- Shiba Inu price has bounced back as the meme coin partners with Travala, SHIB can be used to book flights, hotels, and supercars.

- 101.6 million Shiba Inu tokens were burned overnight, increasing burn rate could fuel recovery.

- Analysts set a bullish target of $0.000014 for Shiba Inu, predicting a recovery in the Dogecoin-killer.

Shiba Inu has witnessed explosive growth in its utility. The meme coin can now be used to book supercars, travel bookings, and flights, in addition to being accepted at fast-food restaurant chains. Analysts are bullish on Shiba Inu’s recovery after the recent slump.

Also read: Shiba Inu burn rate plummets with Ryoshi disappearance, SHIB could crash like Terra’s LUNA

Shiba Inu utility gets massive boost with new partnership

The Shiba-Inu-themed cryptocurrency has seen a boost in its utility with the Travala partnership. Travala.com is a leading travel agency that enables users to book flights, hotels, trips, and even supercars like Ferrari, Lamborghini and Rolls-Royce.

Shiba Inu community members can pay for McLaren, Aston Martin and Bugatti ride bookings with their meme coin. XcelTrip, a travel-booking platform similar to Travala, recently adopted Shiba Inu as a payment method, allowing users to pay for their trips and related expenses through SHIB.

Shiba Inu is now accepted at Travala’s, and users can spend their SHIB tokens in exchange for travel bookings and hailing services like booking rides throughout the trip. Proponents have heavily criticized Shiba Inu for its lack of utility and real-world adoption, so through Travala’s partnership, Shiba Inu could witness a rise in its adoption.

Shiba Inu burn continues, 101.6 million SHIB burned overnight

Token burn is one of the critical features of Shiba Inu that reduces the meme coin’s circulating supply. Over the past 24 hours, 101.6 million Shiba Inu tokens have been burned, and a total of 410.36 trillion tokens were destroyed.

Shiba Inu tokens sent to dead wallet addresses are pulled out of the Dogecoin-killer’s supply. This reduces the number of SHIB tokens in circulation and eases the selling pressure on Shiba Inu across exchanges.

Shiba Inu is headed to the opportunity zone

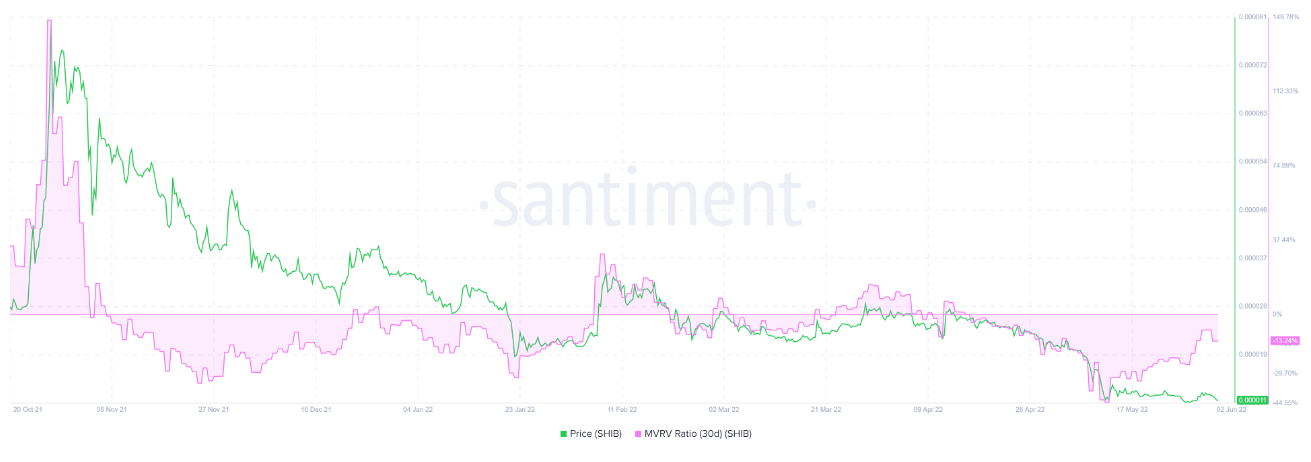

The 30-day Market Value to Realized Value (MVRV), a metric used to assess whether a cryptocurrency is above or below its “fair value” based on data from Santiment, Shiba Inu is nearing the “opportunity” zone with present accumulation. If the metric indicates a rating of -10 to -15%, it implies short-term holders are losing money, and a change below -10% is referred to as the “opportunity zone.” When short-term holders are less likely to sell, there is accumulation, and long-term holders congregate.

The 30-day MVRV for Shiba Inu recently dropped below two local bottoms at -34% and -44%. Therefore, holders accumulated the meme coin.

30-day MVRV Shiba Inu

The 1,000 largest Ethereum whale addresses are holding $621.6 million in Shiba Inu tokens, based on data from WhaleStats. Whales have been more active in the last 24 hours, and there was a spike in activity (transactions higher than $100,000). An increase in whale activity is typically considered bullish for the meme coin.

Analysts set bullish target for Shiba Inu

Analysts at FXStreet evaluated the Shiba Inu price trend and noted there is low liquidity in SHIB. The upside for Shiba Inu is capped at $0.0000128. However, a breakout past that could push the price to $0.0000143.

If the Shiba Inu price plummets between $0.0000107 to $0.0000111, the meme coin could retest its lower limit and offer market participants the opportunity to accumulate.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top gainers Virtuals Protocol, Floki, Hyperliquid: Altcoins extend gains alongside Bitcoin

The cryptocurrency market sustains a market-wide bullish outlook at the time of writing on Tuesday, led by Bitcoin (BTC) and select altcoins, including Virtuals Protocol (VIRTUAL), Floki, and Hyperliquid (HYPE).

Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Coinbase launches new Bitcoin Yield Fund, offering investors 4–8% annual returns

Coinbase has launched a Bitcoin Yield Fund, aiming to offer non-U.S. investors sustainable 4–8% returns paid directly in Bitcoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.