Shiba Inu price dips over 5% following the launch of Ethereum L2 chain Shibarium

- Shiba Inu price surprisingly took a turn for the worse, trading at $0.00000935, down by almost 6% in the last hour.

- Shibarium is the designated Ethereum layer-2 solution developed by the Shiba Inu team as a means of providing cheaper and faster transactions using SHIB as the fee token.

- Awaiting the launch of Shibarium, the network noted a surge in new addresses, resulting in network growth shooting up by 84% within three weeks.

Shiba Inu price began as a meme coin, but the Dogecoin-inspired token is now establishing its presence as a legitimate cryptocurrency network with the launch of its Ethereum-based layer-2 (L2) blockchain. Titled Shibarium, the chain will act as a medium for optimum utilization of dog-themed tokens.

Shiba Inu price crashes against expectations

Shiba Inu price is set to potentially rally and recover the recent losses following the launch of the highly anticipated Shibarium. The blockchain is Shiba Inu's first attempt at expanding the meme coin's reach. With an Ethereum L2, it will be able to attract more users and investment into the ecosystem.

Since Shibarium is a layer-2 solution on Ethereum, it is significantly faster and cheaper than base layer-1 (L1)chains. Shiba Inu presently operates as an L1 chain, and the launch of Shibarium could potentially bring more users to the network. Furthermore, with the mainnet of the blockchain going live, Shibarium would promote the use of dog-themed tokens within the Shiba Inu ecosystem, including the likes of BONE, TREAT and LEASH.

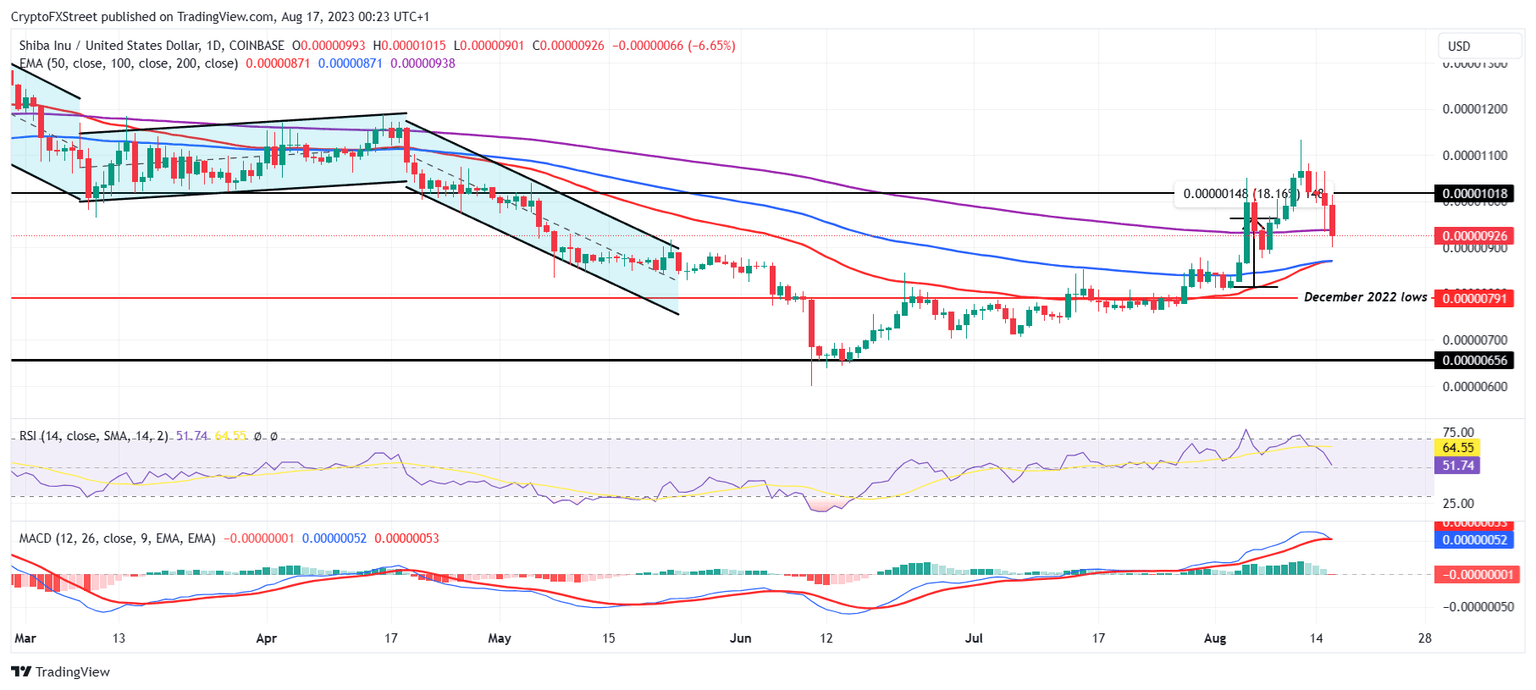

SHIB/USD 1-day chart

All of this was supposed to push the price up, but the opposite of the expected outcome occurred, and the Shiba Inu price crashed. Down by nearly 6% in the past hour, the altcoin is currently trading at $0.00000935. With every red candlestick, the meme coin is losing the potential for recovery with price indicators, including Relative Strength Index (RSI) as well as the Moving Average Convergence Divergence (MACD).

A further decline in the price indicators could cause the investors to lose their hope for recovery straight away since the momentum would turn bearish.

Interestingly this reflects against the expectations from the chain, which was observing a sudden jump in the rate thatnew addresses are formed on the network. This measures whether or not the project is finding traction amongst crypto investors.

Shiba Inu network growth

Over the past three weeks, this network growth has noted an 84% surge, suggesting investors' interest was rising ahead of the Shibarium launch. Going forward, as the users get acclimatized to the network, it could end up pulling the price up toward the end of the month.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B04.58.04%2C%252017%2520Aug%2C%25202023%5D-638278309678914194.png&w=1536&q=95)