- Shiba Inu burn rate is up 443% overnight, fueling a bullish sentiment among SHIB holders.

- Despite yielding nearly 20% gains overnight, Shiba Inu is 84.2% below its all-time high of $0.000086.

- Analysts believe Shiba Inu is following in the footsteps of Dogecoin, breaking out from a long-term downtrend.

Shiba Inu burn data portal revealed a jump in the burn rate of the meme coin. Several bullish triggers have pushed Shiba Inu price higher, the meme coin is following in the footsteps of rival Dogecoin.

Also read: Ripple price: Will crypto lobbyist group’s support for Ripple push XRP price higher?

Shiba Inu burn increased by 443%

Shibburn, the portal that records detailed statistics of Shiba Inu burned revealed a massive spike in the burn rate. Shiba Inu’s burn rate climbed 443% overnight, with a burn of 14,089,818 SHIB tokens over the past 24 hours. Since the beginning of Shiba Inu’s burn implementation, upwards of 410 trillion SHIB were burnt.

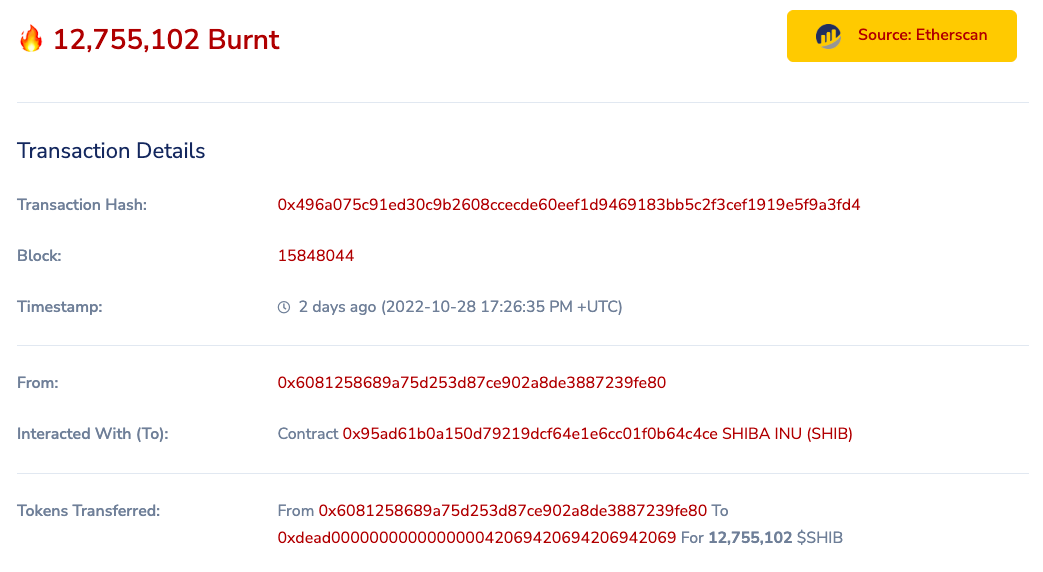

The single largest burn was from an address 0x6081258689a75d253d87ce902a8de3887239fe80 which burnt nearly 12.75 million SHIB tokens, pushing the burn rate higher.

Shiba Inu burnt in a transaction

Shiba Inu set a new milestone

Based on data from a crypto intelligence platform IntoTheBlock, Shiba Inu has witnessed its highest percentage of long-term holders, setting a new milestone. The rate of traders “holding” Shiba Inu in the long term has climbed to 42%, a new all-time high.

The percentage of mid-term speculators and traders holding Shiba Inu in the short term for quick profit-taking has declined. 42% of Shiba Inu holders have held their tokens for over a year, 55% have held SHIB for less than a year, and 3% have held the meme coin for less than a month.

Moreover, there is a spike in large volume transactions worth $100,000 or more. $466.79 million worth of Shiba Inu has been moved around by whales, and large-wallet investors, indicating a rise in on-chain activity.

IntoTheBlock suggests that the sentiment among Shiba Inu holders is mostly bullish.

