Shiba Inu Price Prediction: Is there a chance for traders to short the “Dogecoin killer”?

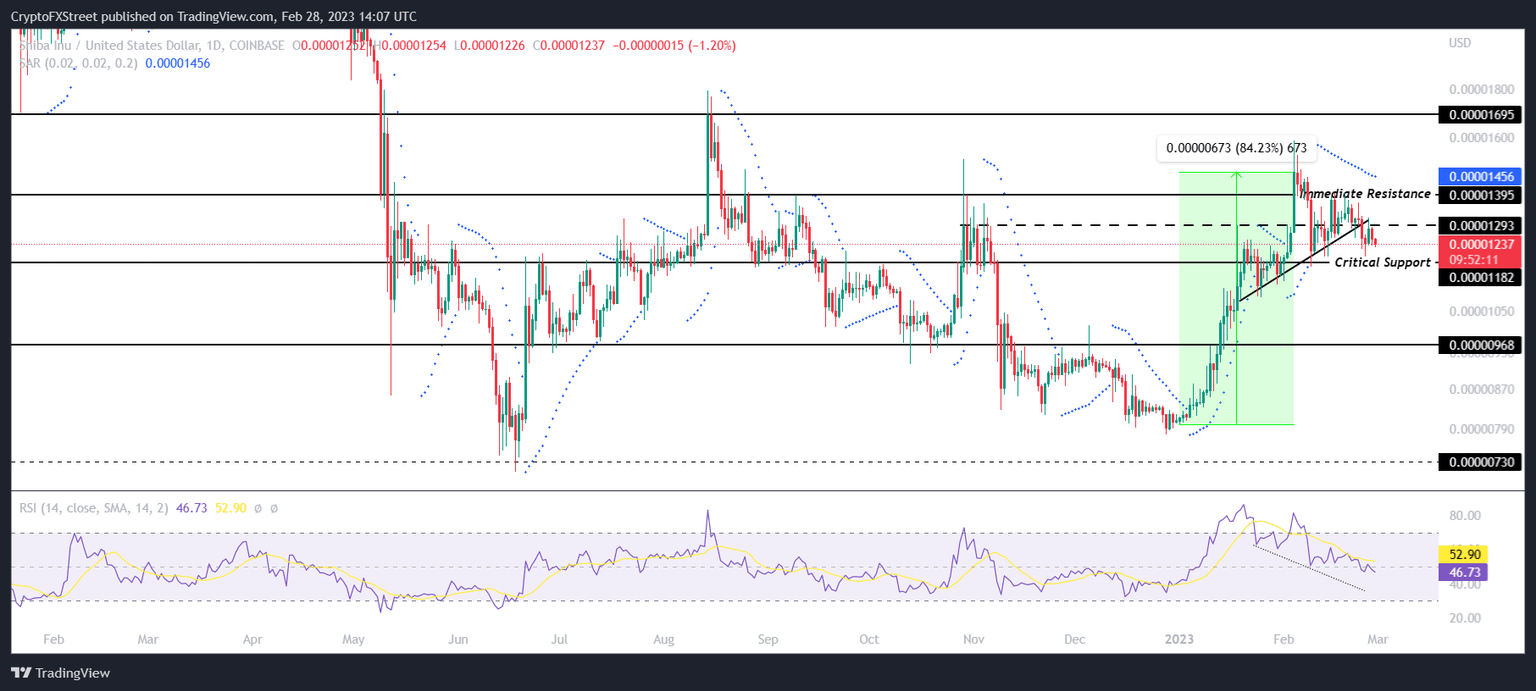

- Shiba Inu price inches closer to the critical support level at $0.00001182.

- Losing the critical support will result in SHIB plunging to $0.00000968.

- If the meme coin reclaims $0.00001395 as support, it would have an opportunity to breach $0.00001695 and invalidate the bearish thesis.

Shiba Inu price surprisingly failed to take the bullish path higher, defying expectations of a rally. There is now a possibility of trend reversal which could lead to corrections down the line, making it a good opportunity for traders to short the asset.

Shiba Inu price could decline

Shiba Inu price responded to bearish divergence with the Relative Strength Index (RSI) momentum indicator by breaking below critical support at $0.00001182 on February 24. The breakdown has resulted in SHIB trading at $0.00001242 at the time of writing.

The Parabolic Stop and Reverse (SAR) is highlighting an active downtrend by tracing its dots above rather than below the price. To add to that, the RSI is also slipping below the neutral line at 50.0 into the bearish zone.

If the indicator lingers in this zone for too long, the corrections could lead to SHIB possibly slipping below the $0.00001182 critical support.

In such a case, traders looking to short the altcoin should expect a crash of 21% A decline to $0.00000968 would bring Shiba Inu price to a month-and-a-half low.

SHIB/USD 1-day chart

If the cryptocurrency manages to bounce off the critical support, however, and breach the immediate resistance at $0.00001395, things might turn around.

Flipping this level into support would give SHIB the boost it needs to rally to $0.00001695, which marks a critical resistance level. A daily candlestick close above this level would invalidate the bearish thesis and mark a six-month price high.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.