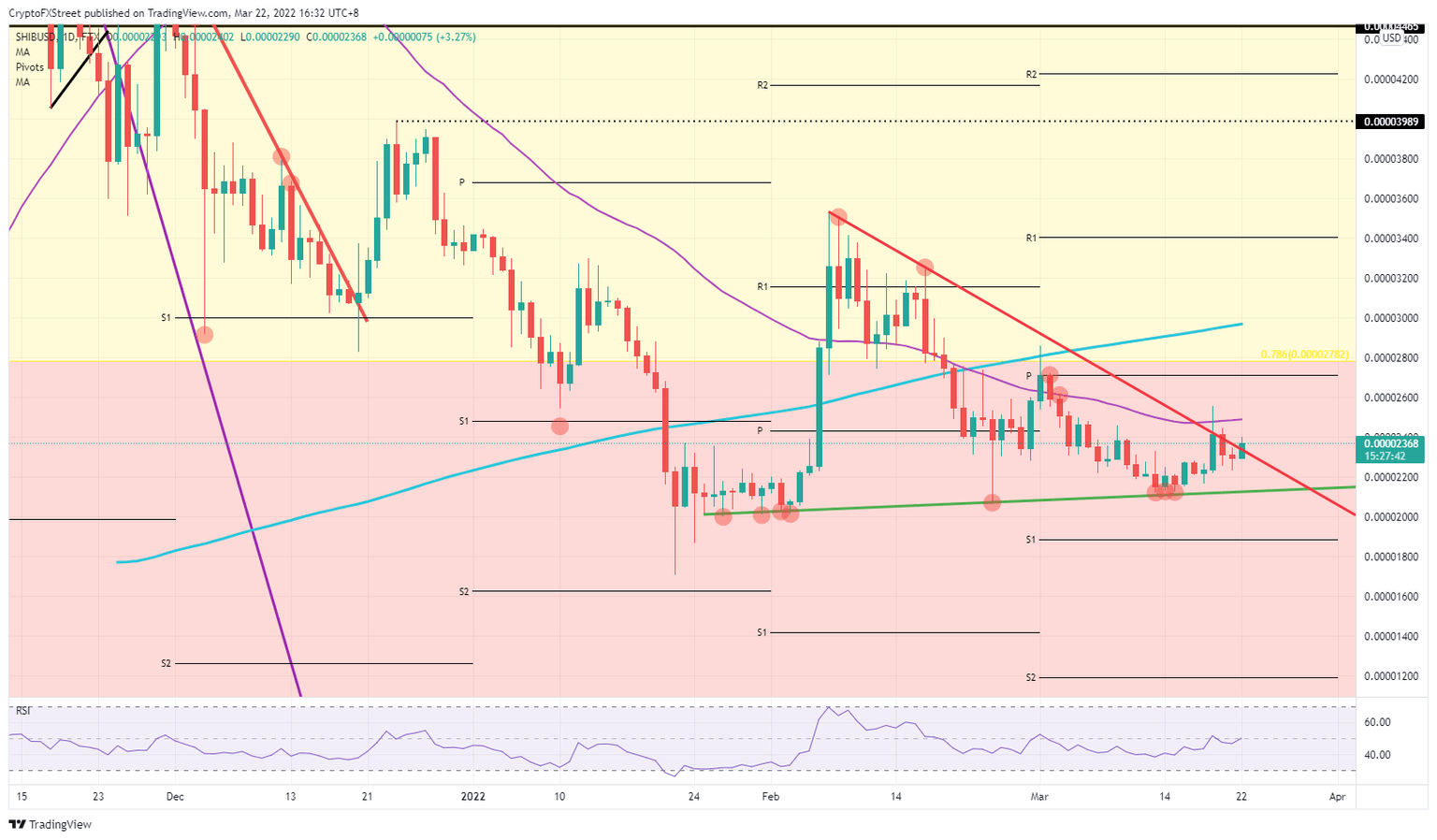

Shiba Inu (SHIB) price sees bulls picking up the short backslide from Monday when bulls let bears run price action back below the red descending trend line. Today a shift in sentiment is rolling through markets, with the stock market showing broad gains across the board and across several time zones. With the Relative Strength Index (RSI) ticking higher again, the best signal bulls could deliver to markets would be a daily close above the 55-day Simple Moving Average (SMA) which would mean over 10% gains for the trading week.

Shiba Inu price prepares for a significant bullish impulse

Shiba Inu price is set to trigger a bear trap after bears were able to push it back below the red descending trend line on Monday. Overnight headlines, however, and a late statement from Powell made markets reshuffle their battle plans, putting equities back on the front foot as the FED looks set to step up its game to contain and deal with inflation worries. This move is being applauded by markets and seeing a spillover effect into cryptocurrencies, with SHIB price squeezing out bears to the upside as it rises back above the red descending trend line.

SHIB price briefly topped above $0.00002400 and the best outcome would be for bulls to break and close above the 55-day SMA at $0.00002494. With that signal, bulls will be perceived as the main drivers in Shiba Inu price, with more gains to come towards the end of the week as the ultimate target isset at $0.00002800, which is the 78.6% Fibonacci level.

SHIB/USD daily chart

A big wave of inflation is heading towards the West, with Europe and the US facing higher commodity prices that will weigh on consumer sentiment. With consumers fretting about higher inflation and the impact on their household budgets, there will be less cash available to spend on cryptocurrencies. Expect to see this reflected in cryptocurrencies which will experience lower volumes and a window of opportunity is likely to open for bears to push Shiba Inu price back to the green descending trend line around $0.00002120 or $0.00001885.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.