- Shiba Inu army burned 666 million Shiba Inu in November 2022 in 149 transactions.

- Technical indicators on the daily price chart confirm a recovery in Shiba Inu price.

- Bitcastle listed Shiba Inu, alongside Dogecoin, Solana and XRP.

Shiba Inu, popularly known as "the Dogecoin-killer", witnessed a spike in burn in November. The community destroyed 666 million SHIB in 149 transactions, pulling these tokens out of circulation permanently. The meme coin is ready to begin its recovery despite the crypto bear market.

Also read: Shiba Inu price is on track to appreciate 15% if this happens

Shiba Inu community burns 666 million SHIB tokens

Shibburn, a platform that tracks Shiba Inu’s burn statistics, noted that 666,903,322 SHIB tokens were burned in the month of November 2022. The Shiba-Inu-themed token’s community destroyed upwards of 666 million SHIB in 149 transactions.

666,903,322 $SHIB tokens have been burned in the month of November with 149 transactions. #shib #shibarmy

— Shibburn (@shibburn) December 1, 2022

The implementation of burn is key to Shiba Inu’s ecosystem as it reduces the number of SHIB tokens in circulation. The reduction in the meme coin’s circulating supply has a direct impact on its price.

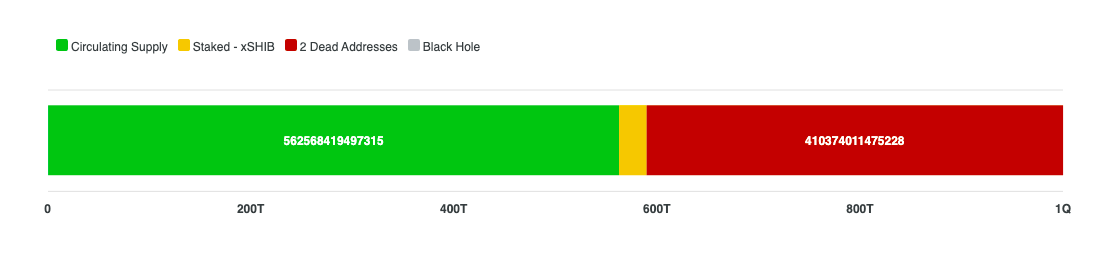

Upwards of 410.38 trillion SHIB tokens in total have been permanently removed from Shiba Inu’s circulating supply. Considered Dogecoin’s largest competitor, SHIB has witnessed a dramatic decrease in its circulation. 41% of SHIB tokens have been destroyed, and 562.56 trillion are currently being circulated across exchanges and users’ wallets.

Shiba Inu tokens in circulation, staked and burned

Shiba Inu price is ready for recovery

The crypto bear market has failed to dampen the recovery of the Shiba-Inu-themed cryptocurrency. SHIB price remained largely unchanged over the past two weeks, and analysts have identified technical indicators that point toward a recovery in the meme coin.

Nancy Allen, a technical analyst at The Coin Republic, argues that Shiba Inu price needs to register a breakout from the falling triangle pattern. Shiba Inu needs to attract more buyers in the intraday trading session to begin its recovery.

The Relative Strength Index (RSI), a momentum indicator, is at 46 and is struggling to break out from neutrality. Allen believes that a strong momentum difference in Shiba Inu, tracked by the Moving Average Convergence Divergence (MACD) indicator could signal a recovery in the meme coin.

SHIB/USD price chart

Allen believes Shiba Inu price could face resistance at $0.00000950 and support lies at $0.00000835.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.