- Shiba Inu community is poised to enjoy new possibilities amid the newly established Ethereum-Shibarium Bridge.

- The innovative solution promises to advance the Shiba Inu ecosystem through seamless, secure cross-chain transactions for SHIB users.

- SHIB influencer Lucie Sasnikova has explained the dynamics of the Ethereum-Shibarium Bridge.

- The meme coin could soar 20% amid growing utility.

Shiba Inu community is poised to enjoy new opportunities following a newly established partnership between Ethereum and Shibarium, dubbed Ethereum-Shibarium Bridge. The partnership breeds an innovative solution committed to advancing the Shiba Inu ecosystem by providing “seamless, secure cross-chain transactions for SHIB users.”

Shibarium is a Layer 2 (L2) blockchain built to address the limitations of Ethereum, the host chain of the SHIB token. Among the key elements it solves are low speed and high transaction costs.

Shiba Inu’s Ethereum-Shibarium Bridge explained

In a successful attempt to explain the working dynamics of the Ethereum-Shibarium Bridge, SHIB influencer, Lucie Sasnikova, said the bridge between the two giant blockchain networks demands a strong and unassailable cross-chain solution.

Ethereum + #Shibarium bridge

— (@LucieSHIB) April 12, 2023

Moving between two large-scale blockchain networks requires a secure and robust cross-chain bridge, and Shibarium has achieved this by utilizing both Plasma and PoS security to create a trustless and bi-directional transaction environment between… pic.twitter.com/itZO9HTk5o

To achieve its standard strong and secure cross-chain solution, Shibarium uses Plasma and Proof of Stake (PoS) security, which creates a “trustless and bi-directional transaction” atmosphere between Ethereum and Shibarium.

The bridge allows users to transfer tokens between networks directly without an intermediary. This eliminates risks and liquidity implications. It is tailored for speed, cost-effectiveness, and versatility and serves as a scaling solution. Further, it uses the Plasma+PoS platform, a dual consensus framework, in prioritizing speed and decentralization. At the same time, it facilitates arbitrary state transitions on sidechains with Ethereum Virtual Machine (EVM) support.

The circulating supply remains unchanged as tokens cross the bridge. It is also worth mentioning that Shibarium mints an equal amount of pegged tokens whenever a token exits the Ethereum network, meaning on a 1:1 ratio.

During the process, tokens are burned on Shibarium and unlocked on Ethereum. This is how tokens are transferred back to the Ethereum network.

Shibarium beta test network

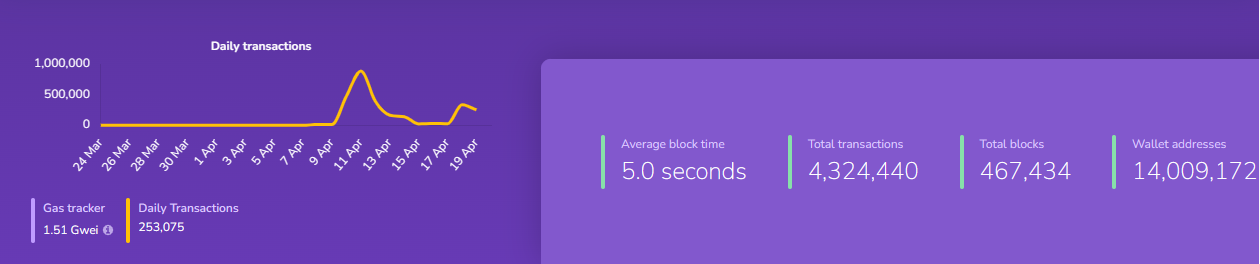

Shibarium’s beta test network is christened PUPPYNET, with blockchain explorer BlockScout noting that the beta version of Shibarium has successfully executed transactions totaling 4,290,709. Notably, that data was only accurate as of April 20 at 5:40 PM UTC. Moreover, the data shows that the number of wallet addresses using Shibarium beta has hit 13,993,009.

For now, the gas fee is typically free, standing at 1.51 Gwei. SHIB lead, Shytoshi Kusama, is on record noting that the Puppynet beta of Shibarium keeps rising and could cross the 14 million addresses milestone linked to Shibarium soon.

#ShibaInu’s Puppynet continues its meteoric rise as the number of interacting wallet addresses on #Shibarium has neared almost 14 million.#Crypto #CryptoCurrency #PuppyNet #CryptoNews #SHIBA https://t.co/sscGRfNjhq

— TWJ News (@TronWeekly) April 20, 2023

Shiba Inu price could soar 20% amid growing utility

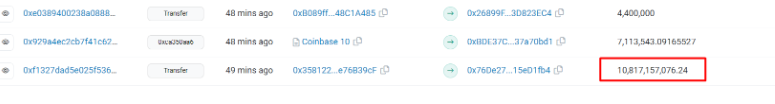

While the Shiba Inu price shows a bearish bias, Etherscan data shows that whales are actively buying huge amounts of SHIB as more wallets are connected to the Shibarium testnet for transaction purposes.

In a recent report, two SHIB whales bought a colossal amount of Shiba Inu in two transfers, first buying 10,817,157,076 SHIB followed by 6,782,260,080 SHIB. According to the latest data, the largest 100 whales on the Ethereum chain currently hold a little over $600 million worth of Shiba Inu. This makes it approximately 12% of their total portfolio. On average, these wallets contain up to 496,214,650,935 SHIB, valued at around $6 million.

Earlier in the week, an unknown wallet moved an astonishing 3,484,812,794,902 SHIB tokens to another unknown address.

At the time of writing, Shiba Inu price is $0.0000106, sitting atop the critical support level at $0.0000103. The meme coin appears to be coiling up for an upswing of about 20% to $0.0000125 before a possible extension to the $0.0000147 range high.

SHIB/USDT 1-day chart

Conversely, if bearish momentum escalates, Shiba Inu price could drop further to tag the $0.0000093 support level or, in the dire case, extend a leg down toward the $0.0000086 support level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP stabilize as SEC Crypto Task Force prepares for First roundtable discussion

Bitcoin (BTC) price hovers around $84,500 on Friday after recovering nearly 3% so far this week. Ethereum (ETH) and Ripple (XRP) find support around their key levels, suggesting a recovery on their cards.

XRP sees growing investor confidence following SEC ending legal battle against Ripple

Ripple's XRP trades near $2.43 on Thursday after seeing a rejection at the $2.60 resistance. The remittance-based token has seen a 400% growth in network activity since the beginning of March. The growth may continue, considering the SEC recently dropped its appeal against Ripple.

SEC confirms Proof-of-Work crypto mining doesn't fall under securities laws

The Securities & Exchange Commission's (SEC) Division of Corporation Finance released a statement on Thursday clarifying its position on proof-of-work (PoW) crypto mining.

Swiss National Bank rejects Bitcoin reserve proposal

Swiss National Bank has rejected a proposal to adopt Bitcoin as a reserve asset, citing concerns over volatility, security, and liquidity.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.