- Shiba Inu price hit $0.00001 on Tuesday, trading at its lowest since August 2024.

- Since the Pectra upgrade testnet launch on March 5, Ethereum total value locked has witnessed $14 billion in outflows.

- Technical indicators on the SHIBUSDT 12-hour chart are shaping up for more downsizing.

Shiba Inu (SHIB) price hit $0.00001 on Tuesday, testing seven-month lows before rebounding 6%. On-chain data shows investors withdrawing funds from the Ethereum ecosystem after the Pectra upgrade could spark further losses.

Shiba Inu (SHIB) price test seven-month lows as memecoin traders panic

Shiba Inu prices plunged to record lows on Tuesday as memecoin traders intensified sell-offs under multiple bearish catalysts.

The first post-US Nonarm Payrolls (NFP) sell-off on Friday set the ball rolling for a bearish weekend.

However, after more tariff spats between the US and Canada on Monday, cascading liquidations sent SHIB prices spiraling to new lows as investors moved to shift funds out of high-risk and low-liquidity meme tokens.

Shiba Inu Price Action, March 11

SHIB price had plunged 28.88% in the last four days, trading as low as $0.000010 on Tuesday before bulls battled back to reclaim territory around $0.000012 at press time. However, the low volumes accompanying the recovery suggest weak conviction.

Ethereum TVL withdrawals signal weakened ecosystem activity since Pectra upgrade

In addition to bearish macro pressure from US trade policy tweaks, SHIB’s weak performance in the past week has coincided with investors pulling funds out of the Ethereum ecosystem.

