Shiba Inu countdown hype dies, layer-2 scaling solution Shibarium launch nowhere on the horizon

- Shiba Inu token mysterious countdown just a website redesign.

- SHIB holders had anticipated launch of layer-2 scaling solution Shibarium.

- Shytoshi Kusama apologized to the community for misleading countdown, appreciating new design.

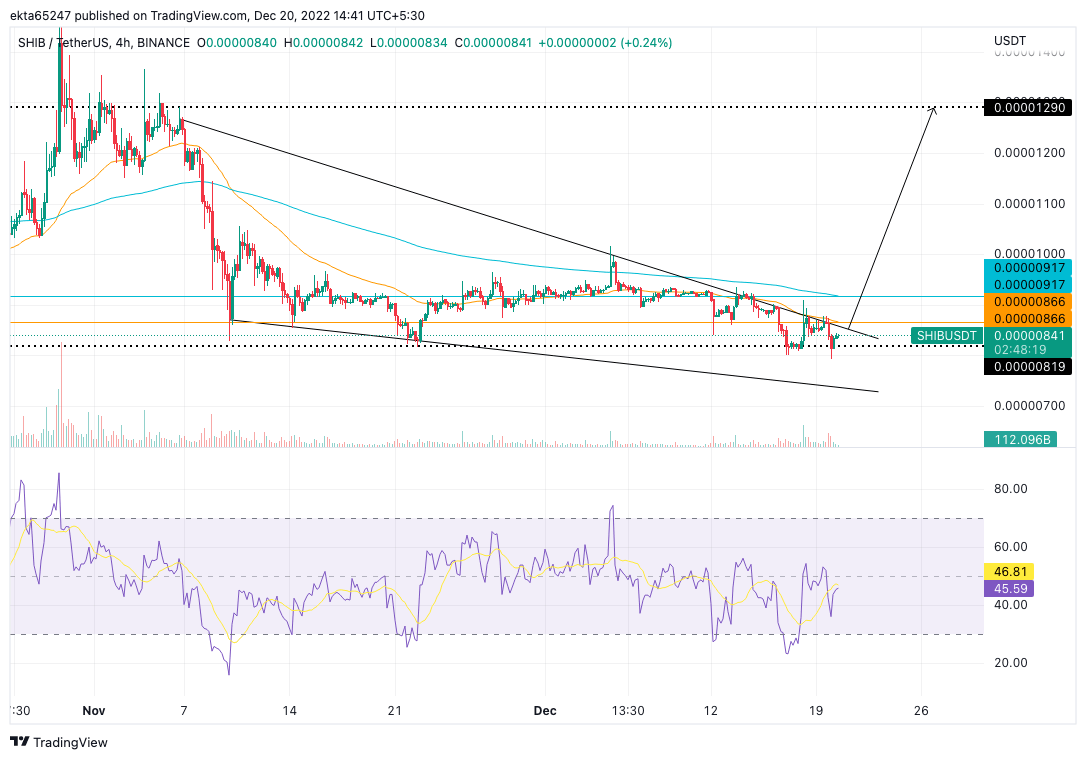

- Shiba Inu price in a falling wedge, bullish breakout could push SHIB to $0.00001290.

The website of Shiba Inu (SHIB), the second-largest meme coin, was redesigned by developers, disappointing the huge hype of its community. SHIB holders expected the website countdown to be followed by the launch of layer-2 scaling solution Shibarium. Shytoshi Kusama, Shiba Inu’s project head, apologized to the community.

Also read: Shiba Inu team begins special countdown, is Shibarium ready for launch?

Shiba Inu countdown results in website redesign, no updates on Shibarium

Shiba Inu, Dogecoin’s largest competitor and a leading meme coin, recently revamped its website. Developers announced a mysterious countdown on their website and the Shiba Inu community anticipated the launch of Shibarium, its highly awaited layer-2 scaling solution.

Shibarium is expected to increase the utility of the Shiba Inu token and the community anticipated the scaling solution’s launch after the mysterious countdown. Shiba Inu added 10,410 new holders to its community in the past two weeks alone, based on data from Etherscan.io.

Shiba Inu holders

However, the hype has now died down despite Shiba Inu’s lead developer Shytoshi Kusama applauding Trophias and his team for the website’s new design. Kusama took to Twitter to apologize to the Shiba Inu community for the misunderstanding. While the countdown was meant for the re-design, a large percentage of SHIB holders and community members expected the Shibarium launch.

Shibarium is key to Shiba Inu’s growth as it scales the meme coin, and reduces the congestion on the base chain – Ethereum. This could act as a bullish trigger for both of the ecosystem’s tokens: SHIB and BONE.

Please note that I am not responsible for every detail of Shib (i.e. website). So I applaud Trophias and his team for the new design and totally understand how the countdown could have been misleading. Although not in control of that, I apologize for any confusion. Stay tuned.

— Shytoshi Kusama™ (@ShytoshiKusama) December 20, 2022

Shiba Inu price draws bullish chart pattern

Shiba Inu price is currently in a falling wedge pattern as seen in the chart below. SHIB price maintained five touches on the two trendlines confirming this falling wedge chart pattern.

SHIB/USDT price chart

The down-sloping and converging trendlines of this chart pattern succesfully predict an upward breakout 68% of the time. The pattern will confirm itself as a valid one when Shiba Inu price closes above its upper trendline.

Shiba Inu price could face potential resistances at the 50-day and 200-day Exponential Moving Averages (EMAs) at $0.00000866 and $0.00000917. There is support at $0.00000841 and the target for the bullish breakout in SHIB price is $0.00001290.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.