Shiba Inu holders get Christmas early as SHIB price eyes 25% upswing

- Shiba Inu price has seen an explosive 34% advance over the last 48 hours.

- A minor retracement should give buyers a chance to recuperate, triggering another 25% upswing.

- A breakdown of the range low at $0.0000282 will invalidate the bullish thesis.

Shiba Inu price experienced a bullish onslaught over the last two days, resulting in an exponential upswing. The run-up, while impressive, failed to collect liquidity resting above a crucial level. Therefore, investors can expect SHIB to retrace briefly before seeing another leg-up.

Shiba Inu price looks ready for more gains

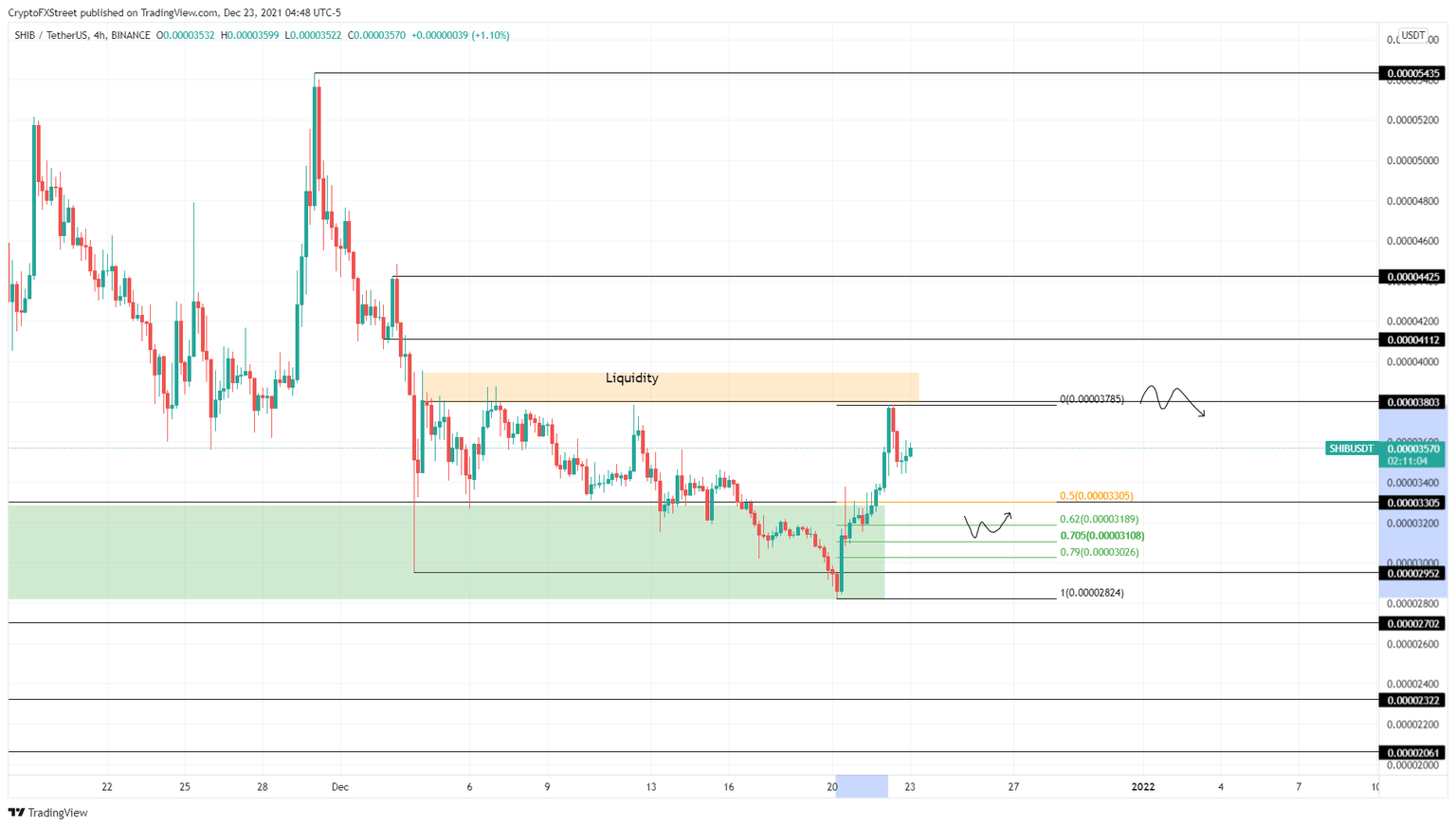

Shiba Inu price rallied roughly 34% in under two days, setting up a swing high at $0.0000378. The uptrend was a result of a liquidity run and a bounce off a significant support level. The run-up was supposed to collect the buy-stops resting above $0.000080, but the bulls fell short.

Investors can expect Shiba Inu price to see a pull-back to the 50% retracement level at $0.0000330 or the 70.5% retracement level at $310. Either way, a bounce off these levels will allow sidelined investors to jump on the bandwagon, triggering another run-up.

From the 62% retracement level at $0.0000318, Shiba Inu price can rally 19% before it approaches the $0.0000380 hurdle to collect the liquidity resting above it. Continued growth in bullish momentum will see SHIB continue this ascent to $0.0000412, suggesting a 25% rally.

SHIB/USDT 4-hour chart

All in all, Shiba Inu price looks primed for another rally. However, if SHIB fails to hold above the 79% retracement level at $0.0000302, it will indicate weakness among buyers. If this selling pressure continues, pushing SHIB to produce a 4-hour candlestick close below $0.0000282, it will create a lower low, invalidating the bullish thesis.

In this scenario, Shiba Inu price could crash 4% to revisit the $0.0000270 support floor.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.