Shiba Inu price stagnancy brings investors’ losses to a 28-month high

- Shiba Inu price has been trading between $0.00000700 and $0.00000800 for the entirety of this month.

- The total number of investors witnessing losses amounts to nearly 90% of all the addresses, the highest since May 2021.

- SHIB supply is moving from investors to whales, which, although it is a good sign, is yet to show any impact on price action.

Shiba Inu price has been rather dormant these past four weeks, which is bearing a negative impact on the investors. The meme coin market has been struggling to make headlines as the lack of increase in altcoin’s market value has left investors in peril, which is now driving them to pull back and wait until SHIB starts rising again.

Shiba Inu price needs to make a move

Shiba Inu price trading at $0.00000729 has remained mostly stuck within a range since the beginning of this month. Treading between $0.00000700 and $0.00000800, the meme coin has mostly hovered closer to the lower limit of the range, marked at $0.00000699. The chances of SHIB falling through this support line are strong.

The Relative Strength Index (RSI) shows that the bullish momentum has not been adequate to pull Shiba Inu into the bullish zone above the neutral mark at 50.0. A flip of this line into support would suggest that a price bounce back is likely; thus, watching the indicator could provide cues as to when one can jump in.

However, losing the aforementioned support level could throw Shiba Inu price lower to $0.00000656, which coincides with the year-to-date lows. Falling through it would result in a fresh 2023 low.

SHIB/USD 1-day chart

But on the off chance that SHIB finds support in its investors and manages to pump bullishness into the altcoin, a rise towards $0.00000800 is possible. The cryptocurrency would also flip the 50-day Exponential Moving Average (EMA) into support, recovering the losses from the past month.

Can investors push for a recovery?

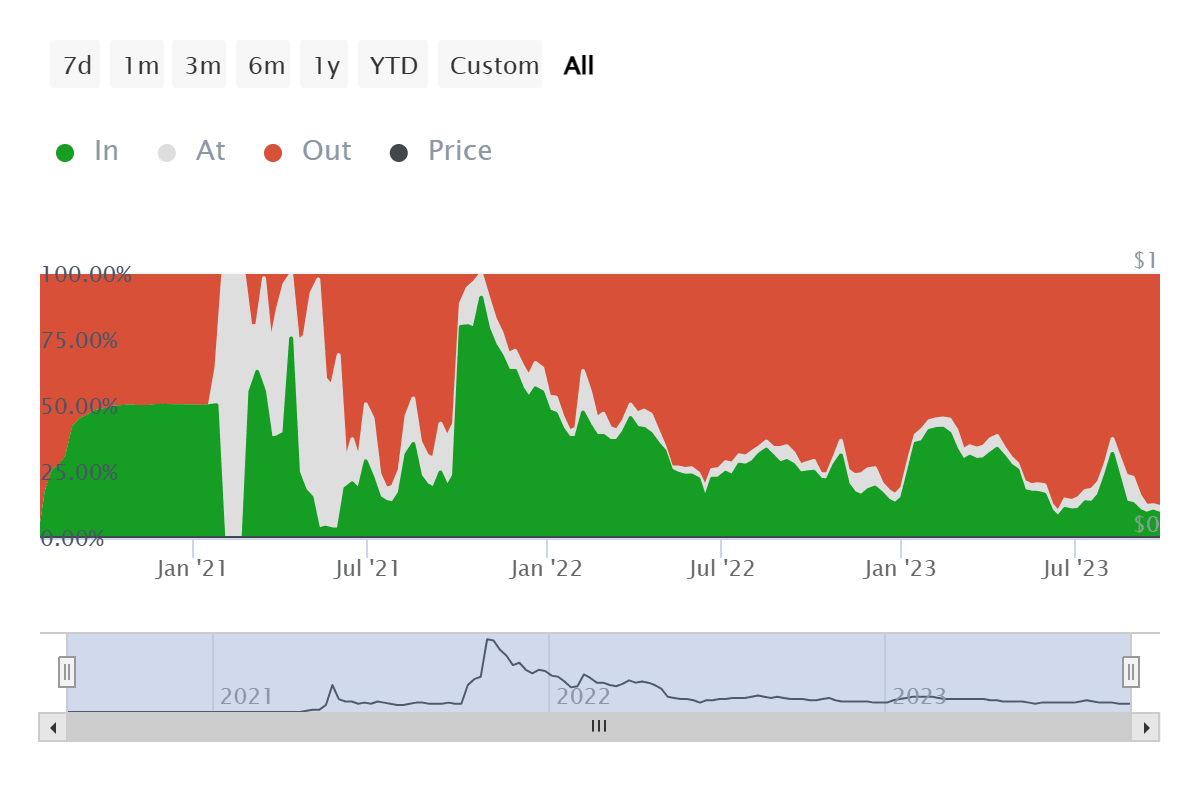

Looking at the on-chain indicators, the possibility of investors engaging voluntarily to imbue bullishness into the market is rather bleak. The is because they have no incentive to conduct transactions on-chain. In the past month, the concentration of investors witnessing a loss has increased significantly.

