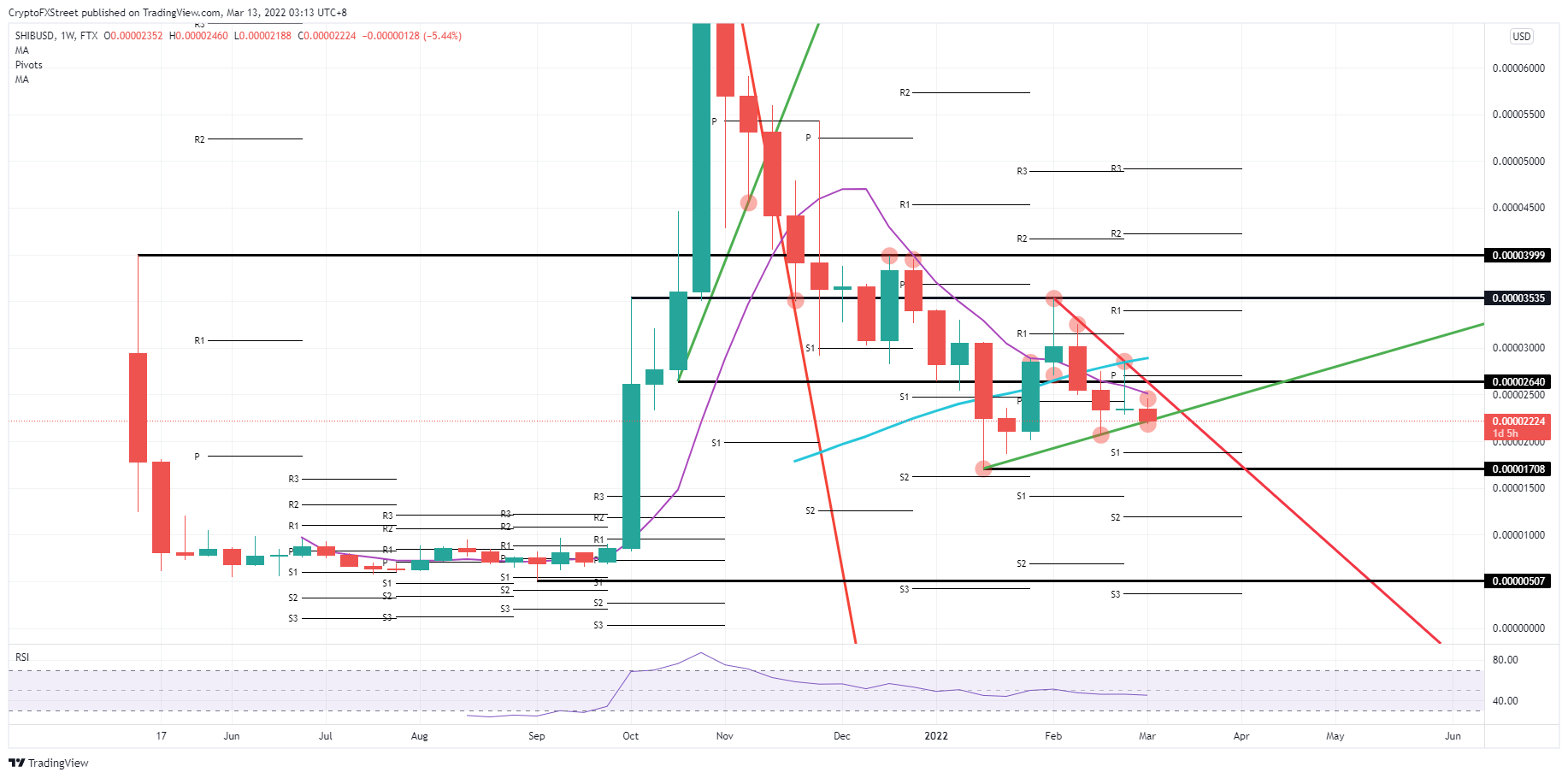

- Shiba Inu price was set to close with a weekly loss after bulls were unfit to break above the 55-day SMA.

- Expect a break below the green ascending trend line to see downward pressure building further.

- Support will only come in at $0.00001704, which is the low of January and for the whole of 2022.

Shiba Inu (SHIB) is under the scrutiny of a trifecta of bearish elements that outweigh any bullish arguments at the moment. Even without mentioning the geopolitical headaches and the worries about stagflation, technically, SHIB price triggers several bearish signals towards the markets. With the current situation, it almost looks impossible for bulls to take a stand and try and squeeze out gains unless the situation finally evolves. But until then, Shiba Inu can only go one way, down.

Shiba Inu price confirms bulls have too few tailwinds in their corner

Shiba Inu's price is facing not just headwinds but rather a hurricane of several headwinds that bulls at the moment can not match with any arguments to make new highs. The red descending trend line is the best proof of that, with price action staying in check below there. Secondly, the death cross is opening up even more with the 55-day Simple Moving Average (SMA) trading further below the 200-day SMA, and with this starting to act as the third argument as a price cap on the price action, as was proven on Wednesday where the rally got cut short even before hitting that 55-day SMA.

SHIB price action looks to be going into next week around the low end on the green supporting trend line. Once a clear broke below there, expect bulls to flee the scene as a new area is open for trading to the downside, and a swing trade towards the low of January makes the most sense. That would mean a drop below $0.00002000, and even though the $0.00001893 level, which is the monthly S1 support, towards $0.00001704 and possibly printing a brief new yearly low before bulls will want to try and repurchase the dip later next week.

SHIB/USD weekly chart

With cryptocurrencies trading over the weekend, any signals of successful peace talks or Russian forces pulling back out of Ukraine would see a massive relief rally being sparked. As all other assets only trade on Monday, Shiba Inu's price could be in for a solid 58% rally as investors will want to be part of the market before official trading begins. Expect to see sharp rises in price action above the monthly pivot at $0.00002715 and continue throughout next week towards $0.00003697 by next weekend.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.