- Shiba Inu supply on exchanges declined by nearly 45% between March and May.

- Around 44.5 trillion SHIB tokens were removed from exchange wallets, reducing the circulating supply of the meme coin.

- SHIB network activity marked on May 26 the highest increase in new addresses created on a daily basis.

The reserve of Shiba Inu tokens across cryptocurrency exchange platforms has consistently declined between March and May. SHIB holders have pulled 44.53 trillion tokens off exchanges, reducing the circulating supply and thus the selling pressure on the second-largest meme coin.

Also read: Dogecoin retakes meme coin throne as Shiba Inu, Pepe mania fades

Shiba Inu reserves on exchanges decline

Dogecoin-killer Shiba Inu’s reserves across crypto trading platforms declined 33% between March and May. Based on data from crypto intelligence tracker Santiment, there were 88.36 trillion SHIB tokens on crypto exchanges as of May 30, sharply down from the 132.89 trillion in March.

%20[13.43.27,%2030%20May,%202023]-638210355429008845.png)

Shiba Inu supply on exchanges (represented by black line)

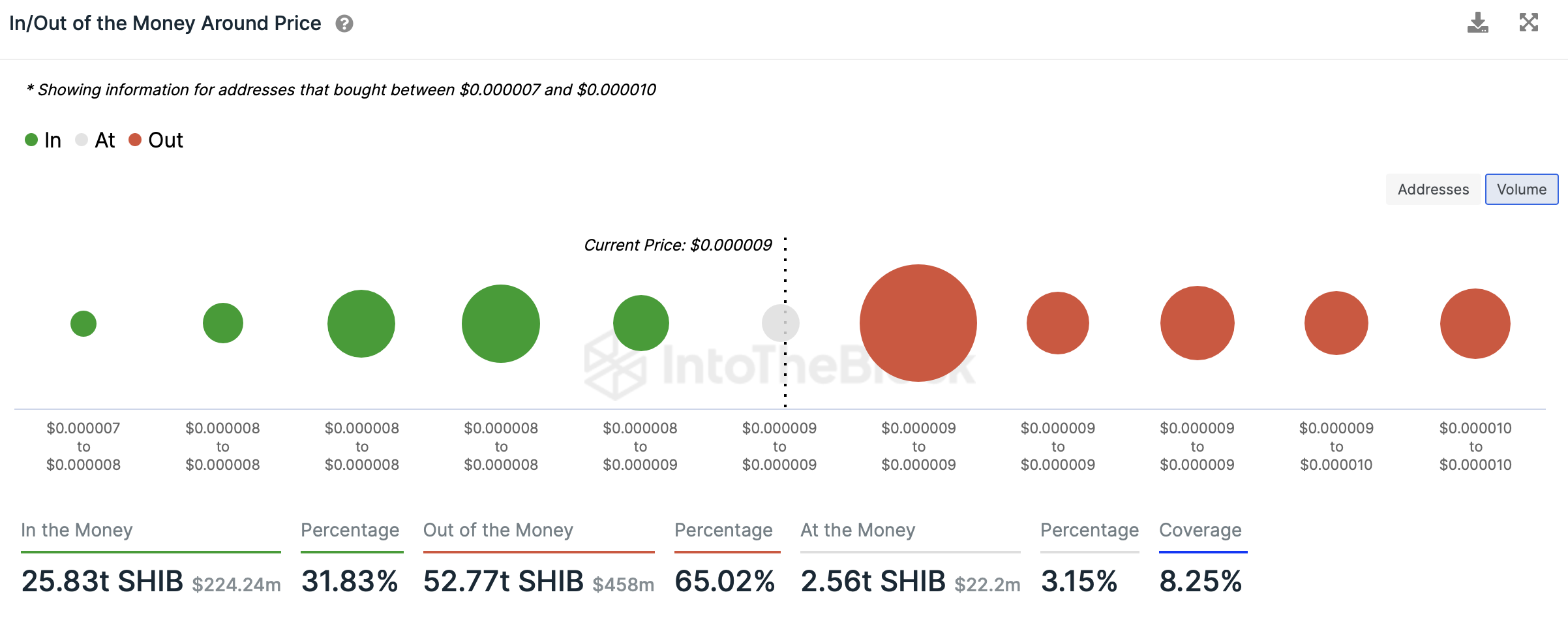

The chart shows the supply held by top addresses increased as exchange reserves declined. This implies that wallet investors and SHIB holders pulled the tokens off exchanges. These actions resulted in a decline in SHIB supply, easing off the selling pressure at a time when 65% of the wallet addresses holding Shiba Inu are underwater, meaning that they are sitting on unrealized losses. Shiba Inu price is $0.00000870 at the time of writing, meaning that 31% SHIB holders are profitable at the current price level.

