- Shiba Inu price plummeted toward $0.000022 on Wednesday, reflecting a 16% loss within the weekly timeframe.

- Shiba Inu funded wallets hit a new all-time high of 1.38 million, with over 100,000 new market entrants added in 2024.

- SHIB 4-hour chart shows a death cross formation, indicating further downside risks.

Shiba Inu price plummeted toward $0.000022 on Wednesday, marking a 13.4% loss within the weekly timeframe. Despite Ethereum’s lackluster performance in 2024, on-chain data shows SHIB continues to attract new buyers. Is SHIB poised for an early rebound?

SHIB price plunges towards $0.000020 support as crypto crash enters day 2

Shiba Inu (SHIB) price experienced significant downward momentum this week, falling 13.4% to reach $0.000022 on Wednesday.

SHIB’s bearish performance mirrors other mega-cap assets with the likes of BTC, ETH and XRP, all booking considerable losses on the day.

This decline marks a sharp correction within the weekly timeframe, reflecting bearish pressure that has persisted since the start of the month.

The downtrend appears to be driven by hawkish expectations from the United States (US) Federal Reserve (Fed), which have caused traders to scale back exposure to high-risk assets, including memecoins like SHIB.

Known for their low liquidity and sensitivity to shifts in market sentiment, memecoins have seen reduced demand amid the broader market’s cautious tone.

Shiba Inu 4-hourly price action, January 8 | TradingView

Shiba Inu 4-hourly price action, January 8 | TradingView

SHIB’s attempt to stabilize around $0.000023 on Monday faltered as sellers intensified mid-week, driving prices closer to the critical $0.000020 support level at the time of writing on Wednesday.

The price action suggests a consolidation phase near $0.000020, with volatility expected to persist in the short term.

Shiba Inu sets a new record of 1.38M funded wallets amid market turbulence

Despite the recent crypto market downturn, Shiba Inu continues to attract a growing number of investors.

