Shiba Inu price provides opportunity to accumulate before SHIB rallies 20%

- Shiba Inu price faced rejection around the weekly resistance level at $0.0000283 and is undergoing retracement.

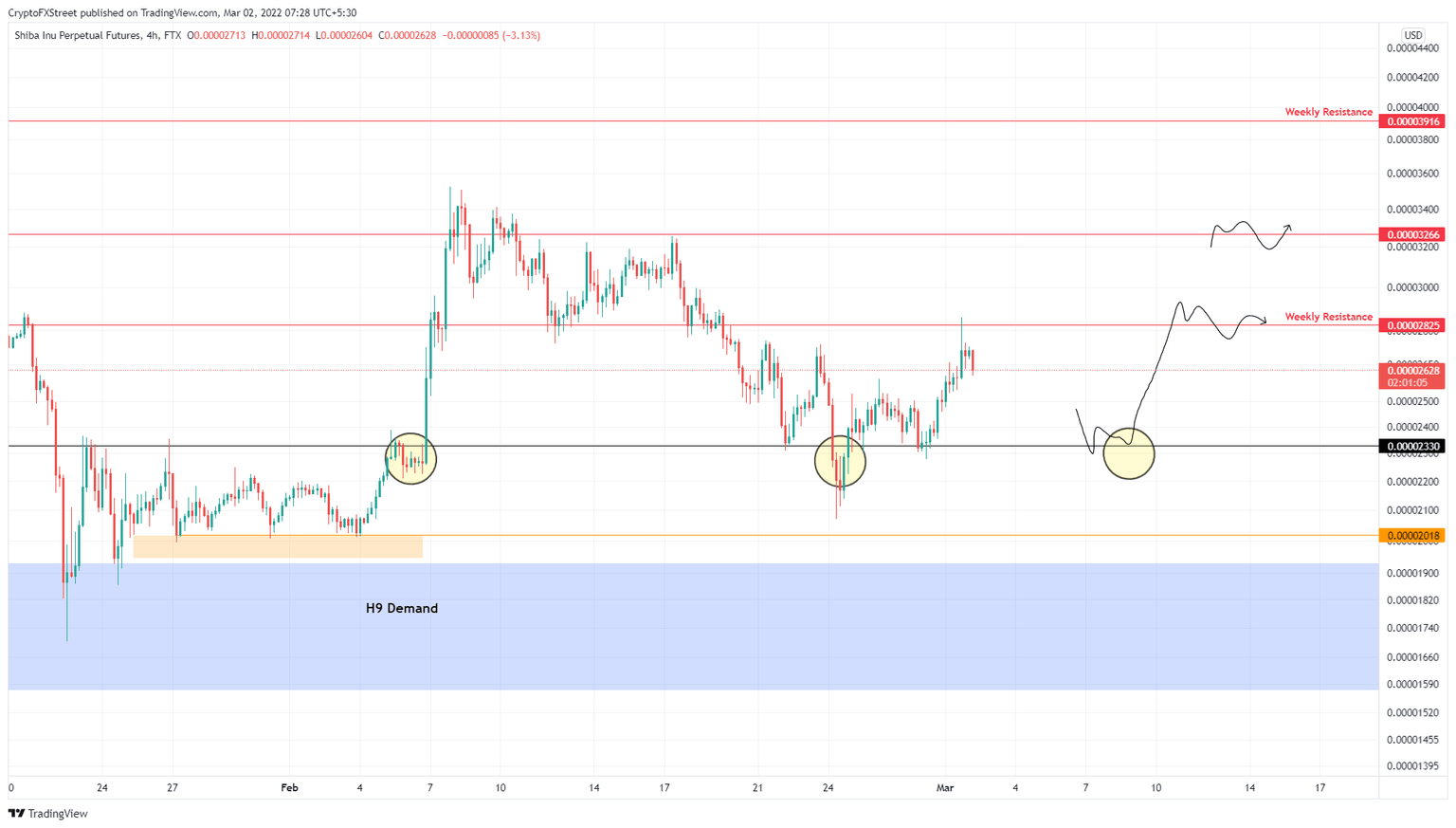

- The ongoing pullback will likely lead to a triple bottom setup at $0.0000233, with a potential to trigger a 20% rally to $0.0000283.

- A four-hour candlestick close below $0.0000233 will create a lower low and invalidate the bullish thesis for SHIB.

Shiba Inu price has struggled to maintain the bullishness witnessed between February 6 and 8. This lack of commitment has led SHIB to go astray and revisit lower levels. Despite the recent bullishness in the crypto market, the meme coin has rallied conservatively.

Shiba Inu price shows promise

Shiba Inu price briefly consolidated below the $0.0000233 barrier before exploding 56%. The resulting downswing knocked the meme coin below $0.0000233, which recovered quickly. Since then, SHIB has rallied 24% and faced rejection at the hands of a weekly resistance barrier at $0.0000283.

The rejection here has the potential to undo recent gains and drag the Dogecoin-killer back to the $0.0000233 support level. If this outlook plays out, it will create a triple bottom setup, which forecasts a trend reversal; in this case, an uptrend.

The said technical formation could trigger a 20% ascent to $0.0000283. In a highly bullish case, Shiba Inu price could make a move to $0.0000323, bringing the total gain to 40%.

SHIB/USDT 4-hour chart

While things are looking favorable for a quick bullish trade, Shiba Inu price needs to hold above the $0.0000233 support floor. A four-hour candlestick close below the said barrier will create a lower low and invalidate the bullish thesis for SHIB.

In this case, Shiba Inu price could slide lower and collect liquidity resting below the $0.0000202 support level. This development will be another catalyzing event for a bullish outlook.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.