Shiba Inu Price Prediction: SHIB may have laid a bull trap, as $0.00000711 becomes pivotal

- Shiba Inu price reverses cup-with-handle breakout with the largest negative day since June 21.

- SHIB daily Relative Strength Index (RSI) reaches the first overbought reading since the May crash.

- The union of the 50-day simple moving average (SMA) with the handle low of $0.00000711 needs to hold to keep the breakout live.

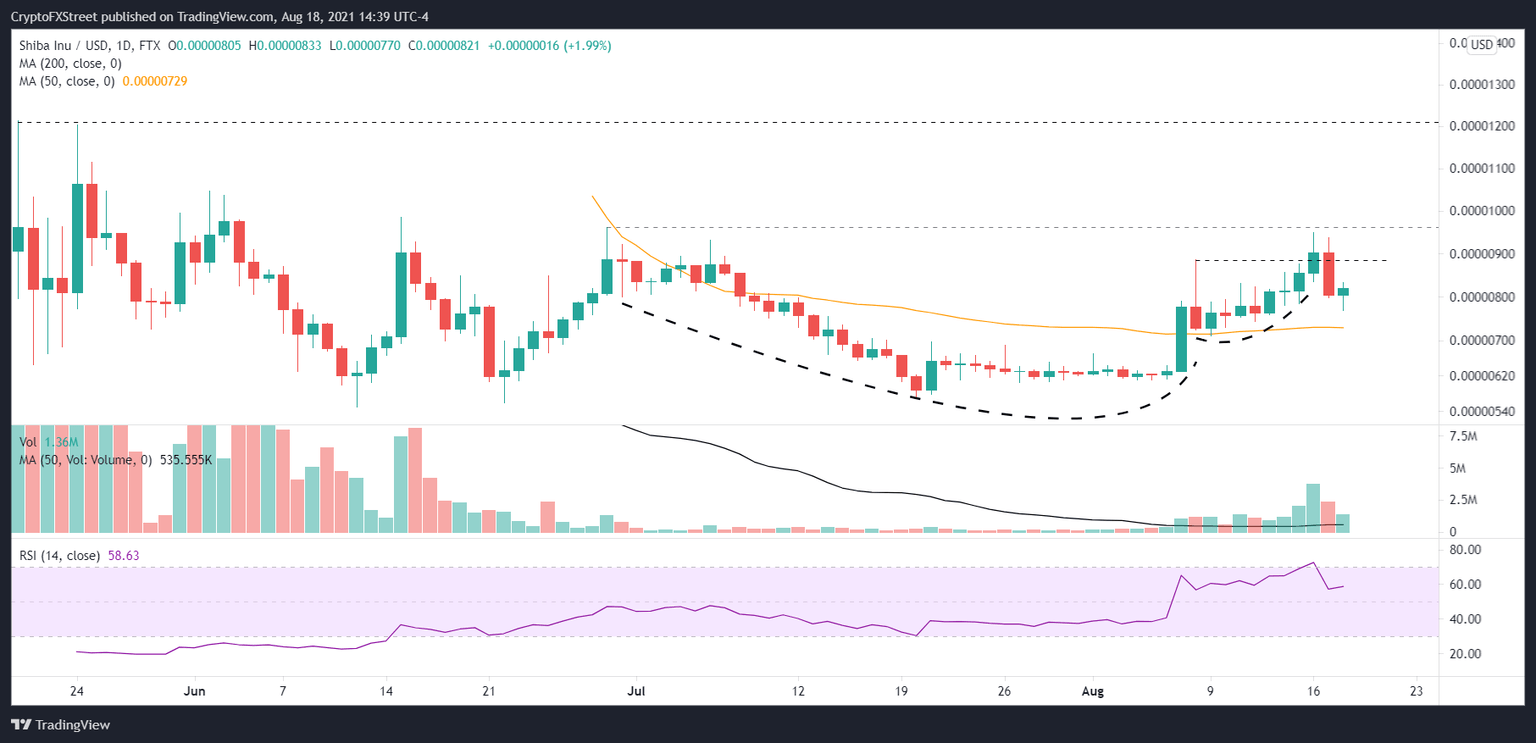

Shiba Inu price shaped a cup-with-handle base through July and early August before triggering on August 16 with a daily close above the handle high of $0.00000887. The breakout has quickly introduced profit-taking, suggesting a bear trap and putting the 36% measured move of the SHIB base in doubt.

Shiba Inu price plots new opportunity, but investors are not convinced

On August 16, Shiba Inu price triggered a constructive base after weeks of false attempts or erratic price structures. However, the breakout was met with a -10.75% reversal on August 17, marking the most significant daily decline since June 21. The potential bear trap has put SHIB investors on the defensive, with the meme token showing a double-digit loss from the handle high entry price.

The lack of conviction and resulting Shiba Inu price reversal has spotlighted the support framed by the 50-day SMA at $0.00000729 with the handle low of $0.00000711. It is the make-or-break level for the cup-with-handle breakout based on a daily close, and it would represent a loss of 20% from the SHIB handle high entry price.

A failure to hold $0.00000711 would quickly flip the Shiba Inu price outlook to bearish, exposing SHIB to a test of the July 20 low of $0.00000570 or the June low of $0.00000550 and a loss of -22.64% from the handle low.

SHIB/USD daily chart

The sharp reversal on August 17 may be a brief reaction to the overbought reading on the daily RSI and not a bull trap. To confirm a renewal of the breakout, Shiba Inu price needs to log a daily close above the breakout high of $0.00000949 printed on August 16. Otherwise, SHIB speculators will be locked in a directionless cryptocurrency, undermining the base legitimacy and the bullish narrative developing since the 23.30% bounce on August 7.

With the cryptocurrency market manufacturing impressive gains in several altcoins, Shiba Inu price finally caught a bid, thrusting SHIB from a constructive base, but investors’ conviction barely lasted a day. It is a reminder of the challenges inherent in trafficking in outlier cryptocurrencies and now emphasizes the importance of $0.00000711.

Here, FXStreet's analysts evaluate where SHIB could be heading next as it seems primed for a correction before another run-up.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.