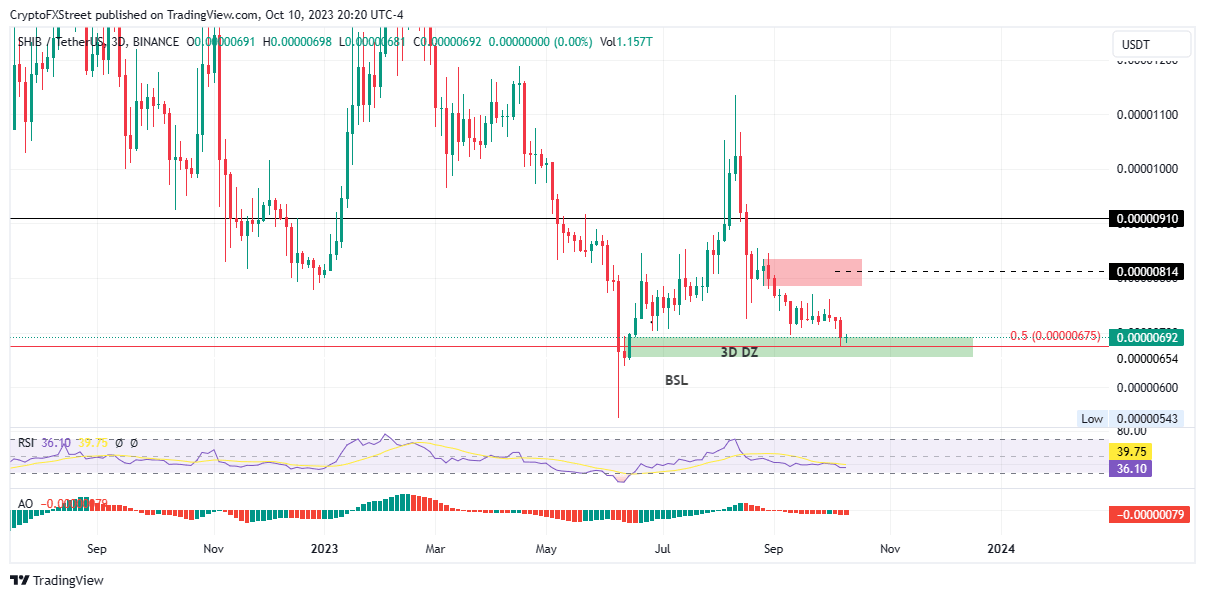

Shiba Inu price at an inflection point with SHIB testing the 50% retracement of a three-day demand zone

- Shiba Inu price tests the three-day demand zone between $0.00000694 and $0.00000655, a make or break moment for the memecoin.

- SHIB must hold above the 50% retracement level of $0.00000675 to maintain its upside potential.

- A decisive breach of the aforementioned level would clear the clog for further decline, putting off prospects for recovery rally.

Shiba Inu (SHIB) price has been on a steep downtrend since mid-August, recording pronounced lower lows on the three-day time frame. The slump has brought SHIB to a crossroad in the short term.

Also Read: Shiba Inu price marking fresh 2023 lows could lead to $107 million worth of tokens facing losses

Shiba Inu price at a crossroad

Shiba Inu (SHIB) price seems to have found support at the $0.00000675 level, which coincides with the 50% retracement level or midline of the three-day demand zone ranging between $0.00000694 and $0.00000655.

Historically, when an asset’s price records a solid move below the midline of an order block, it tends to extend the trend. As such, it is critical that SHIB holds above $0.00000675, or that the order block continues to hold as a support.

While a correction is critical, the odds continue to favor the downside, with the Relative Strength Index (RSI) still below 50 and the Awesome Oscillator (AO) indicators soaked in the negative territory. As such, it is likely that Shiba Inu price could extrapolate the losses, heading towards the $0.00000654 level while collecting the buy side liquidity that continues to reside underneath. Such a move would fail the demand zone, rendering it a bearish breaker.

SHIB/USDT 1-day chart

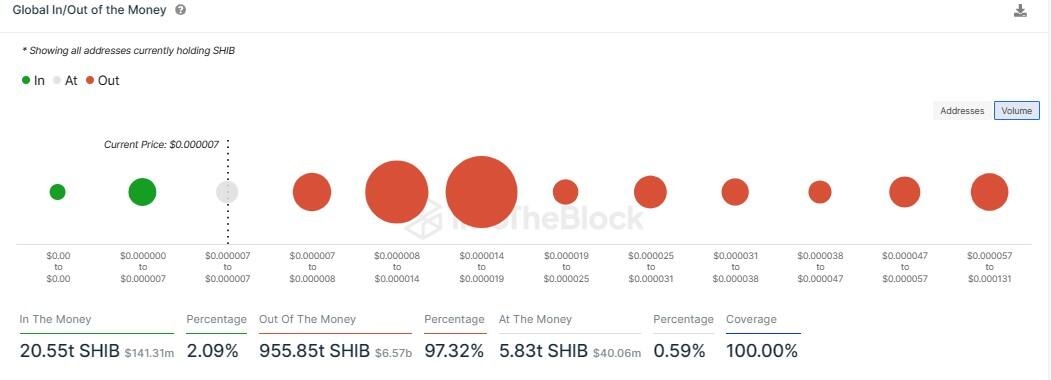

On-chain aggregator IntoTheBlock’s Global In/Out of the Money (GIOM) model reveals there exists a strong supply barrier that will prevent the meme cryptocurrency from achieving its upside potential. Based on this on-chain metric, two major areas of interest abound between $0.000008 and $0.000014 and secondly, between $0.00001400 and $0.00001900. A high number of investors fill these areas, constituting traders that had previously purchased the meme coin around this price level. Here, an aggregate of around 514,140 addresses are holding nearly 721.23 trillion Shiba Inu tokens.

SHIB GIOM

Conversely, if the demand zone holds as a support floor, Shiba Inu price could use it as the jumping-off point for its potential recovery rally. Such a move could send SHIB north, to the supply zone between $0.00000786 and $0.00000837. A decisive three-day candlestick close above the midline of this order block at $0.00000815 would confirm the trend north.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.