Shiba Inu Price Forecast: SHIB needs to hold above this level to sustain upward momentum

- Shiba Inu price has been hovering in the same region for the past two weeks.

- SHIB, though bullish, is suppressed by accumulating overhead pressure due to the EMAs.

- Losing the critical support at $0.00001035 could open the drains for the meme token.

Shiba Inu price (SHIB) has been trading sideways within a very tight range. However, the boring price action hints at a looming bigger move coming soon. Accordingly, investors should expect a violent move from the meme token.

Shiba Inu price could explode by over 30%

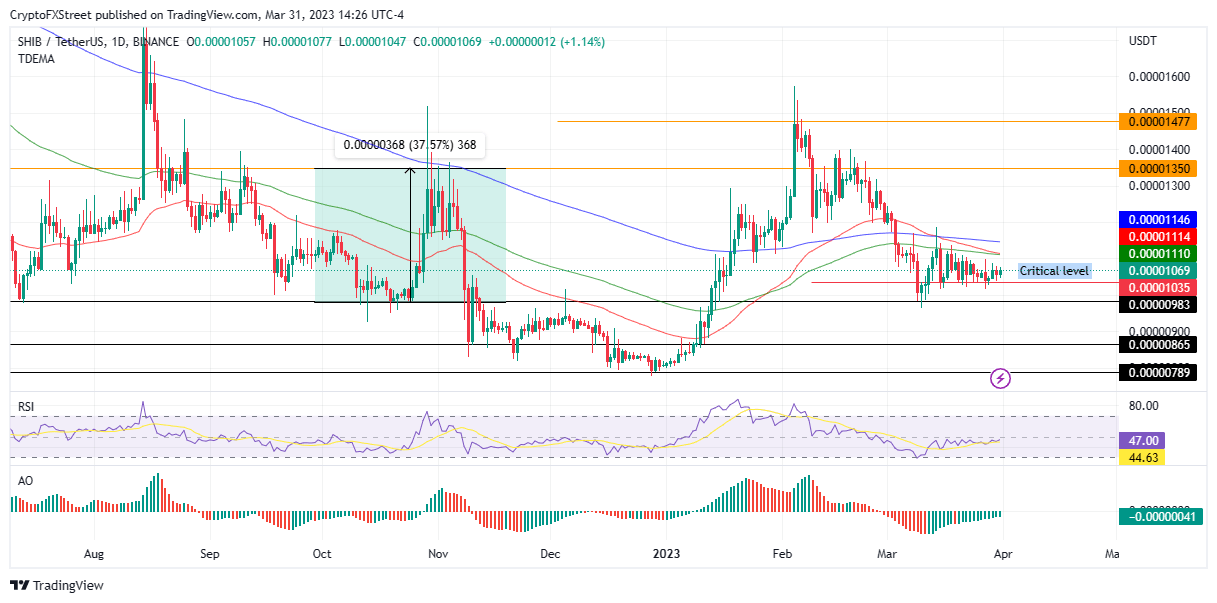

Shiba Inu price, at $0.00001069 at the time of writing, is moving sideways as bulls do their best to hold above the $0.00001035 support level. This level is crucial for SHIB’s directional bias moving forward, given it has kept the token afloat for almost three weeks now.

One of the factors that could solidify a northbound move for Shiba Inu price is the launch of decentralized applications (dApps) on Shibarium. This would come as developers are drawn to Shibarium’s tier-one security models, including Proof of Stake (PoS), plasma, and hybrid (plasma+PoS) securities. Notably, Shibarium is the new layer-2 (L2) protocol for Shiba Inu, built atop Ethereum (ETH), and is similar to Polygon (MATIC).

#Shibarium is the key to burn $Shib, but also to unlock the power of blockchain for everyone.

— Shiba Inu News (@ShibalnuNews) March 30, 2023

Don't sell you $SHIB out of fear! This is only the beginning !✅ pic.twitter.com/OR2a7BObtK

An increase in buyer momentum above the current level could see Shiba Inu price rise to confront the immediate resistance confluence due to the 100- and 50-day Exponential Moving Averages (EMAs) around $0.00001110. Beyond that, the altcoin could reach higher to tag the 200-day EMA at $0.00001146.

In highly bullish cases, Shiba Inu price could tag the $0.00001350 resistance level, denoting a 25% climb from the current price of $0.00001069. The relevance of such a move comes as it would be a mimic of how SHIB performed around October after consolidating sideways for almost two weeks before breaking out 37% north.

SHIB/USDT 1-day chart

Conversely, if traders start booking early profits, Shiba Inu price could descend, first breaching the critical support at $0.00001035. A daily candlestick close below this level will invalidate the bullish thesis.

Losing the aforementioned support level could open the drains for the meme coin, causing Shiba Inu price to plummet further and tag the $0.00000938 support level. In dire cases, the token could revisit the January lows around $0.00000865, or in the worst-case scenario, tag the $0.00000789 swing low.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.