Shiba Inu price rises on speculation of Elon Musk's Twitter moves

- Shiba Inu price is up 20% since mid-June, rallying north as Elon Musk continues to revamp Twitter.

- As part of ongoing changes, chatter around SHIB's involvement in the development has inspired optimism among traders.

- Community members anticipate crypto payment to play a role in the rebranding that Elon Musk has embarked upon.

- X users say the meme coin would thrive if taken as an alternative to the traditional fiat on the platform.

Shiba Inu (SHIB) price continues north, consolidating along an uptrend line as investors record more gains. While there may be several drivers behind the meme coin's current bullishness, the recent Twitter revamp to X merits among them, as community members hope SHIB will play a role in Elon Musk’s plans.

Also Read: ARB, LDO, BLUR, HNT prices find support as Coinbase brings tokens to German residents.

Shiba Inu could feature in Elon Musk's Twitter revamp plans

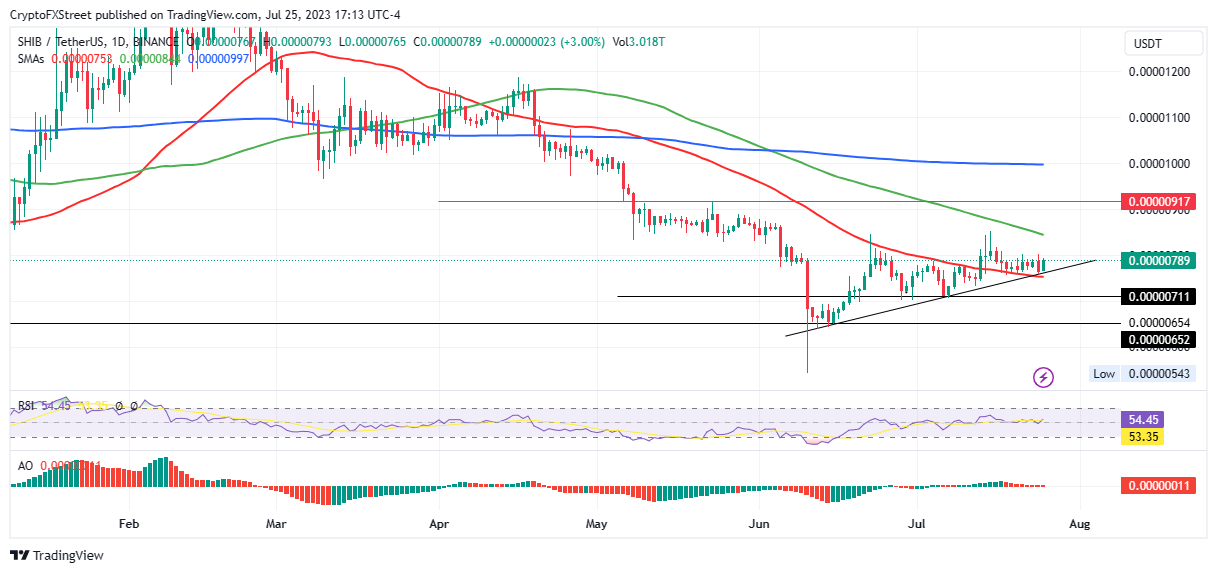

Shiba Inu (SHIB) price is up almost 5% in the last 24 hours, sustaining above an uptrend line as it edges toward the $0.00001100 mark. The meme coin has flipped the 50-day Simple Moving Average (SMA) (red band) from resistance to a support level at $0.00000753. The current optimism, indicated by the latest green candlestick on the daily chart below, comes amid speculation of Shiba Inu token's involvement in Elon Musk's Twitter overhaul plans.

Currently, Twitter (now X) uses fiat to make settlements for different forms of payment. For instance, the $8 payable for account verification is paid in fiat currency. With X tokens making headlines, one user says the giant social media platform needs a full decentralized finance (DeFi) token like SHIB to avoid regulatory issues.

#SHIB system is in place

— Lola (@CryptoLollla) July 25, 2023

X/Twitter cant use their own token as it is against Howey since they are Enterprise. It needs a Full DeFi token like Shiba INU to avoid regulatory issues . $SHIB is available in over 100 CEX and more DEX . Countries are adding them to an official…

This comes amid a regulatory clampdown by the US Securities and Exchange Commission (SEC), which is going after crypto projects selling unregistered securities. The Ripple (XRP) partial victory against the financial regulator has complicated matters further after Judge Analisa determined that the sale of crypto to institutional investors is a criterion for a security label under the Howey Test. Accordingly, using X coin for the social media platform could raise concerns with the SEC.

As Musk steers Twitter to becoming a "global financial empire and a social hub," going for a decentralized meme coin solution such as Shiba Inu would be progressive, adding to the list of use cases for blockchain technology.

It is worth mentioning that Musk had tried integrating Shiba Inu into Twitter earlier in the year, using a dog-themed logo to replace its traditional bird symbol. According to the technology billionaire, the move did not achieve much, and they retracted to the bird.

We rebranded to a Shiba Inu dog for a while. No impact.

— Elon Musk (@elonmusk) July 25, 2023

With more fundamental changes expected on how users can take part on the social media platform, expected plans include "comprehensive communications and the ability to conduct robust financial processes in the coming months." This is where community members feel Shiba Inu should come in.

Shiba Inu price outlook amid plans of SHIB integration into Twitter

Shiba Inu (SHIB) is auctioning at $0.00000789, flashing green as bulls push north. Increased buyer momentum above this level could see SHIB tag the 100-day SMA at $0.00000844. An extended move north could see the second largest meme coin by trading volume tag the $0.00000917 supplier congestion zone.

In a highly bullish case, Shiba Inu price could reach the overhyped $0.00001000 mark, which was last tested on May 8. The Relative Strength Index (RSI) moved north, indicating rising momentum. Equally, the Awesome Oscillators (AO) histograms were in the positive zone, suggesting bulls lead the SHIB market.

With momentum rising and bulls leading, Shiba Inu price maintaining above the uptrend line could see SHB hit the $0.00001000 level soon.

SHIB/USDT 1-Day Chart

Conversely, if sellers recover, Shiba Inu price could head lower, breaking below the support confluence between the 50-EMA and the uptrend line at $0.00000753. However, the bullish outlook would only be invalidated upon a decisive daily candlestick close below the $0.00000711 mark.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.