Shiba Inu hits new milestone, over $9 billion worth of SHIB tokens burnt

- Shiba Inu has burned over $9 billion worth of SHIB tokens from the total supply.

- SHIB holders have consistently realized losses throughout April, nearly $45 million.

- SHIB is likely primed for a recovery, backed by bullish on-chain metrics.

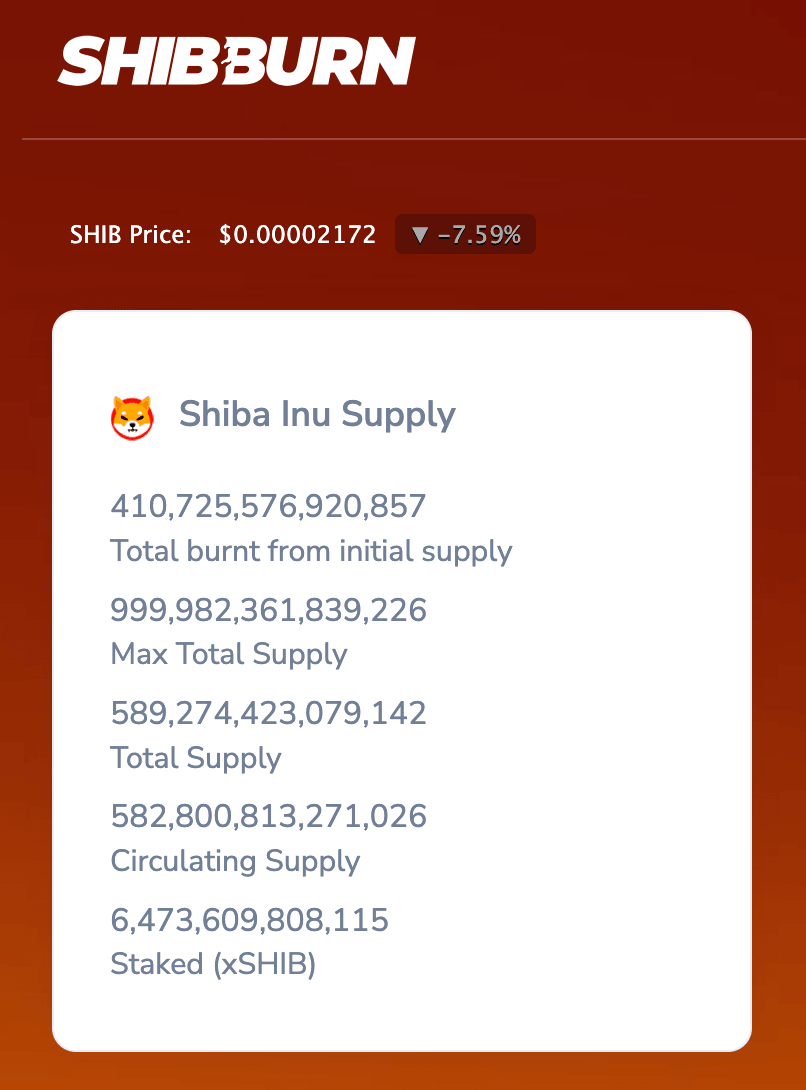

Shiba Inu (SHIB), the second-largest meme coin in the crypto ecosystem, recently hit a milestone in the volume of tokens burned. Shiba Inu has burnt over 410.72 trillion SHIB tokens since the inception of the burn mechanism in the project, worth over $9 billion.

Shiba Inu price is likely to recover, as on-chain metrics from Santiment paint a bullish picture for the meme coin.

Three factors that could catalyze Shiba Inu recovery

Three factors that could fuel a recovery in SHIB are:

- Shiba Inu token burn closes in on a key milestone, elimination of over $9 billion worth of SHIB from circulation on April 16.

- Market Value to Realized Value (MVRV) for SHIB is currently in the opportunity zone, in both 7-day and 30-day timeframes.

- SHIB holders have consistently realized losses, amounting to $45 million throughout April, signaling the likelihood of a capitulation in the meme coin.

Data from Shibburn shows that Shiba Inu token burn removed around $9 billion worth of SHIB from the supply, reducing SHIB in circulation and typically easing the selling pressure on the meme coin.

Shiba Inu supply

Santiment data shows that when MVRV 7-day and 30-day dips in the zone marked in the chart below (between -6% and -18%), there is an increase in SHIB price in the timeframe of a week. The MVRV is back in the opportunity zone and this signals that SHIB price gains are likely.

MVRV ratio 7-day and 30-day

Data from Network Realized Profit/Loss metric (NPL) shows that SHIB holders have consistently realized losses amounting to $45 million in April until the time of writing. When NPL spikes alongside a price decline it is indicative of capitulation in the asset, typically followed by a price increase.

Network realized profit/loss

SHIB price is $0.00002232, on Binance, at the time of writing. The meme coin’s price wiped out nearly 23% of its value in the past week.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B15.04.32%2C%252016%2520Apr%2C%25202024%5D-638488683576391678.png&w=1536&q=95)

%2520%5B15.01.36%2C%252016%2520Apr%2C%25202024%5D-638488683910956807.png&w=1536&q=95)