- Shiba Inu price faces a stiff supply zone, extending from $0.0000293 to $0.0000326, halting the uptrend.

- If SHIB shatters this barrier, a 25% uptrend could emerge but failure could lead to a 24% retracement.

- A run-up could see the meme coin collect liquidity above $0.0000392.

Shiba Inu price has seen impressive gains over the past week that face the threat of getting undone. The run-up is currently facing a massive hurdle that could make or break the meme coin.

Shiba Inu price faces a decisive moment

Shiba Inu price rose a whopping 75% over the past week as it broke out of a nearly two-week consolidation range. This uptrend was a ripple effect of the bullish momentum emanating from Bitcoin.

As impressive as this run-up was, Shiba Inu price is currently facing a supply zone, extending from $0.0000293 to $0.0000326. Investors can expect SHIB to consolidate around this area and probably retest the weekly support level at $0.0000283. If Shiba Inu price manages to stay above this level, there is a good chance the rally will continue.

SHIB/USDT 1-day chart

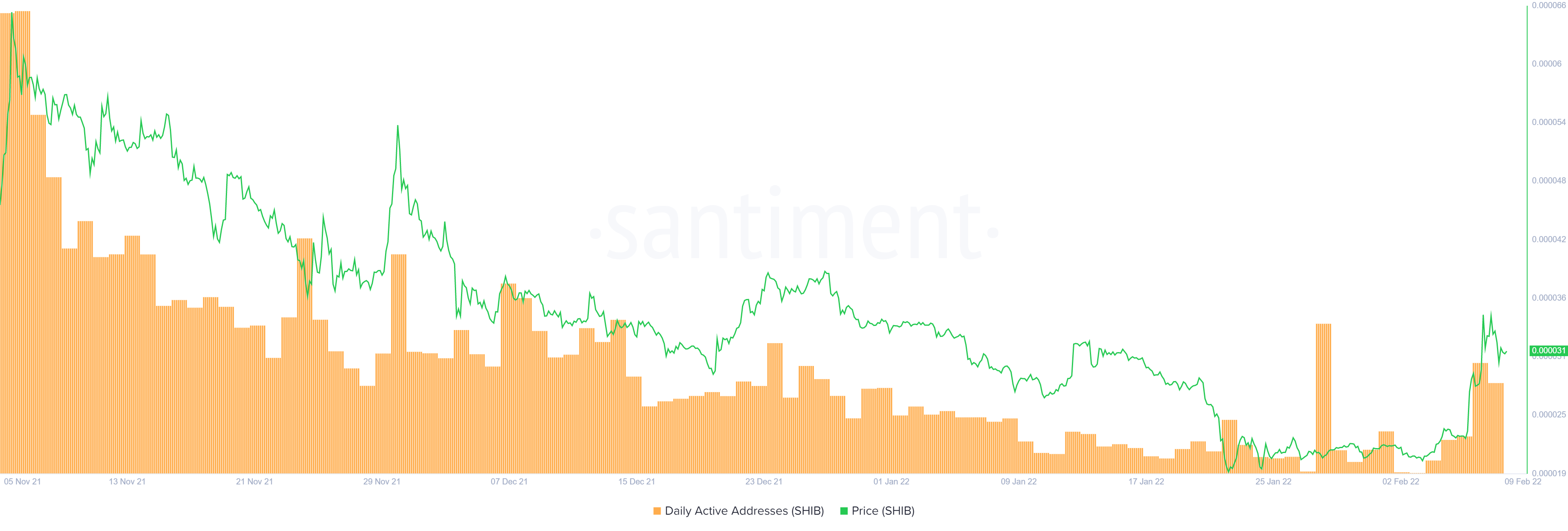

Supporting the possibility of an extension of the rally for Shiba Inu price is the recent uptick in daily active addresses from 5,841 to 10,770 over the past four days. This 84% hike in addresses indicates that investors are interested in SHIB at the current price levels.

SHIB DAA

Adding a tailwind to the potential bullish outlook is the recent growth in the number of large transactions worth $100,000 or more. Such transfers serve as a proxy for institutional investment interest and have increased by 56% from 488 to 761 over the last month, suggesting a bullish outlook.

SHIB large transactions

On the other hand, if SHIB slices through $0.0000283, it will trigger a steep descent to stable support levels at $0.0000233. A breakdown of this barrier will invalidate the bullish thesis and suggest a retest of the demand zone, extending from $0.0000158 to $0.0000193. Here, buyers will have another chance at a bull rally.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.