Shiba Inu Price Outlook: $0.00004 in sight as SHIB joins Dogecoin in the crypto top ten

- Shiba Inu price is up 40% in the last day, 210% over the week as meme coins rally.

- SHIB has joined DOGE in the crypto top ten with a market capitalization above $18 billion.

- The meme coin continues to reclaim the previous peaks with one already in the bag.

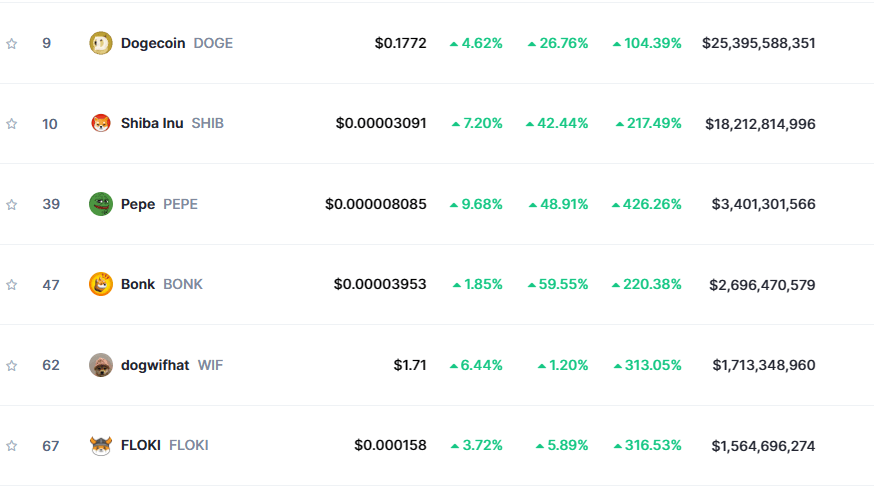

Shiba Inu (SHIB) is among the top performers in the meme coin sector on Monday, rallying alongside its peers, including Dogecoin (DOGE), Pepe (PEPE), Bonk Inu (BONK) and Floki Inu (FLOKI). It comes amid an ongoing meme coin mania, with sector tokens posting double-digit gains on the daily time frame and triple-digit gains on the weekly time frame.

SHIB enters crypto top 10

After an over 40% surge in the last 24 hours and more than 210% in gains over the last week, Shiba Inu (SHIB) is in the crypto top-ten list. SHIB is right behind Dogecoin with a market capitalization of over $18 billion.

Meme coins market capitalization

In a post on X, Lucie Sasnikova, a marketing specialist for the Shiba Ecosystem and Shibarium Tech, highlighted the development, citing “Tears of joy.”

Tears of joy ♥️$SHIB ranked #10 in pic.twitter.com/1JR8oDuRmq

— | SHIB.IO ♀️ (@LucieSHIB) March 4, 2024

It is worth mentioning that meme coins continue to take their cues from Bitcoin price, which is now eyeing its 2021 peak of $69,000. The FXStreet team will bring you an update once this all-time high is recovered.

Meanwhile, data according to on-chain aggregator IntoTheBlock shows a 74% correlation between BTC and SHIB. This is lower than the 87% BTC shares with DOGE.

Bitcoin correlation matrix

Nevertheless, the correlation between DOGE and SHIB is 94% at press time, suggesting that a significant move in the Dogecoin price could propel the Shiba Inu price higher as well.

Shiba Inu price outlook as SHIB market capitalization soars

Shiba Inu price has breached the April 12, 2022 peak at the $0.00003000 psychological level. Momentum is still rising as seen with the Relative Strength Index (RSI) still climbing. Despite SHIB being massively overbought, investors with current open positions for SHIB should probably leave them open as the upside potential remains viable.

The late buyers and sideline investors, on the other hand, should exercise caution amid heightened FOMO (fear of missing out). This is because SHIB is at high risk of a correction.

With the upside potential still intact, key levels to watch include $0.00003510, $0.00004000, $0.00004485, and $0.00005435. These are key peaks between December 2021 and February 2022.

SHIB/USDT 1-day chart

On the flipside, a correction could see Shiba Inu price pull back below the $0.00003000 threshold in the aftermath of an overbought asset.

Also Read: Memecoins market capitalization exceeds $50 billion, above NFTs, DeFi sector

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.