At the time of writing, more than 88% of all SHIB holders are underwater. This was last noted nearly 28 months ago, back in May 2021. Such a high concentration of loss-bearing investors shows that not only is optimism weak, but pessimism is getting stronger.

Shiba Inu investors at a loss

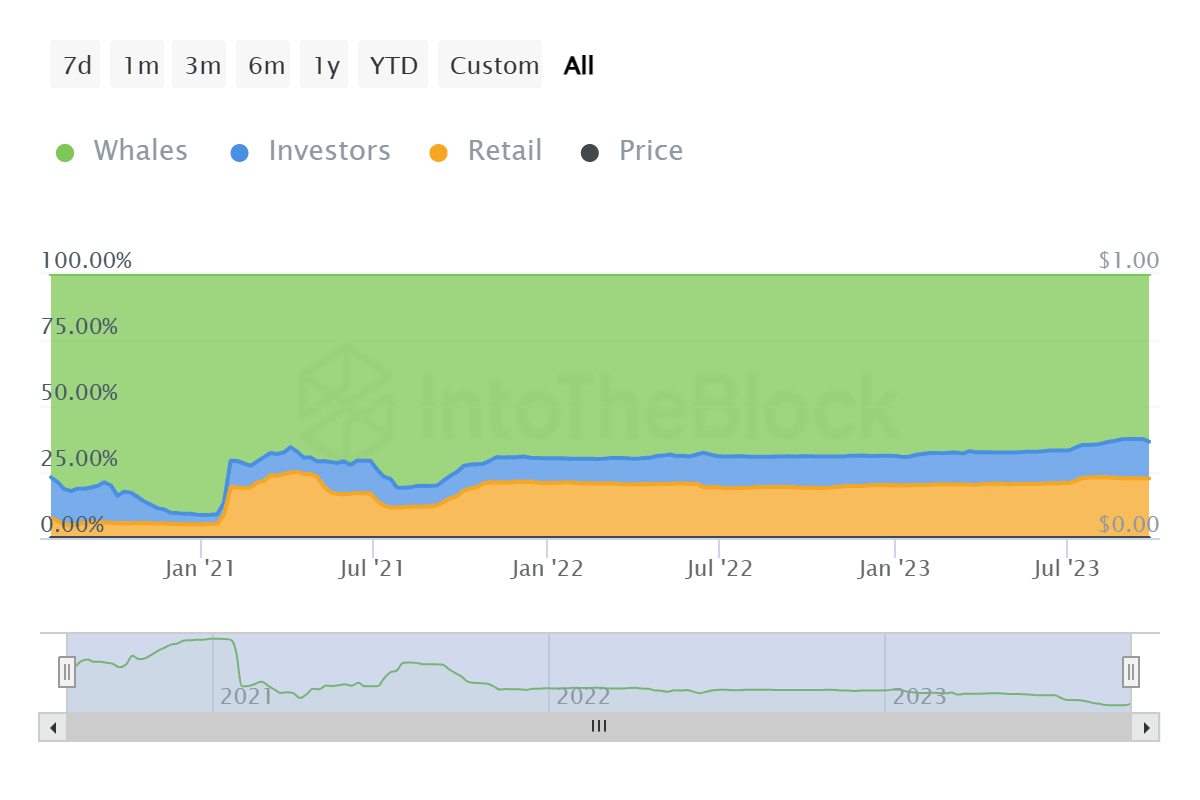

This is also evinced by the shift in the supply held by different kinds of investors. Even though whales are the predominant cohort of investors when it comes to SHIB, other retail investors are also an important chunk.

However, in the past couple of days, the retail investors seem to have dropped a significant portion of their SHIB holdings. This supply was picked up by whales, who now hold 623 trillion SHIB or 63.5% of the entire circulating supply, while In the past weeks, retail investors dropped about 8 trillion SHIB worth nearly $60 million.

Shiba Inu supply held by different cohorts

Thus, the best bet for Shiba Inu price of recovering with the help of its investors is in the hands of the whales.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.