Shiba Inu Price Prediction: A 40% decline targeting $0.00000700

- Shiba Inu Price breached the ascending parallel channel that has provided support all summer.

- SHIB saw an influx of dormant tokens pour into the market last week.

- Invalidation of the bearish thesis is a breach above $0.00001743.

Shiba Inu price is showing concerning technicals that confound recent bearish on-chain metrics. A sweep-the-lows event could occur in the coming weeks.

Shiba Inu price is showing bad signs

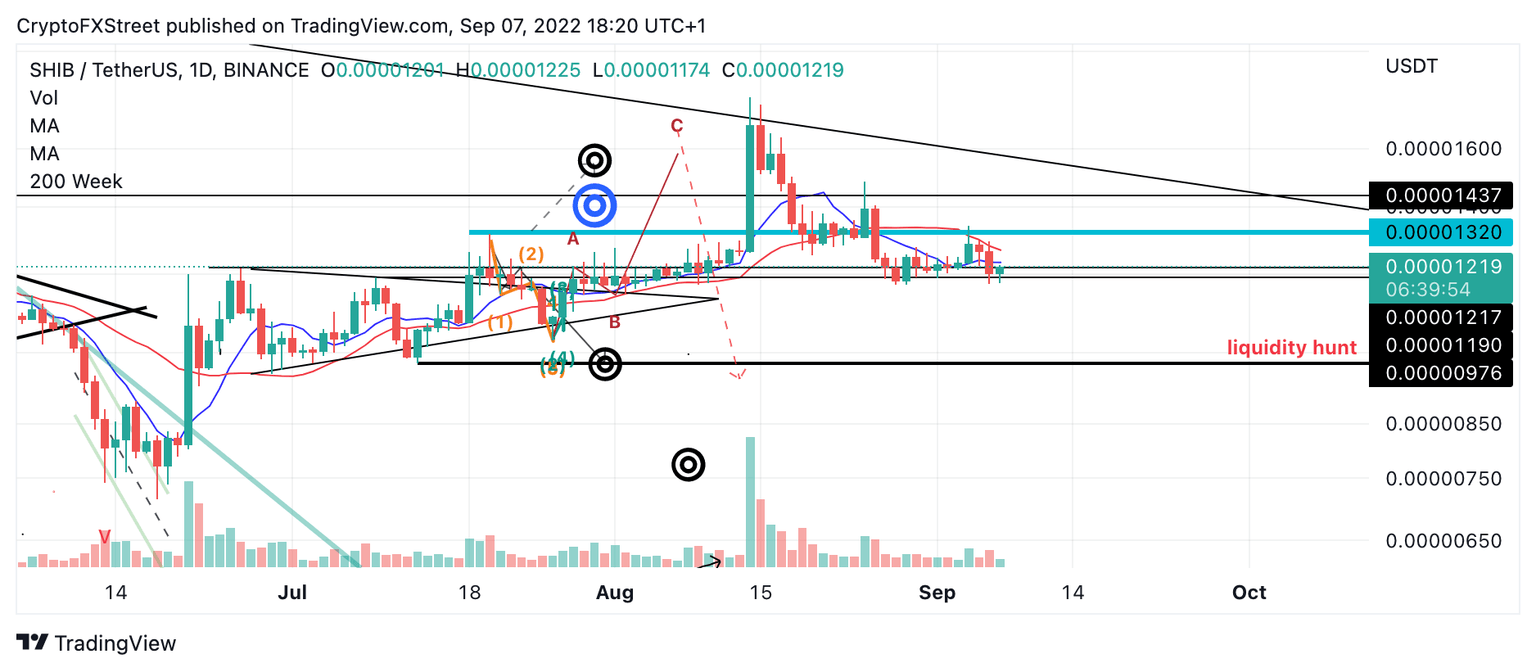

Shiba Inu price currently auctions at $0.00001214 as the bulls are trying to defend their post near the $0.00001200 level on intra-hour time frames. On August 26, investors witnessed the first concerning signal as the bears forged a daily closing candle below the ascending trend channel. The breach came at a unique time for SHIB as an influx of dormant tokens had resurfaced on the market.

A week later, on August 4, the bulls went for a retest of the ascending barrier while dually colliding with the 21-day simple moving average (SMA). The SMA ultimately rejected re-entry of the ascending trend near the $0.00001300 zone. The Shiba Inu price has fallen two consecutive days in a row and is now consolidating as investors anticipate another decline.

SHIB USDT

If market conditions are genuinely bearish the first target for SHIB shorters is the July 15 low at $0.00000976. If the bulls do not step in to provide support at the mid July level, all of summer’s countertrend rally could get wiped, with bearish targets near $0.00000700. Such a decline would result in a 40% decline from the current Shiba Inu price.

Invalidation of the downtrend scenario is contingent upon the ascending trend remaining as a rejective border for countertrend bulls. The current price is $0.00001420 but subject to incline as time progresses. If the bulls can hurdle the ascending boundary, they could rally as high as $0.00001800, resulting in a 40% increase from the current SHIB price.

In the following video, our analysts deep dive into the price action of Shiba Inu, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.