Shiba Inu Layer 2 to power meme gaming and Play-to-Earn

- Shiba Inu’s Shibarium will offer scalability and low transaction costs needed to power meme games and play-to-earn.

- Shiba Inu will drop further details on meme gaming and Shibarium for developers at Shiba Con 2024 in November.

- SHIB price is nearly unchanged this week, down less than 1% and trades at $0.00001335 at the time of writing.

Shiba Inu (SHIB) is in a state of decline, even as the meme coin unveils plans for its Layer 2 scaling solution Shibarium. Lucie, behind the X handle @LucieSHIB, shared details of how Shibarium’s scalability and low transaction costs can help power play-to-earn and meme games in the Shiba Inu ecosystem.

SHIB trades at $0.00001335 at the time of writing.

Shiba Inu could power Play-to-Earn and meme games through Shibarium

Meme coin narrative has been dominant this crypto cycle. The meme coin sector has yielded highest gains for traders in H1 2024. Shiba Inu, the second largest meme coin could power meme games and Play-to-Earn gaming through its Layer 2 platform Shibarium.

Lucie, marketing executive at Shiba Inu, dropped details of what to expect from Shibarium and elaborated on low transaction costs and scalability. Shibarium is built on top of the Ethereum blockchain and turns Shiba Inu into a complete ecosystem that can power games.

— (@LucieSHIB) August 16, 2024

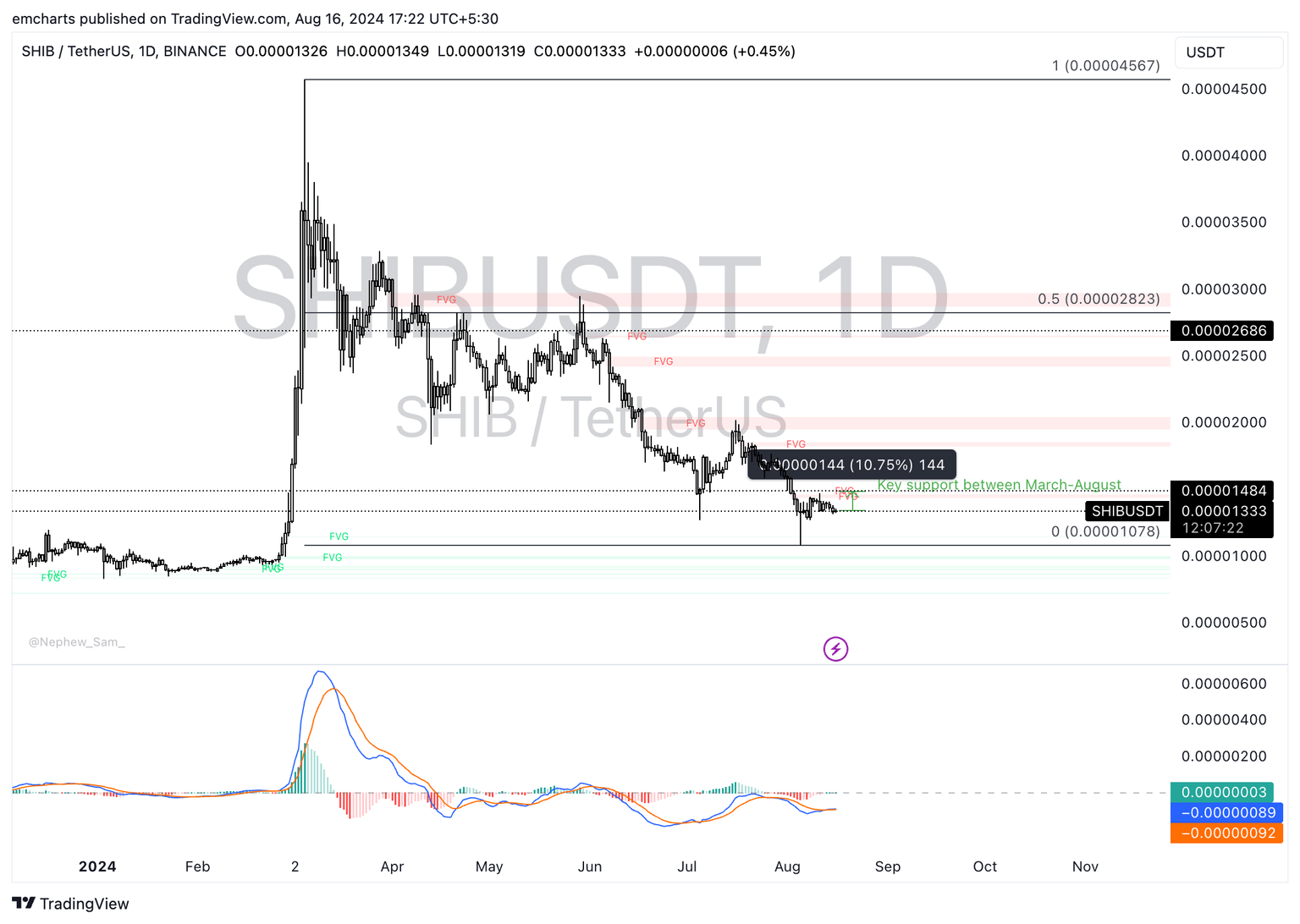

Shiba Inu could extend gains by nearly 11%

Shiba Inu price is nearly unchanged this week, with less than 1% decline on Binance. The meme coin could extend gains by nearly 11% and revisit the August 1 low of $0.00001484 as seen in the SHIB/USDT daily chart. This is a key level for the meme coin since it acted as support for the meme coin between March and August.

The Moving Average Convergence Divergence (MACD) indicator shows green histogram bars, signaling underlying positive momentum in Shiba Inu’s price trend.

SHIB/USDT daily chart

Shiba Inu could find support at the August 5 low of $0.00001078 in the event of a correction in the meme coin.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.