- Shiba Inu price refuses to resolve the descending channel of the last nine days.

- SHIBA quietly approaching the May 19 low at $0.00000607.

- A resurgence of upside momentum will strike formidable resistance at the earlier symmetrical triangle apex level.

Shiba Inu price has been sealed in a descending channel since June 3. Therefore, unless SHIB can overcome the channel’s magnet effect, it will test the May 19 low and possibly extend the decline that originated on May 10.

Shiba Inu price decouples from the bellwether cryptocurrency

Since June 3, Shiba Inu price has trended lower in a descending channel reaching a 40% decline for SHIB on June 8. However, it is interesting to note that the volume underpinning the descending channel has been sporadic, revealing there is no stampede for the exits, despite the weakness. In fact, today’s four-hour volume bars barely exist.

For some time, the limited SHIB volume validated the view that the soft descent was a function of the broader weakness in the cryptocurrency complex. Still, the SHIB correlation coefficient with BTC has quickly turned negative over the past two days. The negative correlation hints that Shiba Inu price has decoupled from the broader market and is driven by token-specific issues or by the governing descending channel.

It will take a compelling upside release from the descending channel to drown the skepticism that the current Shiba Inu price structure provokes. Immediate support materializes at the May 19 low of $0.00000607, followed by the channel’s midline, currently at $0.00000572. After that, a deeper decline could reach the channel’s lower boundary at $0.00000485, realizing a 25% decline from the current price.

SHIB/USD 4-hour chart

If the digital asset does unlock from the channel, there is no immediate resistance for Shiba Inu price until the symmetrical triangle apex line at $0.00000757. The level provided support in May and created resistance earlier this month. A successful close above the line could extend the SHIB rally to the 50 four-hour simple moving average (SMA) at $0.00000788.

For aggressive market operators, look for a close above the average to target a rally to the June 2 high of $0.00001048, generating a 60% gain from the current price.

A heightened level of uncertainty accompanies rookie cryptocurrencies as price history is too limited to define an outlook confidently. Instead, investors are better served to realize that they are the creation of social media hype and the resulting fear of missing (FOMO) that convinces retail investors of staggering returns.

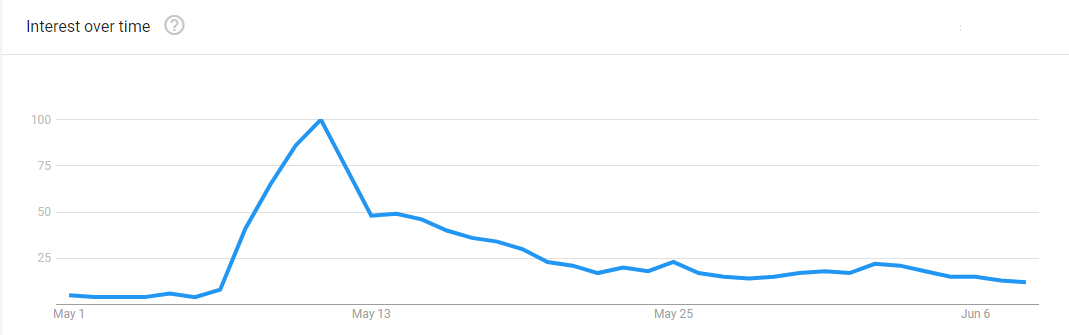

Interestingly, Google Trends shows that SHIB search interest is 10% of the May 11 peak and is resting at the lowest level since the peak. Thus, it is difficult to rally a new cryptocurrency without retail interest because institutions are not buying SHIB.

SHIB Search Interest - Google Trends

Shiba Inu price sits a pivotal moment in its short history. How it resolves the SHIB descending channel and manages the May 19 low will dictate the price structure for many weeks.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.