- Shiba Inu price action is unchanged on its Point and Figure chart.

- A tight trading range over the past few weeks could be a sign of strength.

- Downside risks exist but are very limited in scope and range.

Shiba Inu price has been stuck in a very, very constricted trading range over the past seven trading days, but throughout December, SHIBA formed a strong support zone and a new Volume Point Of Control – indicating a new uptrend may be imminent.

Shiba Inu price readies for launch and significant outperformance

Shiba Inu price, from an Ichimoku perspective, looks extremely bearish and should be pursuing new multiple-month lows – but it isn’t. Short-sellers have been unable or unwilling to push Shiba Inu into a central capitulation zone. Instead, participants have created a new and massive Volume Point Of Control at $0.000032.

SHIBA/USDT Daily Ichimoku Chart

The Volume Point Of Control in the volume profile is an equilibrium area. It is the price level where the most buying and selling has occurred. It is where bulls and bears have battled the most. It is a tipping point level and whichever direction Shiba Inu price eventually moves, those on the opposite side of the trade will get crushed.

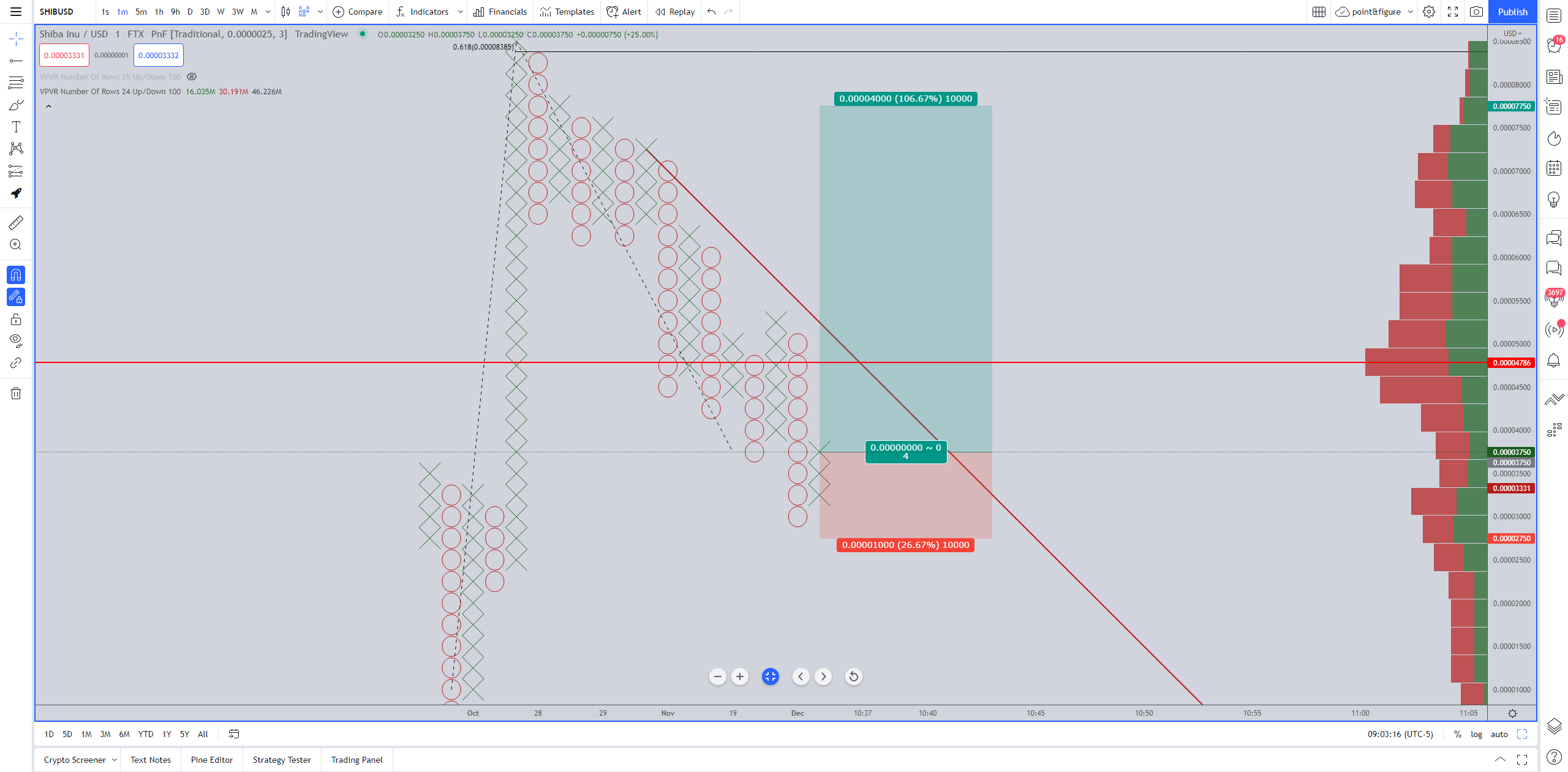

On the $0.0000025/3-box reversal Point and Figure Chart, SHIBA is unchanged from the recent, prior analysis. The theoretical long entry remains a buy stop order at $0.0000375, a stop loss at $0.0000275, and a profit target at $0.0000775. The trade idea represents a 4:1 reward for the risk setup with an implied profit target of nearly 107% from the entry.

SHIBA/USDT $0.0000025/3-box Reversal Point and Figure Chart

The long trade idea is invalidated if Shiba Inu price drops below $0.0000200. Additional downside risks below $0.0000200, however, are probably limited to $0.0000150.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Cardano Price Forecast: Sign of robust bullish reversal emerges despite dwindling DeFi TVL volume

Cardano rebounds to test resistance at $0.69 as technical indicator flashes a buy signal. A minor increase in the derivative Open Interest to $831 million suggests growing trader interest in ADA.

Crypto Today: Bitcoin's downside risks escalate as BTC spot ETF outflows extend

The cryptocurrency market is consolidating losses after starting the week amid high volatility. Bitcoin attempted to steady the uptrend above $106,000 but lost steam, resulting in a reversal to $105,204 at the time of writing on Tuesday.

Bitcoin falls below $106,000 as risk-off sentiment persists

Bitcoin price faces rejection around its $106,406 resistance level on Tuesday, hinting at a potential correction ahead. Market sentiment sours as growing Israel-Gaza tensions weigh on riskier assets, such as BTC.

Coinbase asset roadmap adds Ethena, ENA targets $0.34 breakout before listing

Ethena records its fourth consecutive positive day, signaling increased bullish momentum. Coinbase announces the addition of Ethena to the asset roadmap, making it tradable on the platform soon.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.