Analysts believe Shiba Inu price breakout is confirmed

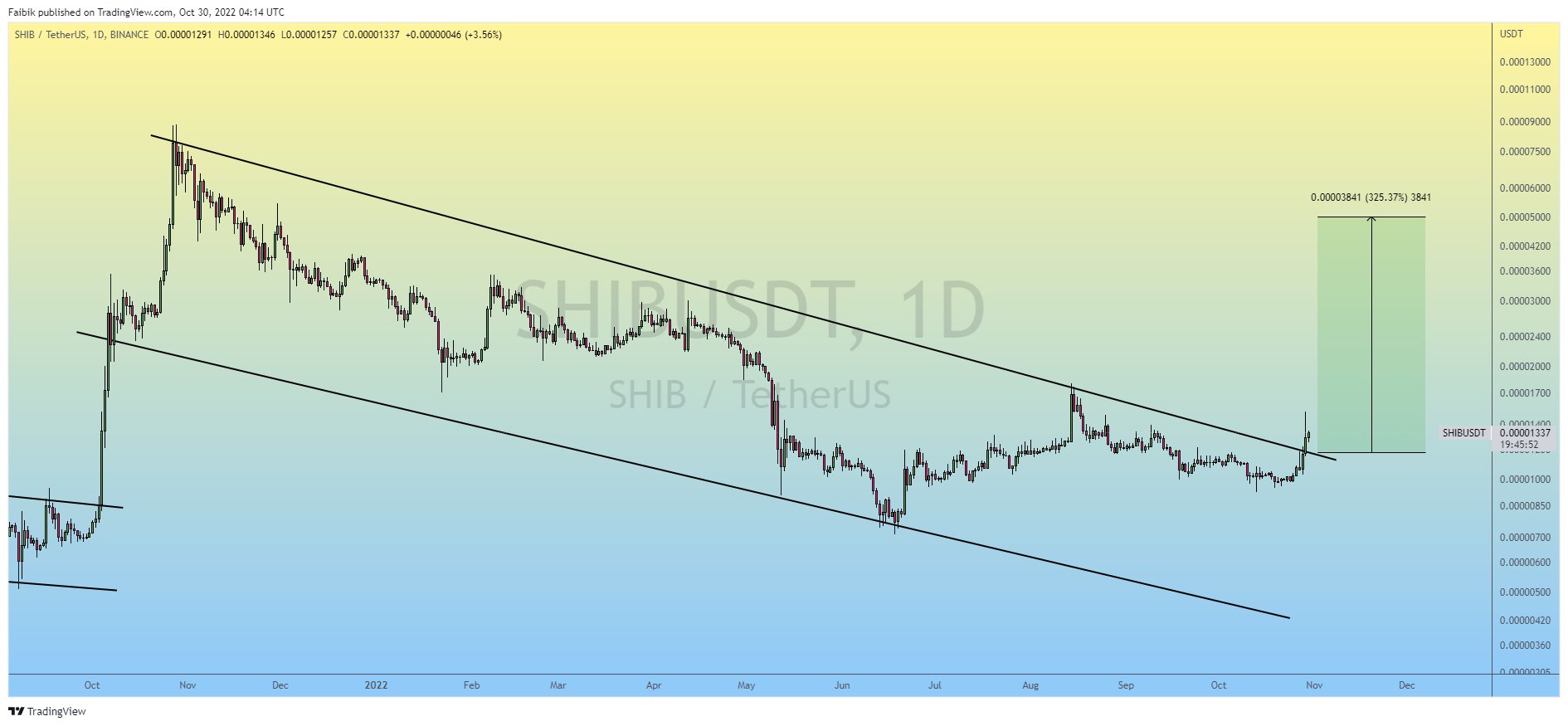

Crypto Faibik, a crypto trader and analyst evaluated the SHIB/USDT price chart and argued that a descending channel upside breakout is confirmed. There is bullish solid volume to back up the breakout in Shiba Inu, therefore Faibik expects the meme coin to rally like Dogecoin.

SHIB/USDT price chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.