- Talks of burned tokens and their impact on the Shiba Inu price persist throughout social media and media outlets.

- SHIB price shows a massive uptick in bearish volume accompanied by severe bearish divergence.

- Invalidation of the bearish thesis is a breach and close above $0.00001700.

Shiba Inu price market sentiment remains optimistic despite the penny-from-Eiffel style decline.

Shiba Inu price de-correlates

Shiba Inu price shows extremely bearish technicals, confounding that a sweep of the lows event could be underway. The technicals suggested that an immediate liquidation could occur after a five-wave impulse into the bullish targets occurred.

On August 15, both bullish targets were breached as the Shiba Inu price saw a 35% hike in just one day. As a result of the buyer’s surge, the Relative Strength Index (RSI) measured the Shiba Inu price as more overbought than when the notorious dog coin price traded nearly 150% higher at $0.00003261 back in February of 2022. Accompanied with the RSI bearish divergence was an influx of bearish volume near the top of the price hike and a classical bearish ramping pattern.

SHIB/USDT 2-Day Chart

Shiba Inu price currently trades at $0.00001304. Despite the extreme bearish signals, an influx of headline news persists in the media about Shiba Inu tokens being burned from the total supply. According to the Economic Times, 400 trillion tokens were recently burned in the summer of 2022.

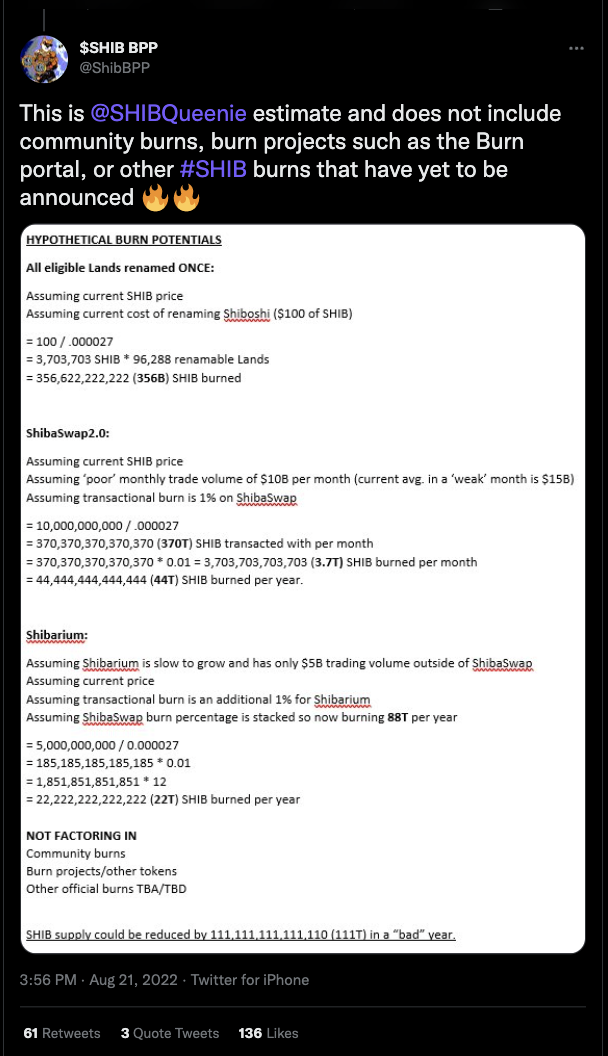

Twitter accounts have contributed to the discussion with theoretical models of what the impact burning SHIB tokens could have on the Shiba Inu price and overall ecosystem. According to a popular Twitter account and SHIB advocate @SHIBBPP, 111 trillion tokens could be burned within months.

Despite the optimistic market sentiment, the Shiba Inu price has not correlated well with the burned-token theory. From a technical standpoint, the SHIB price has struggled to make persistent gains, and the recent 35% upswing may have been too steep for the bulls to sustain. What was once a profit-taking consolidation near the $0.00001500 levels has morphed into a “penny-from-Eiffel” style decline as the SHIB price is currently down 27% since the new monthly high at $.00001800 high was established.

The recent pump and dump confound the previous technical outlooks forecasting a further 25% decline. Bearish targets of interest are near $0.00000970 liquidity levels in the short term.

Invalidation of the bearish thesis is a breach and close above $0.00001700. If the bulls can breach this level, they may be able to prompt a bullish scenario targeting $0.00001978, resulting in a 52% increase from the current Shiba Inu price.

In the following video, our analysts deep dive into the price action of Shiba Inu, analyzing key levels of interest in the market. -FXStreet Team

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Monero Price Forecast: XMR soars over 19% amid rising demand for privacy coins

Monero (XMR) price is extending its gains by 19% at the time of writing on Monday, following a 9.33% rally the previous week. On-chain metrics support this price surge, with XMR’s open interest reaching its highest level since December 20.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH stabilize while XRP shows strength

Bitcoin and Ethereum prices are stabilizing at around $93,500 and $1,770 at the time of writing on Monday, following a rally of over 10% and 12% the previous week. Ripple price also rallied 8.3% and closed above its key resistance level last week, indicating an uptrend ahead.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.