Shiba Inu price cracks under pressure, while 10% loss would bring new low for 2023

- Shiba Inu price action looks bleak against its performance earlier this year.

- SHIB has more downside tensions building as a break below $0.00000800 spells trouble ahead.

- Even a new low below 2022's bottom is possible for SHIB.

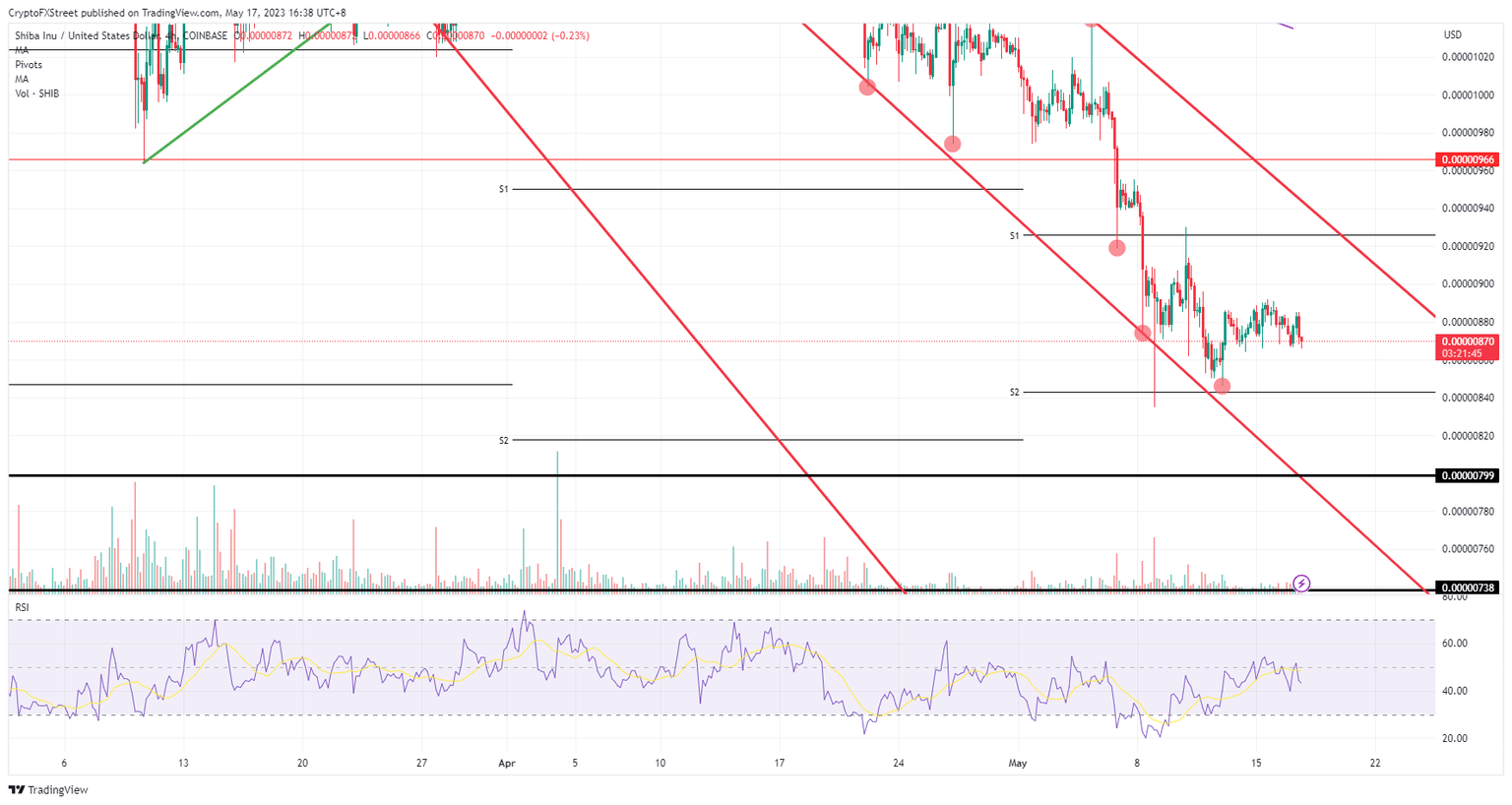

(SHIB) price is still very much caught in a downward trend channel, and a swift recovery or breakout is nowhere to be seen. Bulls are finally able to let at least the price action trade a bit sideways for this week, while once again cracks are starting to show. Itt is only a matter of hours before SHIB breaks lower. Keep an eye on $0.00000840. Once that breaks, expect to see another leg lower toward a new low for 2023.

Shiba Inu price action impeded by dangerous lower highs

Shiba Inu price sees bulls putting up a dismal performance as for now the only movement they can trigger is a sideways price action. The idea at least would be to head higher toward the upper band of the descending trend channel, but bulls are unfit for it. To make matters worse, selling pressure is building as lower highs have been detected since Monday.

Meanwhile, SHIB has bears sinking their teeth into the current low near $0.00000860, which is nibbling at bullish support. Once that gives way, a quick slide to $0.00000840 is logical with the monthly S2 as support. In case even the S2 does not hold, it becomes inevitable that a new low for 2023 will be printed as $0.00000800 and $0.00000799 are breached, adding a 10% loss to its performance.

SHIB/USD 4H-chart

The fact that for a few days now that area near $0.00000860 has been holding means that bears might break their teeth on this level. If that turns out to be the case, it would mean that bulls are continuing to buy against the short-sellers. If bulls can overhaul the price and head toward $0.00000890, then a squeeze could force SHIB to shoot higher toward $0.00000920.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.