Shiba Inu price deviates from the mean, hinting at a 25% upswing for SHIB

- Shiba Inu price has sliced through the $0.0000331 support level, collecting liquidity resting below it.

- This move hints at an incoming 25% upswing to $0.0000442.

- A swing low below $0.0000295 will invalidate the bullish thesis.

Shiba Inu price looks ready to move higher as it collects liquidity resting below crucial levels. This move has primed SHIB for an upswing, and the confirmation will arrive after a higher high is set up.

Shiba Inu price ready for a recovery rally

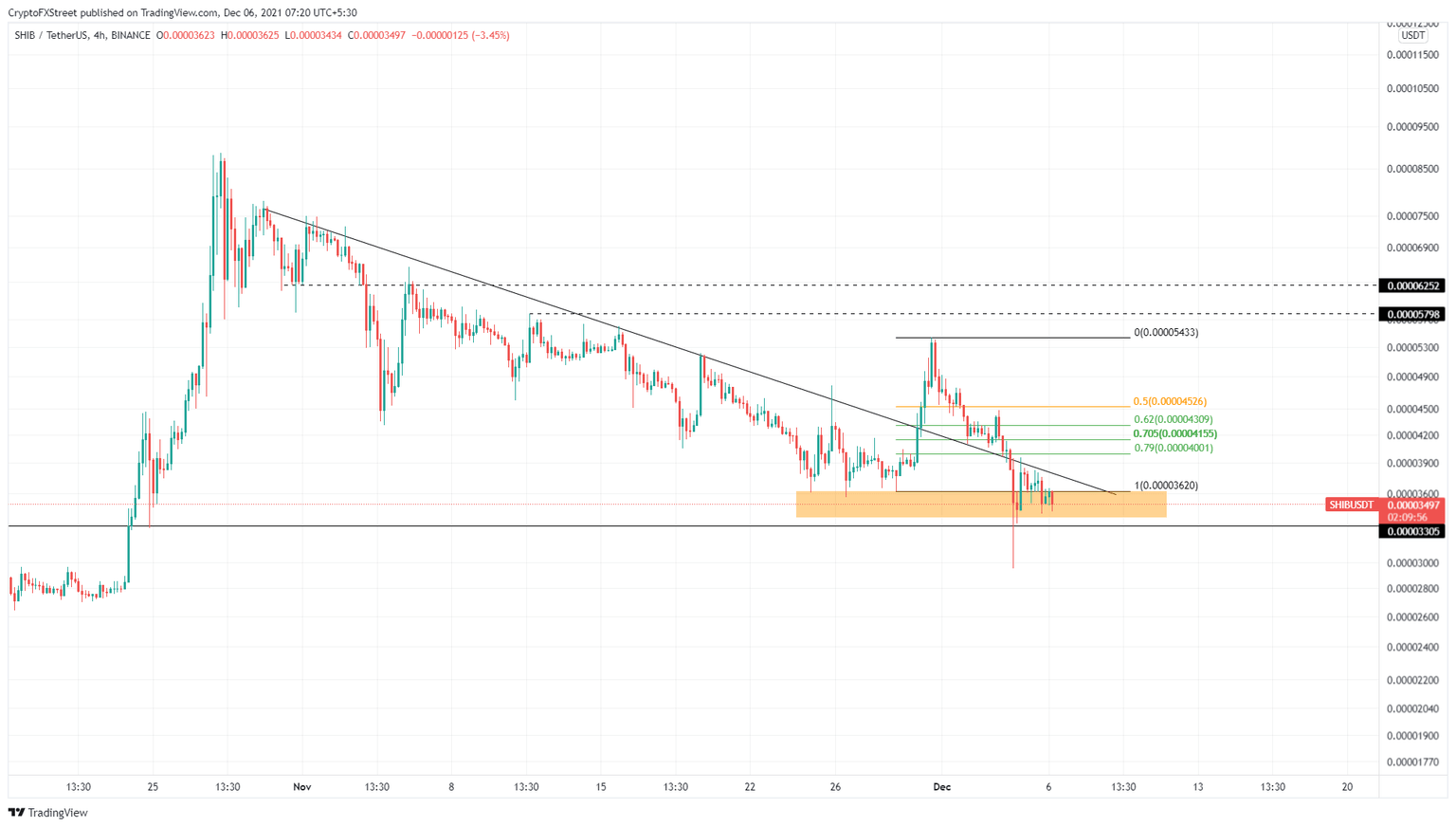

Shiba Inu price dropped 45% between November 30 and December 4, as the cryptocurrency market experienced a sell-off. This move collected liquidity resting below $0.0000362 and set up a swing low at $0.0000295.

Since this downswing, Shiba Inu price has recovered 19% to where it currently trades - $0.0000352. As SHIB forms a base of sorts, investors can expect Shiba Inu price to see a bullish reaction soon. The first hurdle is a 25% upswing away at $0.0000442. Hence, market participants can expect the meme coin to see an uptick in its bullish momentum to this target.

Clearing this level will suggest that the buyers are dominating and also open the path to $0.0000543. Retesting this level will constitute a 55% ascent and indicate a full recovery.

SHIB/USDT 4-hour chart

Regardless of the bullish outlook, if Shiba Inu price fails to set up a higher high above $0.0000380, it will indicate increased selling pressure. This development could hinder the optimistic narrative, knocking SHIB down to the immediate support level at $0.0000330.

Here, the buyers have another chance at an upswing. However, if Shiba Inu price produces a lower low below $0.0000295, it will invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.