Shiba Inu holders sitting on unrealized losses (out of the money)

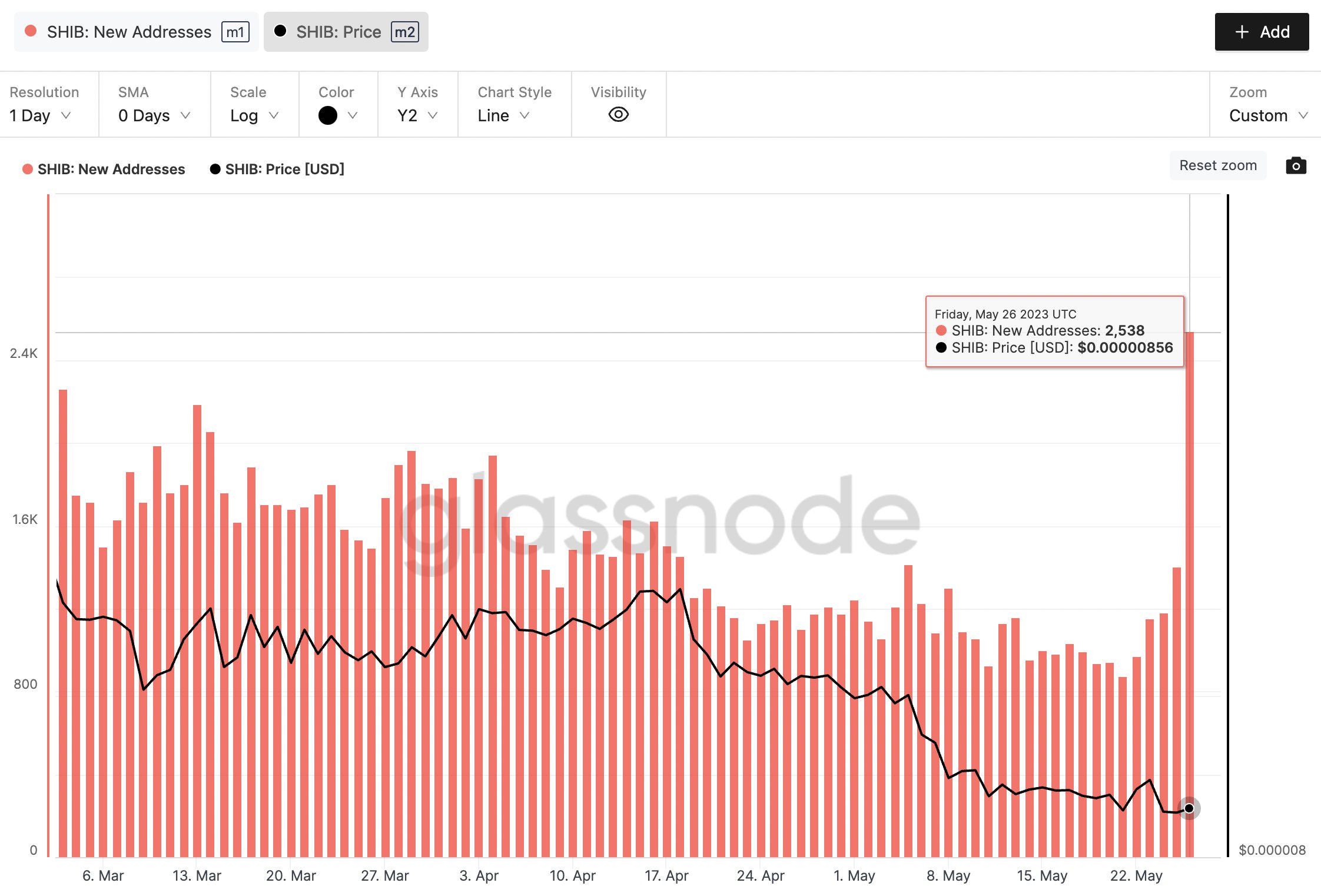

Moreover, there is an increase in Shiba Inu address activity on May 26. Rising address activity is likely to support a recovery in the meme coin’s price.

According to Glassnode data, 2,538 new Shiba Inu wallet addresses were created that day. This metric marks the daily largest spike in new addresses in the past three months.

Shiba Inu new addresses (plotted in red bars) against SHIB price (black line)

A decline in SHIB prices, coupled with less supply on exchanges and a large volume of new addresses created, are likely to act as a catalyst for the Dogecoin-killer price recovery in the short term.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP Price Prediction: XRP battles tariff turbulence amid MVRV buy signal

Ripple (XRP) seeks stability in a volatile crypto landscape influenced by macroeconomic factors, including reciprocal tariffs. The international money transfer token hit a low of $1.64 on Monday after opening the week at $1.92, representing a 14.5% daily drop.

Trade war escalates crypto market downturn amid President Trump's new tariff announcement

The cryptocurrency market extended its decline on Monday, stretching its market capitalization loss to $250 billion since the US slapped tariffs on international trading partners.

Chinese Yuan devaluation could drive Chinese capital flight into Bitcoin– says Arthur Hayes

BitMEX co-founder Arthur Hayes highlighted a potential Chinese Yuan devaluation in his X post on Tuesday, suggesting it could drive Chinese capital flight into Bitcoin. Arthur says this trend worked in 2013 and 2015 and can work in 2025.

Crypto whales buy 874 billion SHIB as Shiba Inu price plunges to lowest in 13 months

Shiba Inu (SHIB), one of the most talked-about meme coins in the cryptocurrency space, took a sharp nosedive on Monday, plunging below the $0.00001 threshold for the first time since February 2024.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.