- Shiba Inu price has breached a two-month consolidation, indicating its readiness to move.

- Investors can expect SHIB to rally 25% and tag the $0.0000315 resistance level.

- Invalidation of the bullish thesis will occur on the daily candlestick close below the $0.0000210 support level.

Shiba Inu (SHIB) price continues its struggle above a key hurdle. This development comes as SHIB, an ERC-20 meme coin, reacts to the Ethereum spot ETF approval news. The uptrend is likely to pick up as the ETF approval deadline nears. Investors looking to accumulate SHIB have a good opportunity to do so before the meme coin shoots up.

Also read: Week Ahead: Ethereum and DeFi to come under spotlight this week

Shiba Inu price poised to move higher

Since setting up a local top at $0.0000457 on March 5, the Shiba Inu price has produced lower lows and lower highs. Drawing a trend line connecting these swing points shows a declining trend line, which was breached on May 20. This daily candlestick close above the declining trend line and above the horizontal support level of $0.0000253 is a sign of an uptick in buyer pressure.

Going forward, investors can expect SHIB to form a base above $0.0000253 and kickstart a 25% recovery rally to the $0.0000315 resistance level. In a highly bullish scenario, investors can expect the dog-based meme coin to retest $0.0000355, the midpoint of the $0.0000253 to $0.0000457 range.

The Relative Strength Index (RSI) has flipped the 50 mean level into a support floor, showcasing the spike in bullish momentum. The same can be seen with the Awesome Oscillator (AO), which has recovered above the zero mean level.

With a clear rise in bullish momentum and SHIB clearing key technical levels, a breakout rally is just around the corner.

SHIB/USDT 4-hour chart

The consolidation seen in the past two months was a good accumulation zone, which can be confirmed by Santiment’s Whale Transaction Count indicator. This index tracks transactions that are $100,000 or higher and can be used as a proxy for institutional investors’ activity.

If a spike in this on-chain metric is noted after a crash or during a consolidation, it most likely means that these investors are accumulating. On the contrary, if this index spikes after a rally, it suggests that these investors could be looking to sell their holdings.

Between April 12 and May 21, the Whale Transaction Count index showed consistent spikes during the dips, showing that institutional investors were accumulating. This development adds credence to the bullish thesis explained from a technical perspective.

SHIB Whale Transaction Count

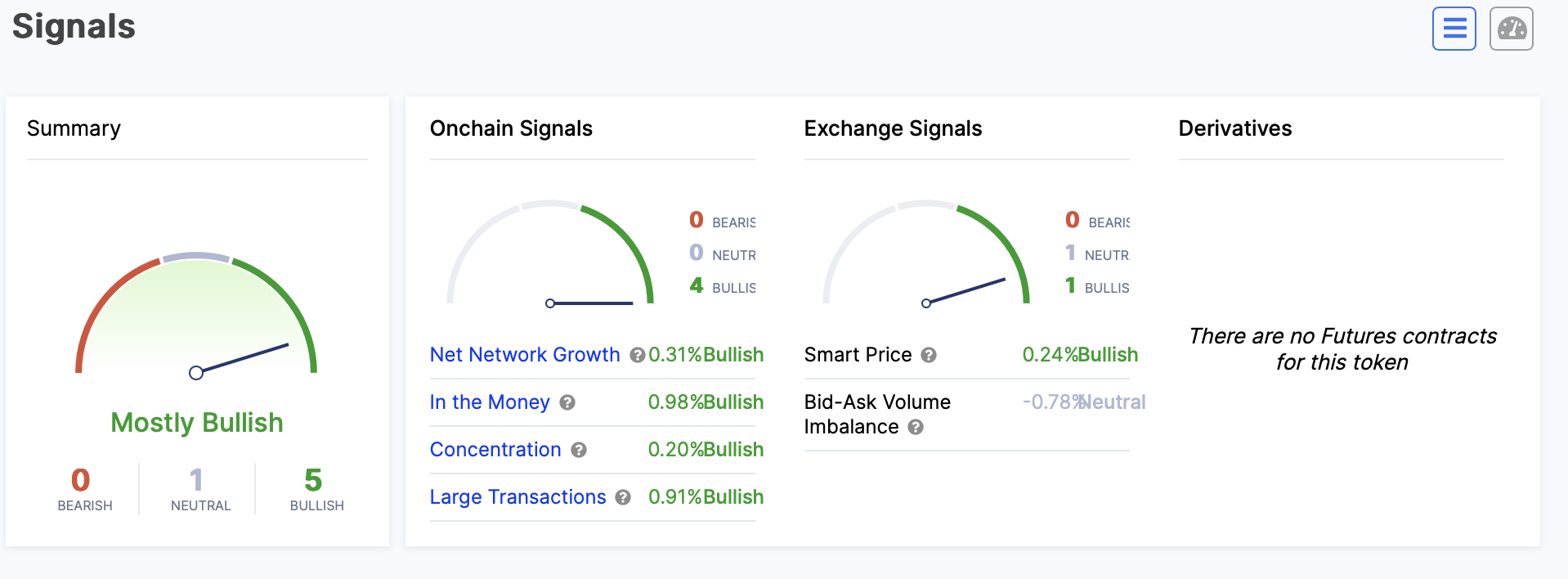

Furthermore, a quick look at IntoTheBlock’s signals shows that the overall outlook for SHIB is bullish. Net network growth, larger transactions and other metrics are forecasting an optimistic outlook for Shiba Inu.

SHIB Signals

Although the outlook for Shiba Inu price is bullish, investors need to be cautious of a sudden downturn in the crypto market sentiment. In case of a spike in selling pressure that pushes SHIB to produce a daily candlestick close below $0.0000210, it would create a lower low and invalidate the bullish thesis.

Such a development could see SHIB crash 20% to the next key support level at $0.0000168.

Read more: Top 3 meme coins Dogecoin, Shiba Inu, Bonk: DOGE accumulation, SHIB update, BONK listing fuel gains

Cryptocurrency prices FAQs

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: Metaplanet raises $10M to buy BTC, ETH price moves below $1,600 as Tron gains signals panic

The cryptocurrency aggregate market capitalization stabilized around $2.7 trillion on Wednesday, with Bitcoin’s $84,000 support momentarily anchoring the market against external bearish discourses.

Chainlink active addresses drop as whale selling spikes, could LINK crash below $10?

Chainlink active addresses slide dramatically to 3,200 from February’s peak of 9,400. The downtrend in network activity coincides with increasing selling activity among whales with between 10 million and 100 million LINK.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin is stabilizing around $83,500 at the time of writing on Wednesday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. A breakout of this strong level would indicate a bullish trend ahead.

Binance Chain completes $914M BNB token burn, hinting at a potential rally

Binance Chain has finalized its programmed 31st quarterly BNB token burn, potentially setting the stage for the world’s fifth-largest cryptocurrency, with a market capitalization of $81.45 billion, to rally in the coming weeks.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[09.04.41,%2021%20May,%202024]-638518612508974945.png)