Shiba Inu Price Prediction: We've all made gains, now here comes the pain

- Shiba Inu Price Prediction: We've all made gains, now here comes the pain

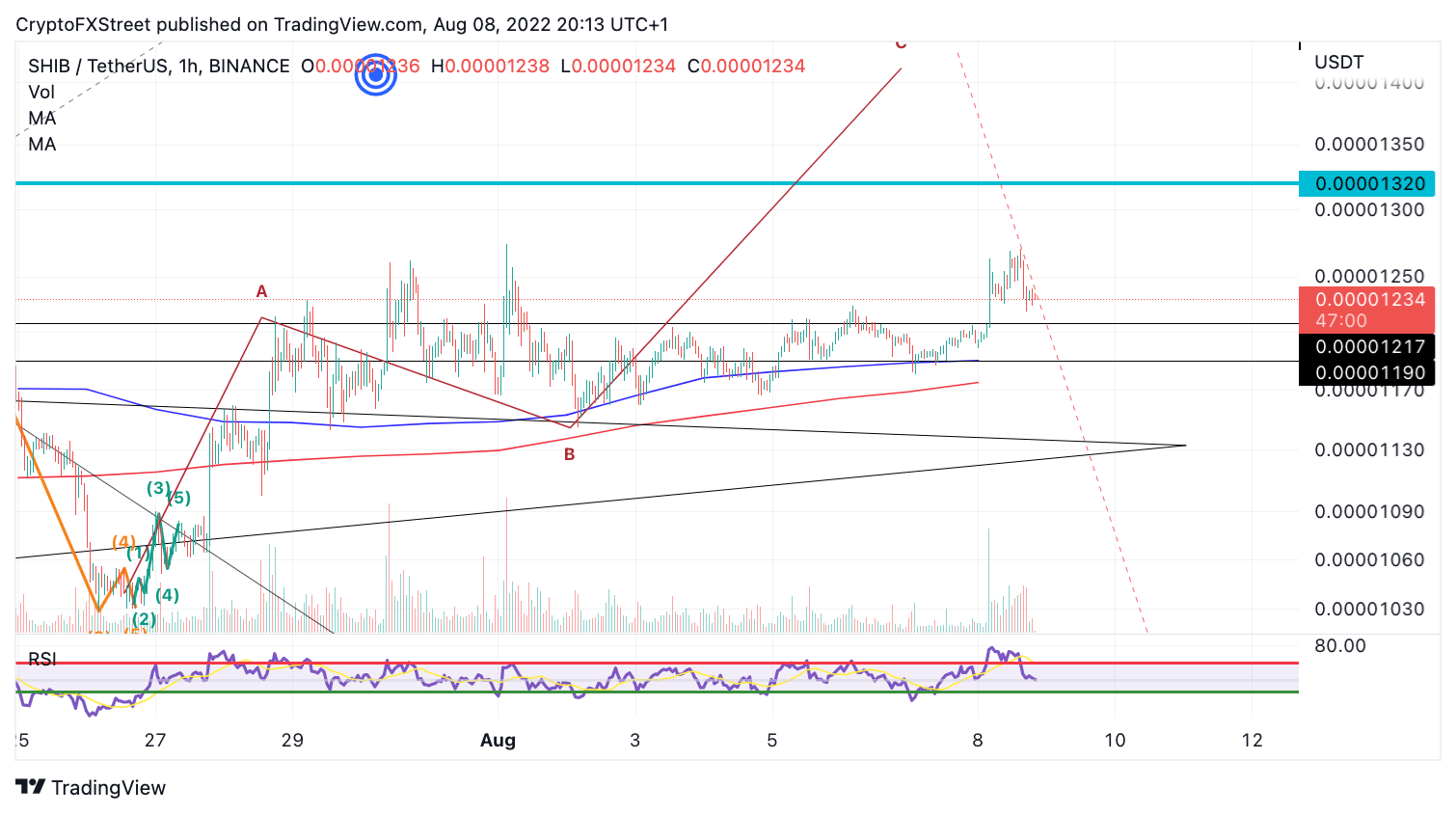

- Shiba Inu price falls in free-fall fashion after tagging last week's bullish target zones.

- Invalidation of the bearish thesis is a breach above $0.00001875.

Shiba Inu price could witness a sharp decline as multiple forecasts issued a warning of a potential pump and dump underway,

Shiba Inu price follows suit.

Shiba Inu price is continuing to validate technical outlooks forecasted throughout the summer. Last week, a 35% increase was forecasted ahead of time, enabling subscribers a chance to partake in a profitable swing trade.

However, the same bullish thesis gave a warning to immediately withdraw from the market upon reaching the intended $0.00001700 target zone as the uptrend appeared to be a part of a larger corrective structure. The technicals forecasted potential for a sharp decline once the target was reached.

Shiba Inu price currently trades at $0.00001428. The volume profile indicator shows a large uptick in transactions amidst breaching the bullish target, but the bearish stop candle hovering next to it depicts a concerning signal.

The bulls have yet to challenge the stop candles’ force, which showed more transactions than the previous consolidation zone, which led the way to a month-long consolidation in July. Additionally, the RSI shows the SHIBA price as more oversold than when the notorious coin traded 150% higher back in February 2022.

SHIB/USDT 1-Day Chart

When combined, Shiba Inu price could be heading south to collect liquidity at the $0.00000975 levels, a 33% decline from today's current value. Invalidation of the bearish thesis is now a closing candler above $0.00001875 until further notice.

Shiba Inu Trade Setup Recap

SHIB/USDT Bullish Trade Setup

Shiba Inu price has recently rallied an impressive 35% in just one day. Throughout the summer, the outlook on Shiba Inu price has been maintained at a short-term bullish stance with targets in the $0.00001400 -0.00001550 area. In last week’s bullish thesis, a 2.7-1 reward to risk trade setup was forecasted.

A volatile spike towards $0.00001300 could be a significant catalyst for higher targets. Invalidation of the uptrend remains at $0.00001150.

After spotting a bearish divergence on the daily chart, an update was issued which suggested trailing the profitable trade and continuing to aim for higher targets.

“Still, the intended target zone at $0.00001400 is within arms reach. If the target is surpassed, traders may want to consider actualizing the profit as bearish divergences tend to result in liquidations after the fact. Early signs of uptrend weakness will be a break below $0.00001217.”

Shiba Bearish Divergence Thesis

In the following video, our analysts deep dive into the price action of Shiba Inu, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.