Shiba Inu Price Prediction: SHIB awaits a spark to kick-start 20% advance

- Shiba Inu price has collected liquidity resting below $0.0000283, signaling a new uptrend’s start.

- A swift recovery above $0.0000283 will likely restart a 20% ascent to $0.0000341.

- A breakdown of the daily demand zone, ranging from $0.0000269 to $0.0000293, will invalidate the bullish thesis.

Shiba Inu price has fumbled around a stable support level, flipping it into a resistance level multiple times. However, this development was a necessary evil required to collect the liquidity resting below it. Therefore, the recent downswing could be the key to kick-starting a new uptrend.

Shiba Inu price to pull a 180

Shiba Inu price tagged the $0.0000283 support level on December 20, 2021, and January 5, creating a double bottom setup. Soon after this pattern, SHIB sliced through this support level, collecting the sell-stop liquidity resting below it.

The sidelined buyers took this opportunity to accumulate Shiba Inu price at a discount, triggering a minor uptrend that allowed the meme coin to recover above $0.0000283. Going forward, SHIB needs to stay above this trend line to kick-start a 20% advance to $0.0000341 or the 50% retracement level and the buy-stop liquidity resting above it.

Although unlikely, Shiba Inu price could continue this rally and make a run for the double top formed around the range high at $0.0000399, doubling the total gain from 20% to 40%.

SHIB/USDT 4-hour chart

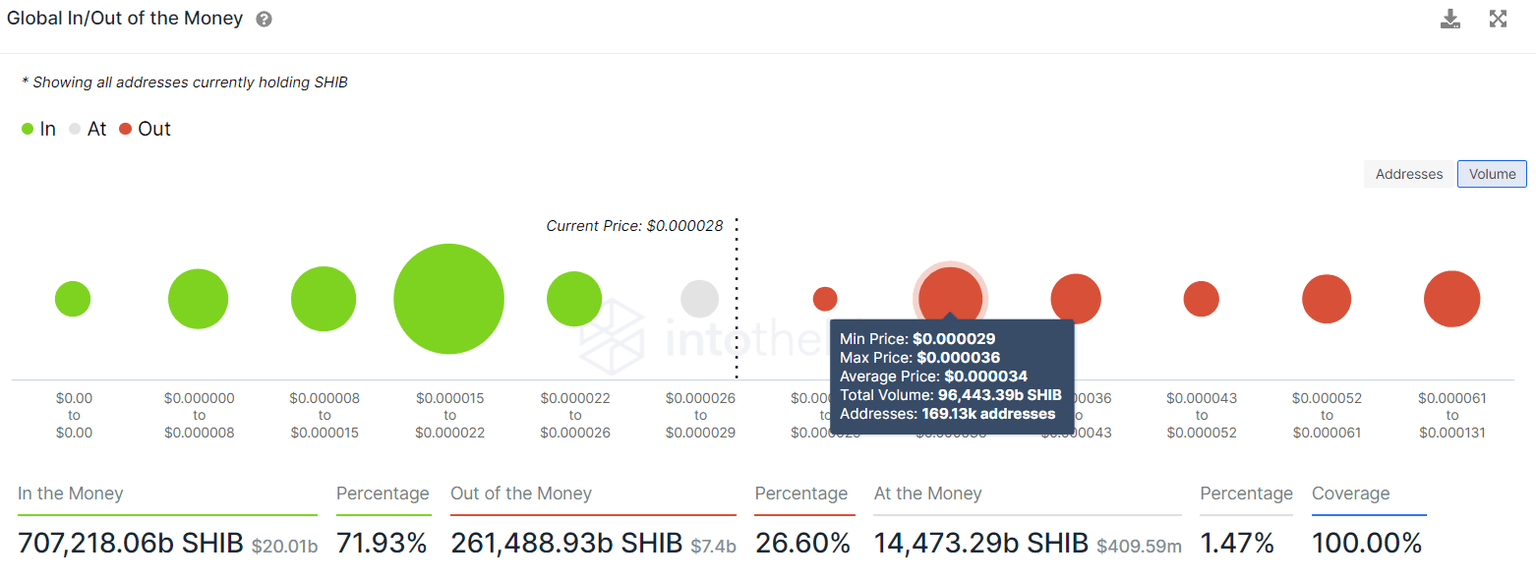

Supporting the bullish outlook up to $0.0000340 is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This on-chain index shows that the only resistance area that could prevent an uptrend for SHIB extends from $0.0000290 to $0.0000340. Here, roughly 170,000 addresses that purchased 96,443 billion SHIB tokens are “Out of the Money” and are likely to sell at break-even, resisting any advances for the meme coin.

SHIB GIOM

Further indicating a bullish outlook is the Market Value to Realized Value (MVRV) model.

This on-chain metric is used to determine the average profit/loss of investors that purchased SHIB over the past month.

Currently, the 30-day MVRV is hovering inside the opportunity zone at -14.8%, indicating that a majority of the short-term holders are at a loss. Long-term holders often accumulate around these levels, where the risk of a sell-off is less.

Therefore, investors can expect SHIB to see considerable buying pressure around the current levels.

SHIB 365-day MVRV

Regardless of the bullish outlook and the on-chain metrics, if Shiba Inu price fails to stay above the demand zone, extending from $0.0000269 to $0.0000293, it will indicate a weakness in buying pressure.

A four-hour candlestick close below $0.0000269 will create a lower low, invalidating the bullish thesis. In this case, investors can expect Shiba Inu price to crash 12%, retesting the $0.0000237 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%20%5B07.46.11%2C%2010%20Jan%2C%202022%5D-637773873154286004.png&w=1536&q=95)