Shiba Inu faces volatility

Shiba Inu sees sharp volatility, as technical signals and reduced whale activity hint at potential market shifts.

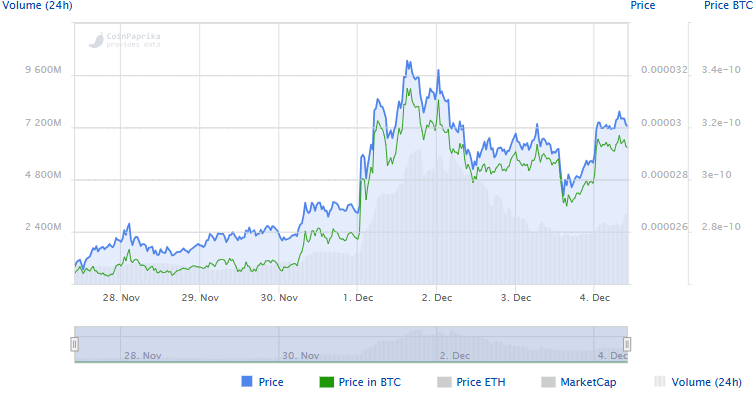

Shiba Inu (SHIB) has experienced a volatile week, gaining over 19% in seven days, cementing its position as the second-largest meme coin by market cap, just behind Dogecoin. However, mixed technical signals suggest both opportunities and risks for traders.

SHIB’s Relative Strength Index (RSI), a key momentum indicator, has cooled significantly, dropping from overbought levels. This shift indicates reduced buying pressure and a possible consolidation phase. While an RSI decline from high levels often points to traders taking profits, it also signals a more balanced market, potentially paving the way for sustainable price movements.

The behavior of SHIB's largest holders, known as whales, adds another layer of complexity. The number of whale addresses holding over 1 billion SHIB has dropped by 155 in the past month, suggesting that some large investors are offloading tokens after the recent price surge. This selling pressure could create short-term headwinds, but the redistribution of holdings among smaller investors may lead to greater decentralization, which is beneficial for long-term stability.

On the technical side, SHIB has dipped below its shortest Exponential Moving Average (EMA), a signal that short-term bearish momentum may be building. Despite this, longer-term EMA trends remain positive, keeping the potential for a bullish reversal intact. The price is at a critical juncture where both correction and recovery scenarios are equally plausible. A bearish outcome could see SHIB test lower support levels, while renewed buying momentum might drive the price higher, potentially surpassing recent highs.

For traders, SHIB’s current volatility offers both risks and opportunities. The market awaits a decisive move that will determine whether the coin continues its upward trajectory or enters a corrective phase.

Author

Jacob Lazurek

Coinpaprika

In the dynamic world of technology and cryptocurrencies, my career trajectory has been deeply rooted in continuous exploration and effective communication.