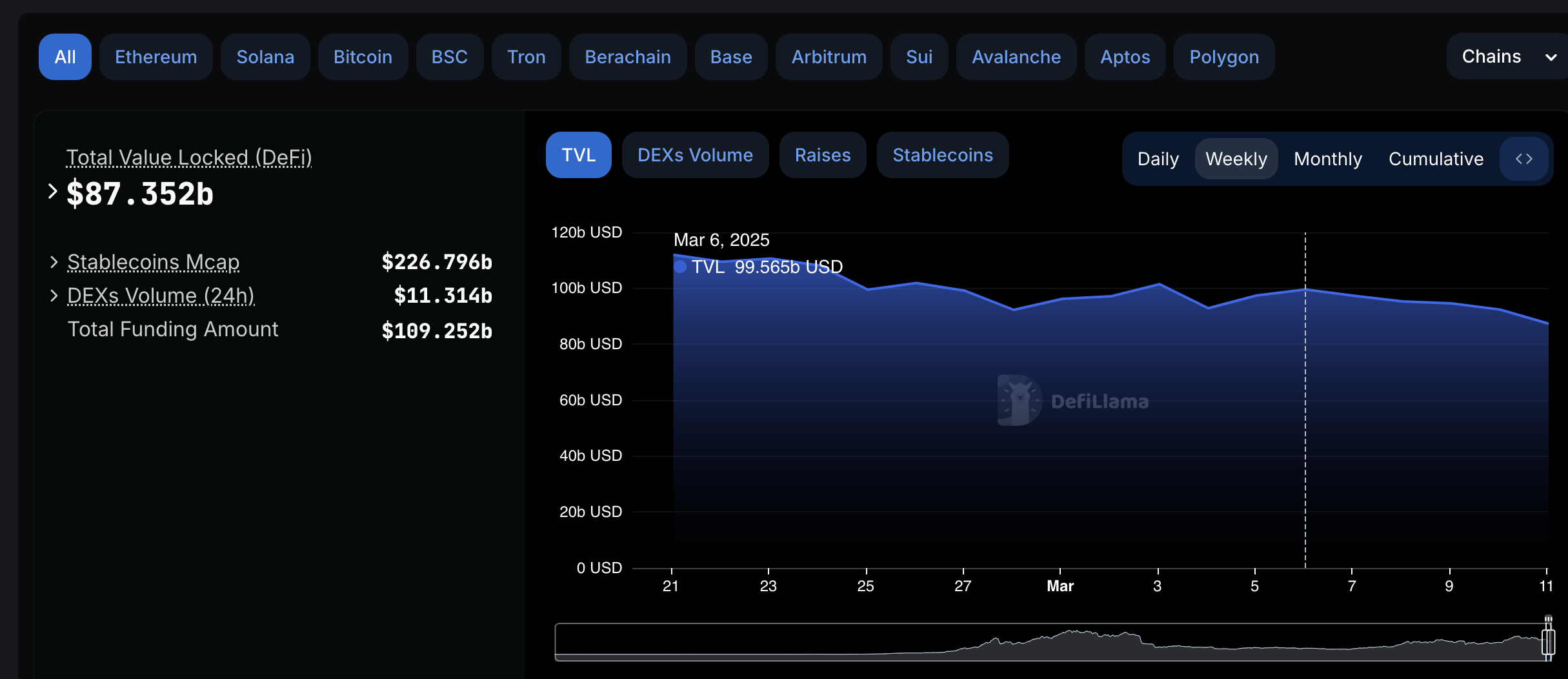

DeFiLlama’s Total Value Locked (TVL) tracks the value of capital invested within a blockchain ecosystem and serves as a key indicator of investor sentiment.

Since the Pectra upgrade testnet launch on March 5, Ethereum’s TVL has suffered $14 billion in outflows, declining from $101 billion to $87 billion as of Tuesday.

This coincided with a 17% decline in Shiba Inu’s price within the same period.

Ethereum Total Value Locked (TVL) | DeFiLlama

Ethereum Total Value Locked (TVL) | DeFiLlama

The downturn suggests that the highly anticipated Pectra upgrade has so far failed to attract new liquidity into the Ethereum ecosystem.

While the upgrade was expected to improve efficiency and scalability, investor sentiment has leaned bearish, reflecting concerns about implementation delays and broader crypto market headwinds.

Adding to the uncertainty, growing doubts over Donald Trump’s ability to secure congressional approval for his crypto strategic reserve proposal have likely dampened investor confidence.

Trump’s proposal had previously fueled speculative optimism for Ethereum-based assets like SHIB, but legislative hurdles now present additional downside risks.

If Ethereum’s TVL outflows persist, SHIB price could face further declines. A sustained drop in ecosystem-wide liquidity often leads to lower on-chain activity, shrinking trading volumes, and weaker price support for Ethereum-hosted assets such as Shiba Inu.

Shiba Inu Price Forecast: Bears could target $0.00001 breakdown

Despite mild intra-day recovery on Tuesday, Shiba Inu price remains under pressure. The 12-hour chart shows SHIB trading at $0.00001188 after briefly touching a seven-month low of $0.00001000. Bollinger Bands are widening, with price action hovering near the lower band, indicating heightened volatility and persistent selling pressure.

The Volume-Weighted Average Price (VWAP) at $0.00001156 signals that bulls are struggling to reclaim lost ground, reinforcing the dominance of bearish momentum.

Shiba Inu Price Forecast

BM-X indicator reflects weakening bullish strength, with green peaks losing momentum while red zones dominate, signaling that market sentiment remains fragile.

A breakdown below $0.00001124, the lower Bollinger Band support, could expose SHIB to another retest of the critical $0.00001000 floor.

If bearish pressure accelerates, cascading liquidations from overleveraged positions may drive the price lower, with $0.00000950 emerging as the next significant support.

On the upside, SHIB needs a decisive close above $0.00001297, the upper Bollinger Band resistance, to regain bullish footing.

A successful breakout past this level could open the door to a short-term recovery toward $0.00001470. Until then, the risk of further downside persists, with traders closely watching liquidity levels and leverage unwinding in the broader market.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-638773230900970529.png)