- Shiba Inu’s price rally extends as Donald Trump takes the lead to become the next US president.

- The meme coin price is close to a descending trendline that, if broken, would signal a further rally ahead.

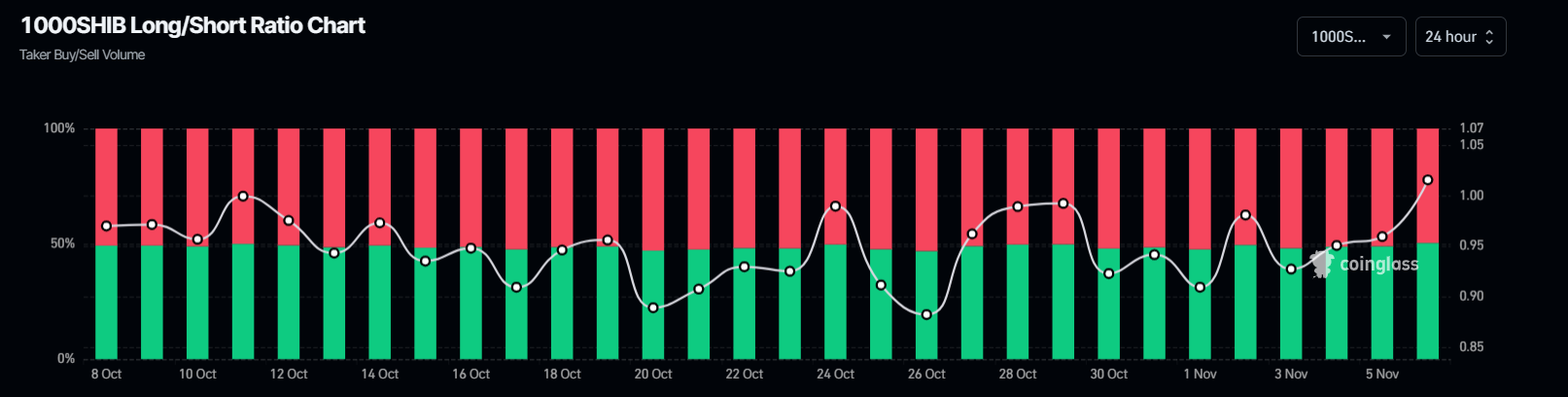

- SHIB’s long-to-short ratio jumps to the highest level since October, indicating more traders are anticipating a rally.

Shiba Inu (SHIB) soars more than 7% on Wednesday, following the surge in the main cryptocurrencies, as former President Donald Trump takes a clear lead in the US presidential election. The technical outlook suggests a rally if the meme coin price breaks and closes above a descending trendline, bolstered by a rising long-to-short ratio that reached its highest level since October.

SHIB is poised for a rally if it closes above the key resistance level

Shiba Inu’s price surges more than 7% on Wednesday and is nearing a descending trendline (drawn by joining multiple highs since the end of March).

If SHIB breaks above the descending trendline and closes above the daily resistance level at $0.000020, it would rally 30% to retest its June 5 high of $0.000026.

The Moving Average Convergence Divergence (MACD) indicator on the daily chart is about to flip a bullish crossover on Wednesday, giving a buy signal and indicating upward momentum. Additionally, the Relative Strength Index (RSI) reads at 58, above its neutral level of 50, suggesting that bullish momentum is gaining traction.

SHIB/USDT daily chart

The Shiba Inu team proposed plans to reshape the US crypto landscape on Tuesday, igniting investor enthusiasm. Shytoshi Kusama’s blog post highlights a proposal to establish a Strategic Hub for Innovation and Blockchain (SHIB) in a US city, “Silicon Valley of Crypto,” to be presented to the future US president and the global crypto community.

“This SHIB initiative aims to stimulate economic growth, create high-quality jobs, enhance national security, and reinforce the United States’ leadership in emerging technologies. The hub will integrate sustainable practices, aligning with national goals for environmental stewardship and sustainable economic development.”, says the blog post.

Coinglass’s data further support Shiba Inu’s bullish outlook. SHIB’s long-to-short ratio is 1.03, the highest level in one month. This ratio reflects bullish sentiment in the market, as the figure above one suggests that more traders anticipate the price of SHIB to rise.

SHIB long-to-short ratio chart. Source: Coinglass

However, the bullish thesis would be invalidated if SHIB fails to break above the descending trend line and closes below the September 30 low of $0.000015. This scenario would lead to a further 14% decline in the Shiba Inu price to retest its September 18 low of $0.0000129.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP decline as President Trump’s team considers “broader and higher tariffs”

Bitcoin continues its decline, trading below $82,000 on Monday after falling 4.29% the previous week. Ethereum and Ripple followed BTC’s footsteps and declined by 9.88% and 12.40%, respectively.

XRP Price Forecast: Weak demand and rising supply could trigger a downtrend

Ripple's XRP is down 7% on Friday following bearish pressure from macroeconomic factors, including United States (US) President Donald Trump's tariff threats and rising US inflation.

Crypto Today: XRP, SOL and ETH prices tumble as South Carolina moves to buy up to 1 million BTC

Bitcoin price tumbled below the $85,000 support on Friday, plunging as low as $84,200 at press time. The losses sparked over $449 million in liquidations across the crypto derivatives markets.

Hackers accelerate ETH decline following $27 million dump, bearish macroeconomic factors

Ethereum (ETH) declined below $2,000 on Friday following a series of hacks traced to accounts of crypto exchange Coinbase users, which caused a loss of $36 million.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.