- Shiba Inu price is retracing after rallying 50% in less than two days.

- This downswing will provide market participants an opportunity to accumulate SHIB before it triggers a 30% ascent.

- A breakdown of the range low at $0.0000356 will invalidate the bullish thesis.

Shiba Inu price is undergoing a minor retracement after it saw a sudden uptick in buying pressure, leading to a rally. This correction will provide sidelined buyers with an opportunity to jump on before the next leg higher.

Shiba Inu price prepares for another launch

Shiba Inu price rallied 50% between November 28 and November 30 as it rose from $0.0000362 to $0.0000543. This massive upswing is currently undergoing a retracement and hovering around the trading range’s midpoint at $0.0000452.

Investors can expect SHIB to eventually reverse after it dips back into the buy zone. This high probability reversal zone will allow investors who missed the first Shiba Inu price pump to get onboard for the next bull phase.

To enter long, market participants need to wait for a retest of the 62% Fibonacci retracement level at $0.0000431. This dip will prime Shiba Inu price to trigger a 25% surge, leading to a retest of the range high at $0.0000543.

Clearing this barrier will confirm buyers’ strength and propel Shiba Inu price to make a run at the following levels: $0.0000579 and $0.0000652. In total, the move from $0.0000431 to $0.0000652 will represent a 46% advance.

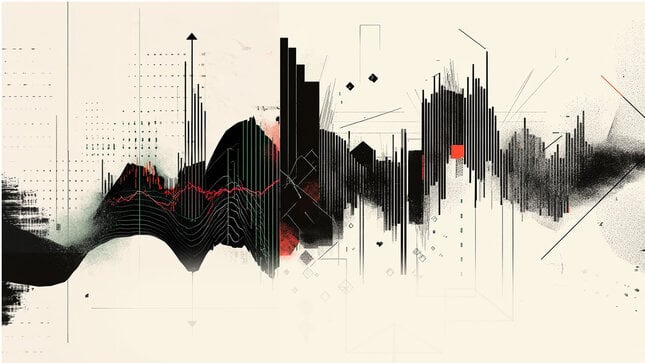

SHIB/USDT 4-hour chart

While the reversal zone, ranging from $0.0000362 to $0.0000543, has a high chance of triggering an upswing, there are chances an excessive increase in selling pressure could lead to a break below this area.

In such a situation, investors can expect Shiba Inu price to retest the range low at $0.0000362. A small dip below this area is possible and is a ploy by market makers to collect the sell-stop liquidity resting below it.

If Shiba Inu price produces a daily close below $0.0000356, it will invalidate the bullish thesis and potentially trigger a crash to $0.0000327.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRUMP token leads $906 million in unlocks this week with over $330 million release

According to Tokenomist, 15 altcoins will unlock more than $5 million each in the next 7 days. Wu Blockchain data shows that the total unlocked value exceeds $906 million, of which the TRUMP token will unlock more than $330 million.

Why Mantra token’s dramatic 90% crash wiped out $5.2B market share

Mantra price hovered at $0.83 during the Asian session on Monday, following a massive 90% crash from $6.33 on Sunday. The crash wiped out $5.2 billion in the token’s market capitalization, quickly drawing comparisons to the infamous collapse of Terra LUNA and FTX in 2022.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC is on the verge of a breakout while ETH and XRP stabilize

Bitcoin price approaches its key resistance level at $85,000 on Monday; a breakout indicates a bullish trend ahead. Ethereum and Ripple found support around their key levels last week, suggesting a recovery is in the cards.

Bitcoin and crypto market sees recovery as Fed official says agency ready to stabilize market if necessary

Bitcoin rallied 5% on Friday, trading just below $84,000 following Susan Collins, head of the Boston Federal Reserve (Fed), hinting that the agency could stabilize markets with "various tools" if needed.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.