Shiba Inu Price Prediction: Will BONK profit rotation kickstart SHIB’s 25% rally?

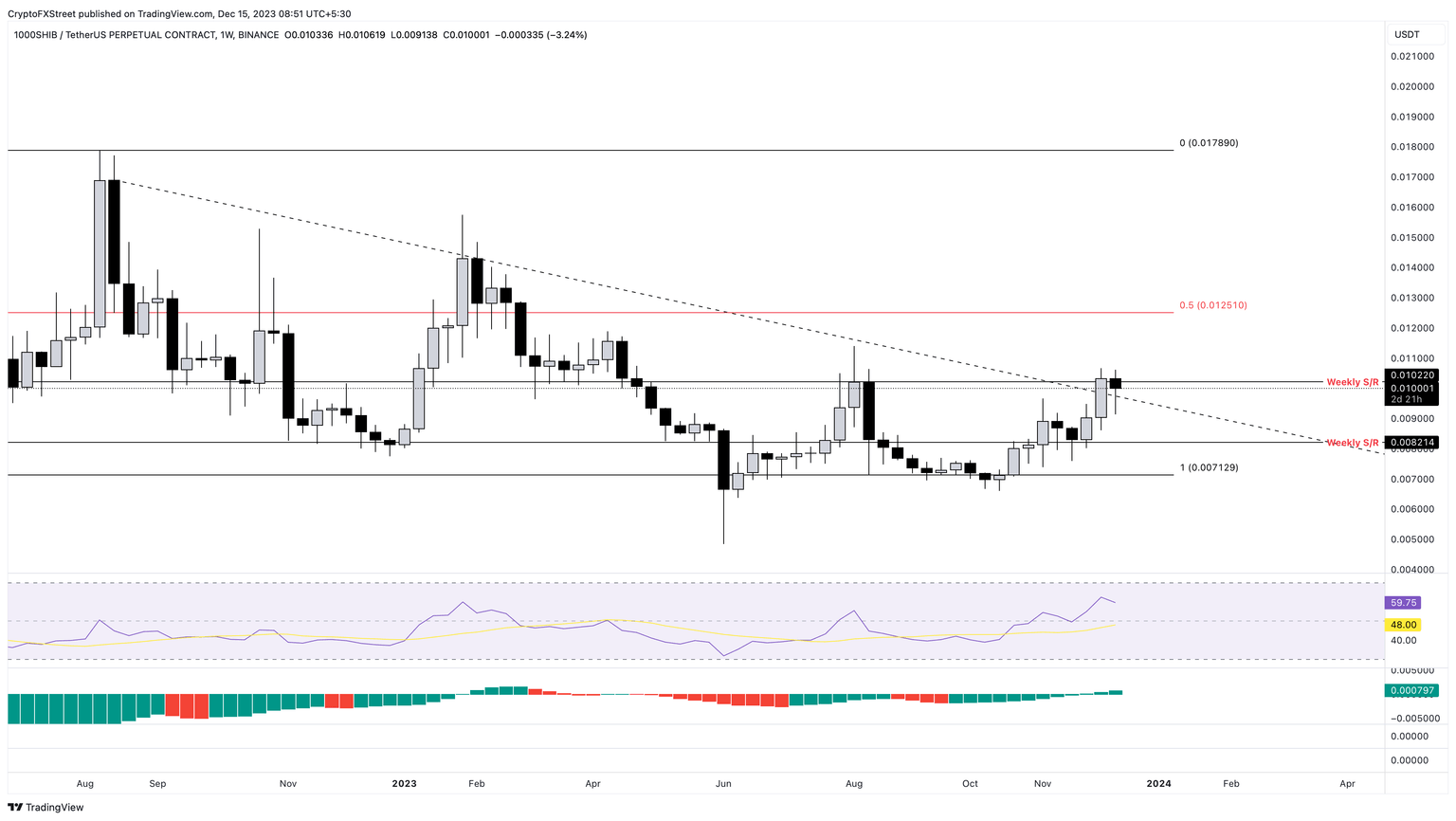

- Shiba Inu price breached the multi-month declining resistance level after last week’s near 9% rally.

- If this move is followed by a flip of the weekly resistance level at $0.00001022 into a support floor, it could kickstart a 25% rally to $0.00001250.

- A weekly candlestick close below $0.00000821 will invalidate the bullish thesis for SHIB.

Shiba Inu (SHIB) price shows signs of kickstarting a massive rally after last week’s development. If SHIB bulls are successful in overcoming one more hurdle, SHIB could trigger a massive uptrend in the coming week.

Also Read: PEPE price stuck in a rut loses to Solana memecoin BONK as latter’s market cap triples in 48 hours

Will Shiba Inu benefit from altcoin profit rotation?

With huge gains noted in Solana-based meme coin Bonk Inu (BONK), investors are likely going to pay attention to other altcoins, including Dogecoin and Floki Inu, which could cause a rally in these cryptocurrencies as well. If this development is followed by altcoin profit rotation, meme coins could, in general, see gains by association.

Altcoin profit rotation in the cryptocurrency ecosystem refers to a phenomenon where investors shift their focus and funds between different altcoins to maximize profits. This rotation occurs as traders seek opportunities in various altcoins rather than solely focusing on Bitcoin. The profits from one crypto usually rotate into another crypto, which causes successive rallies in different sectors of altcoins.

Read More: Shibarium transactions surpass milestone, exceed 105 million

Shiba Inu price ready to move higher

Shiba Inu price was trading under a declining resistance level since August 2022, but this downtrend was breached last week as SHIB produced a weekly candlestick close above it. Despite this major development, SHIB needs to overcome another hurdle at $0.00001022.

A successful flip of this barrier into a support floor will be the buy signal before Shiba Inu price kickstarts a nearly 25% rally to $0.00001250.

The weekly Relative Strength Index (RSI) and the Awesome Oscillator (AO) for Shiba Inu price are both in a good spot to support bullish moves.

SHIB/USDT 1-day chart

On the other hand, a weekly candlestick close below the key support level of $0.00000821 will create a lower low and invalidate the bullish thesis for SHIB. This development could see Shiba Inu price shed 13% and revisit the range low at $0.00000712.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.