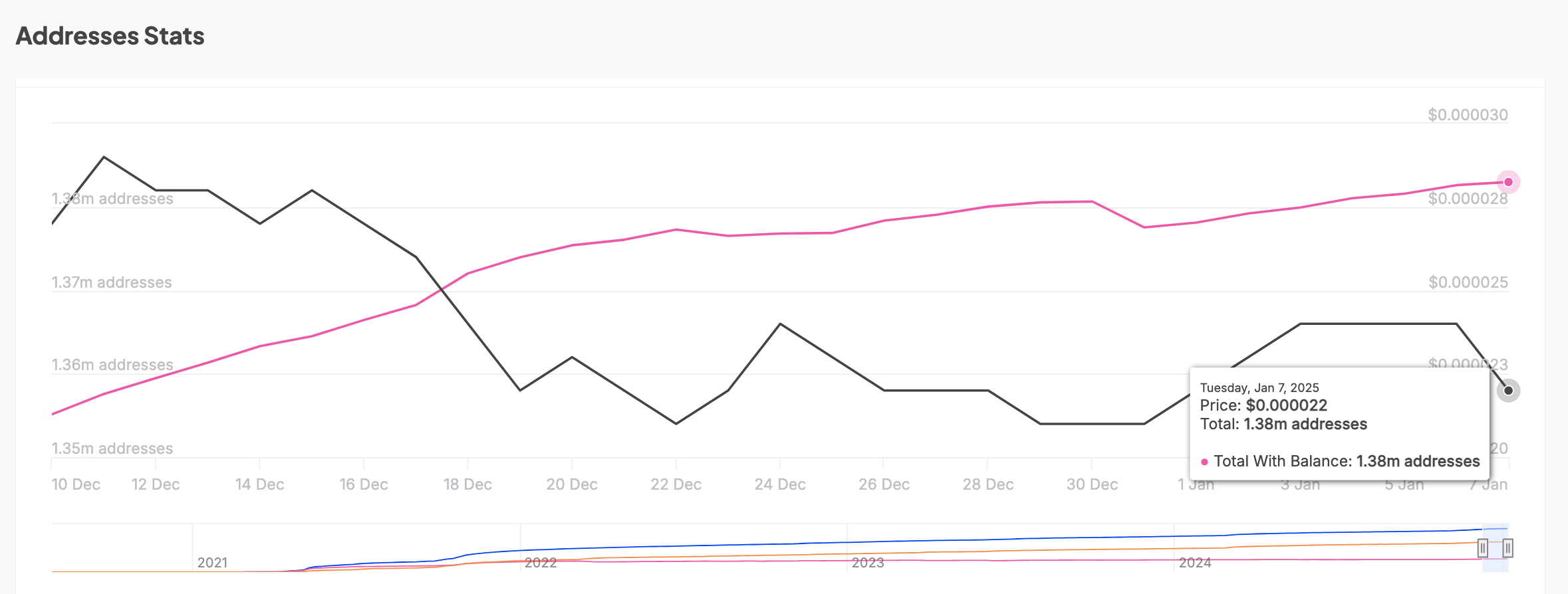

IntoTheBlock’s Funded wallets metric represents unique addresses holding a balance greater than zero, providing a snapshot of the overall adoption and investor interest in a cryptocurrency.

Shiba Inu Funded Wallets vs. SHIB Price | Source: IntoTheBlock

Shiba Inu Funded Wallets vs. SHIB Price | Source: IntoTheBlock

The total number of funded wallets holding SHIB has reached an all-time high of 1.38 million, with over 100,000 new wallets added in 2024 alone.

This shows that the Shiba Inu ecosystem continues to attract new investors.

Beyond that, the record-breaking network growth reaffirms Shiba Inu’s global appeal, despite Solana memes dominating the media trends in recent months.

However, the bearish sentiment continues to hold sway as traders brace up for a more contractionary monetary policy landscape in 2025.

Hence’ SHIB's increased wallet adoption may not translate to immediate price recovery in the short term.

Instead, it reflects speculative bets on SHIB’s long-term potential.

Shiba Inu price forecast: New buyers could prevent $0.000020 breakdown

Shiba Inu faces significant downside pressure after a sharp 16% decline in the last 24 hours.

Technical indicators on the SHIBUSD 4-hourly chart signal significant downside risks with bears capitalizing on a “death cross” signal between the 50-day and 200-day simple moving averages on the 4-hour chart.

This bearish crossover highlights the dominance of sellers, who could drive prices toward the critical support at $0.000020, or even further to $0.000015 if current market weakness continues.

Shiba Inu price Forecast | SHIBUSD

Shiba Inu price Forecast | SHIBUSD

Meanwhile, the Volume-Weighted Average Price (VWAP) at $0.000021 indicates that bulls are attempting to establish a short-term floor above this level.

A sustained recovery above the VWAP could push SHIB toward the next resistance at $0.000023, where the 50-day SMA resides.

However, this scenario hinges on a broader market rebound and increased accumulation volume to invalidate the bearish narrative.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

BNB Price Forecast: Poised for a decline on negative Funding Rate

BNB price hovers around $696.40 on Thursday after declining 4.58% in the previous two days. BNB’s momentum indicators hint for a further decline as its Relative Strength Index and Moving Average Convergence Divergence show bearish signals.

Ripple's XRP eyes recovery following executives' dinner with Donald Trump

Ripple's XRP is up 2% on Wednesday following positive sentiments surrounding its CEO Brad Garlinghouse's recent dinner with incoming US President Donald Trump. If the recent recovery sentiment prevails, XRP could stage a breakout above the upper boundary line of a bullish pennant pattern.

Has Bitcoin topped for the cycle? Here's what key metrics suggest

Bitcoin experienced a 2% decline on Wednesday as the cryptocurrency market grapples with recent losses. On-chain data has indicated a shift in the accumulation of the leading cryptocurrency, suggesting that holders are increasingly selling their assets.

Ethereum Price Forecast: ETH could decline to $3,110 despite increased accumulation from whales

Ethereum briefly declined below the $3,300 key level, recording a 4% loss on Wednesday as short-term holders led the selling pressure. If the buy-side pressure of large whales fails to outweigh the bears, the top altcoin could decline to $3,110.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.