Shiba Inu Price Prediction: SHIB can rally 7% if bulls can overcome critical resistance level

- Shiba Inu price has created a foothold, which could trigger a quick rally soon.

- A flip of the $0.00000694 hurdle is in progress and could catalyze a 7% run-up to $0.00000748.

- A daily candlestick close below the $0.00000684 support level will invalidate the bullish thesis.

Shiba Inu (SHIB) price breached a key resistance level on October 21, which opened the possibility of a further rally. Investors can note that SHIB bulls have the upper hand and are likely to take advantage of that in the coming week.

Read more: Shiba Inu price rises 6% as SHIB pivots to the lower mean threshold

Shiba Inu price to climb higher

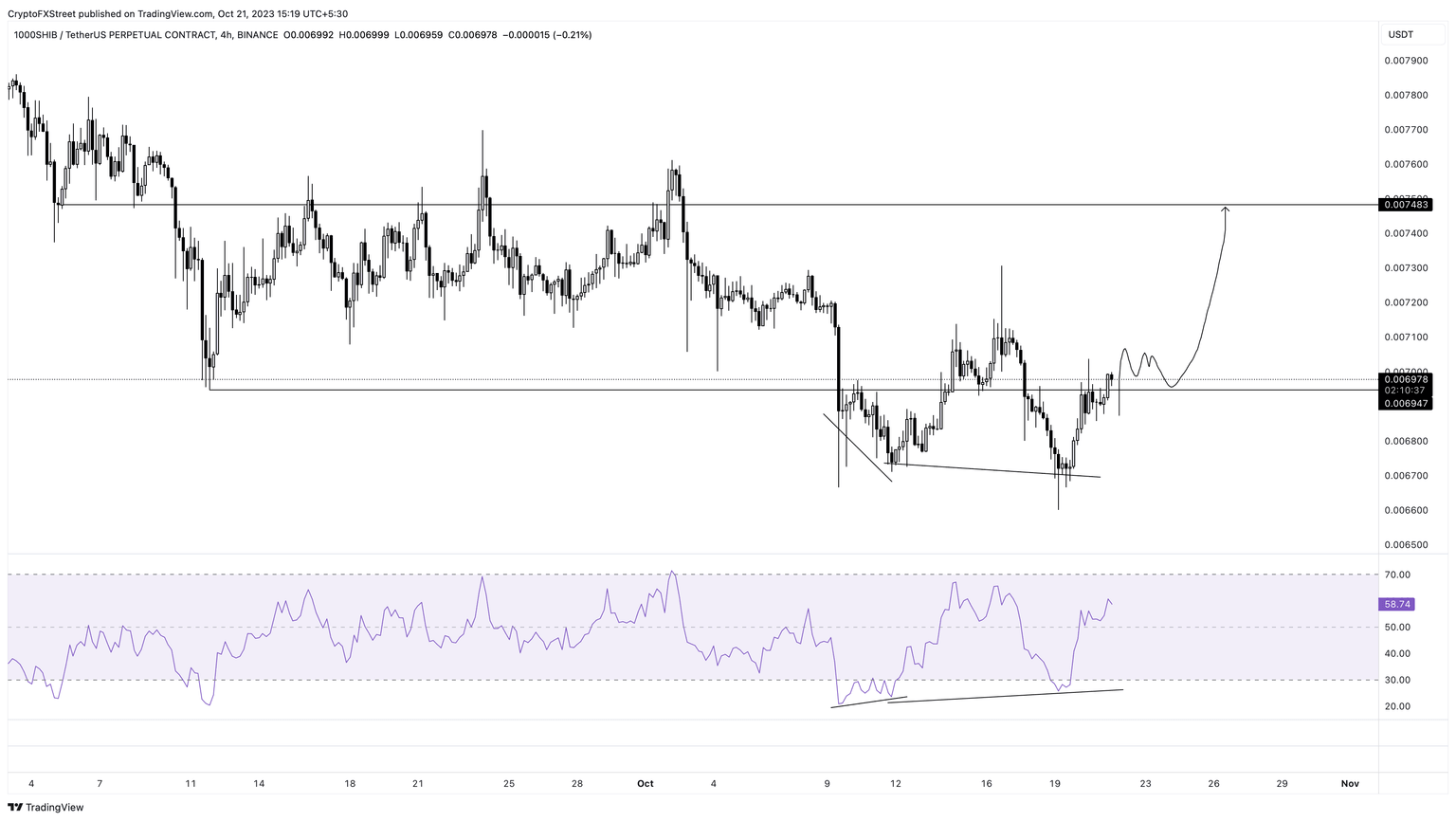

Shiba Inu (SHIB) price faced and overcame a key hurdle at $0.000000694 on October 21 after producing two key lower lows on October 12 and 18. Due to the non-conformity between the Relative Strength Index and the aforementioned swing lows, the rally that began after the October 18 swing low is still in motion.

Going forward, investors can expect Shiba Inu price to retest the $0.00000694 as a support floor and trigger a 7% run-up to tag the $0.000000748 hurdle. This barrier is critical as it has been preventing the price from ascending for the past month.

SHIB/USDT 4-hour chart

On the contrary, if Shiba Inu price produces a daily candlestick close below the $0.00000684 support level, it will create a lower low. A failure to create a higher high after the said breakdown will indicate a trend reversal. These developments will invalidate the bullish thesis described above and potentially kickstart a selling spree.

In such a case, Shiba Inu price could drop 3.6% and retest the October 19 swing low at $0.00000660.

Also read: Shiba Inu price marking fresh 2023 lows could lead to $107 million worth of tokens facing losses

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.