Shiba Inu price could surge 30% if SHIB can overcome this hurdle [Video]

- Shiba Inu price bounces off the daily demand zone, extending from $0.0000269 to $0.0000293.

- Increased buying pressure could propel SHIB by 31% to sweep the range high at $0.0000399.

- A four-hour candlestick close below $0.0000269 will create a lower low, invalidating the bullish thesis.

![Shiba Inu price could surge 30% if SHIB can overcome this hurdle [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Cryptocurrencies/Shiba/Shiba_logo_200_XtraLarge.jpg)

Shiba Inu price is at an interesting point in its journey since it has produced two areas of liquidity in the opposite direction. Adding to this exciting development is one hurdle that blocks the path for SHIB and might hinder the bullish outlook.

Shiba Inu price prepares for a rally

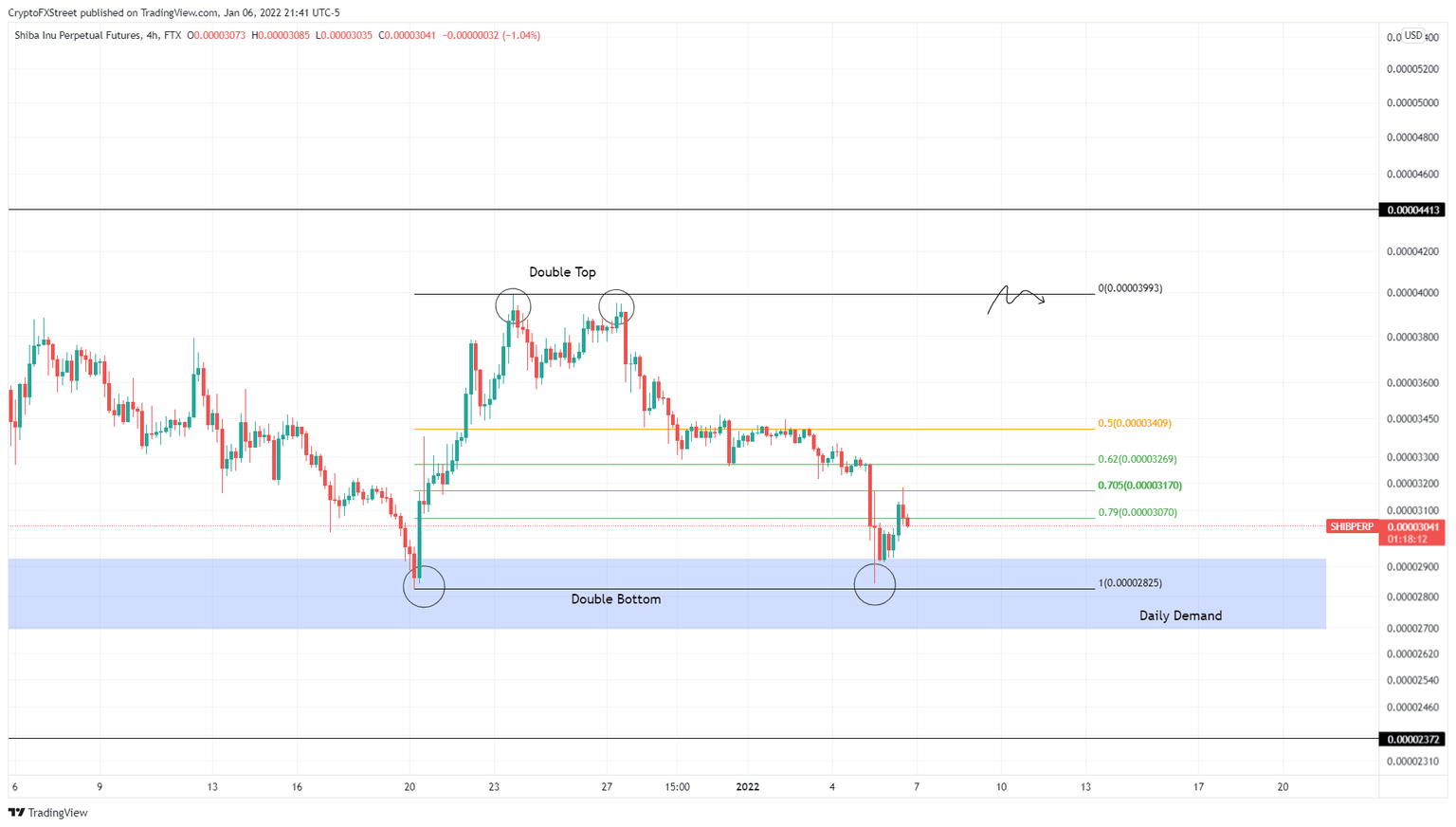

Shiba Inu price set up two swing lows at $0.0000283 on December 20, 2021, and January 5, creating the double bottom setup. Interestingly, this setup took place inside the daily demand zone, extending from $0.0000269 to $0.0000293.

