- Shiba Inu price edges close to triggering a rally after elaborate consolidation inside a Po3 setup.

- A successful breakout could send SHIB up from 20% to 27% to tag the $0.00000964 and $0.0000101 levels, respectively.

- A daily candlestick close below the $0.00000684 support level will invalidate the bullish thesis for the dog-themed cryptocurrency.

Shiba Inu price has set up a Power of 3 setup, which forecasts massive gains for the altcoin. The predicted rally, however, is contingent that SHIB can flip a critical resistance level into a support floor.

Also read: Shiba Inu introduces ‘Shibacals’ to link nfts to real-world items – SHIB jumps

Shiba Inu price edges closer to catalyzing a swift rally

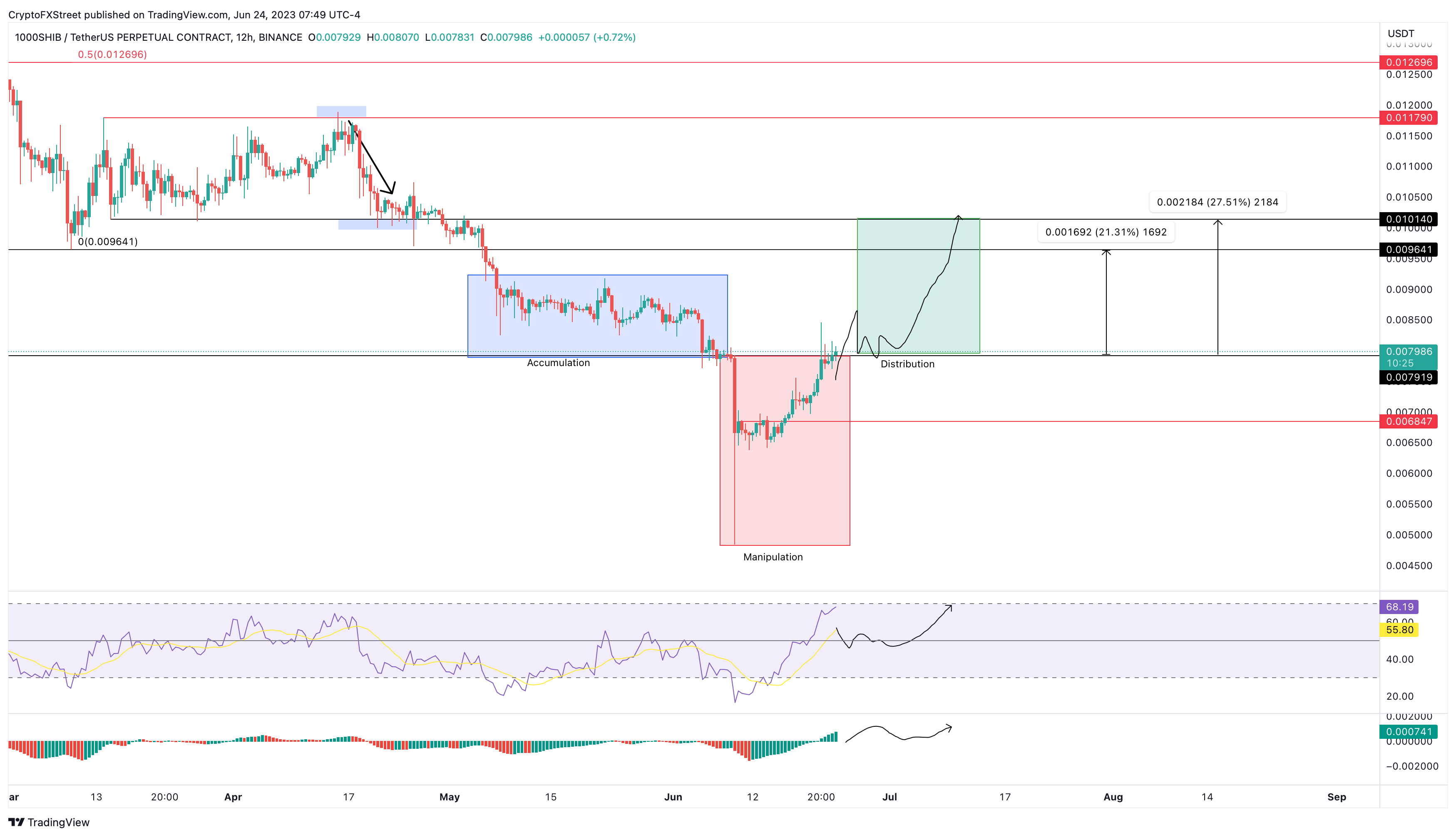

Shiba Inu price has shown incredible resilience to bears over the past few days. The result of which is a 25% ascent in the last nine days. Considering the price action of SHIB between May 8 and June 24 reveals the foundation of a Power of Three (Po3) setup.

This technical formation contains three distinctive phases:

- The asset needs to consolidate above a significant support level, which in SHIB’s case is the $0.00000791, This is the accumulation phase.

- Following this stage, the asset drops lower to collect liquidity below a key swing low and take out early bulls, which is a clear sign of manipulation. Hence, this is the manipulation phase.

- The last stage involves a recovery above the recently broken critical support level, which will confirm the start of the next phase - Distribution.

The last phase is the most volatile one and often results in massive moves.

Currently, Shiba Inu price is edging closer to recovering above the $0.00000791 hurdle and flipping it into a stable support level. Doing so will confirm the breakout from the Po3 setup and kick-start a distribution phase for SHIB.

The ideal take-profit levels for Shiba Inu price include $0.00000964 and $0.0000101, which are roughly 20% and 27% away from the current position at $0.00000797.

SHIB/USDT 12-hour chart

While the Po3 setup for Shiba Inu price hints at a minimum of 20% gain for SHIB holders, a failure to break above the $0.00000791 will signal a weak buyers’ camp. Furthermore, a breakdown of the $0.00000684 support level will invalidate the bullish thesis for the dog-themed cryptocurrency.

In such a case, Shiba Inu price could slide 6.30% and retest the June 14 swing low at $0.00000641.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP Price Prediction: How Ripple's alignment with the $18.9T tokenization boom could impact XRP

Ripple (XRP) approached the critical $2.00 level during the Asian session on Friday after a minor correction the previous day reinforced higher support at $1.95.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH show weakness while XRP stabilizes

Bitcoin (BTC) and Ethereum (ETH) prices are hovering around $80,000 and $1,500 on Friday after facing rejection from their respective key levels, indicating signs of weakness. Meanwhile, Ripple (XRP) broke and found support around its critical level.

Can Trump's tariff pause and declining inflation keep Bitcoin afloat? Experts weigh in

Bitcoin (BTC) dived below $80,000 on Thursday despite US Consumer Price Index (CPI) data coming in lower than expected and President Donald Trump's 90-day reciprocal tariffs pause on 75 countries.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin (BTC) miners are reportedly scrambling to import mining equipment into the United States (US) following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.