While SHIB has recovered above this area, it needs to rally 12% before it faces the trading range’s midpoint at $0.0000341. Clearing this barrier will lead the meme coin to face $0.0000349, which harbors the buy-stop liquidity resting above it.

Shiba Inu price needs to clear $0.0000349 before it can reach the range high at $0.0000399, completing its 31% ascent.

SHIB/USDT 4-hour chart

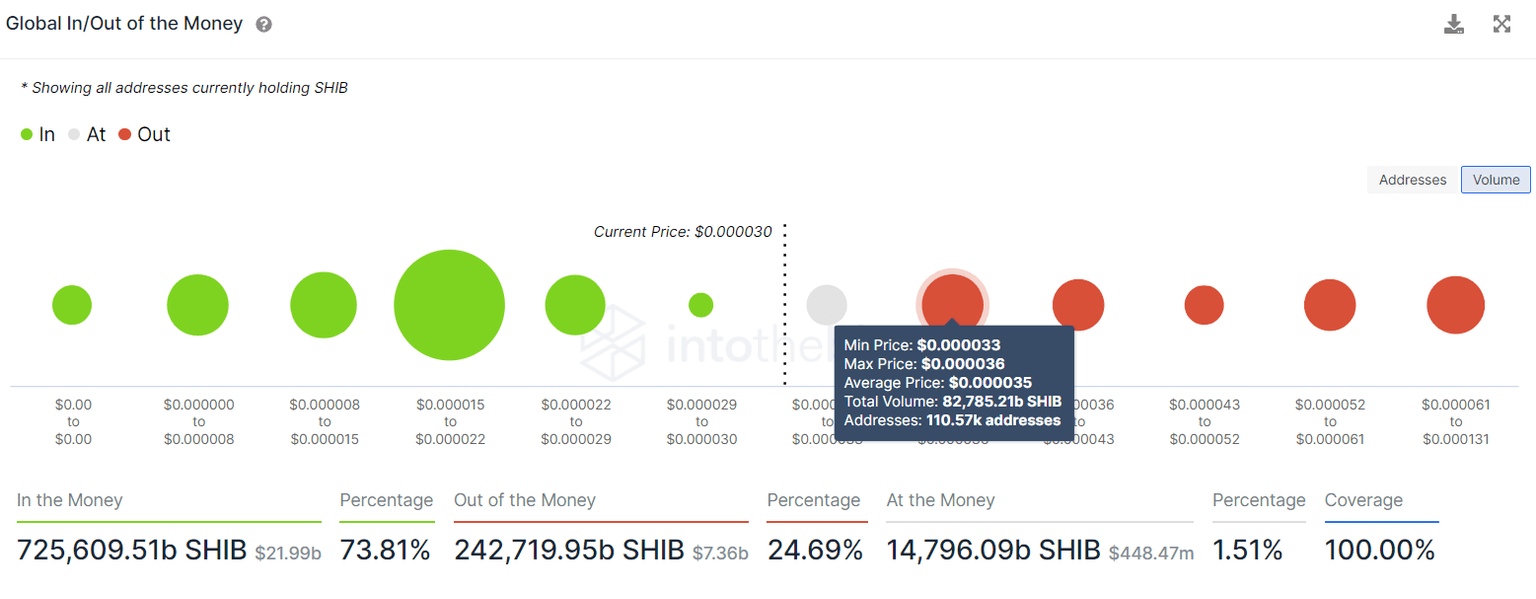

Depicting the importance of the hurdle at $0.0000349 is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This on-chain metric shows that roughly 110,570 addresses that purchased 82,785 billion SHIB tokens at an average price of $0.0000350 are underwater.

Therefore, Shiba Inu price needs to flip this barrier to reduce the selling pressure from holders trying to break even.

Beyond this area, the resistance barriers thin out until $0.0000680, supporting the bullish outlook detailed above.

SHIB GIOM

Further indicating the oversold nature of Shiba Inu price is the Market Value to Realized Value (MVRV) model. This on-chain metric is used to determine the average profit/loss of investors that purchased SHIB over the past month.

Currently, 30-day MVRV is hovering at -11.53%, an opportunity zone, suggesting that SHIB holders are at a loss and are less likely to sell their tokens. Moreover, long-term holders tend to accumulate in this area, which could serve as a significant source of buying pressure and could be the reason to kick-start an uptrend.

SHIB MVRV

While things are looking up for Shiba Inu price, a four-hour candlestick close below the daily demand zone’s lower limit at $0.0000269 will create a lower low, invalidating the bullish thesis. This development could trigger a crash, knocking Shiba Inu price to retest the $0.0000237 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%20%5B09.01.16%2C%2007%20Jan%2C%202022%5D-637771288924970979.png&w=1536&q=95)